you position:Home > us stock market live > us stock market live

US Debt and Stock Market Graph: Unveiling the Connection

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the world of finance, the relationship between the U.S. national debt and the stock market is a topic that has sparked considerable debate. Understanding this connection is crucial for investors and policymakers alike. This article delves into the intricacies of this relationship, using a US debt and stock market graph to illustrate the dynamics at play.

The National Debt: A Growing Concern

The U.S. national debt has been a subject of concern for years. As of 2021, the debt stands at over $28 trillion. This figure has been steadily rising, largely due to increased government spending and lower tax revenues. The national debt is the total amount of money that the federal government has borrowed to finance its operations. It includes both public and intragovernmental debt.

The Stock Market: A Reflection of Economic Health

The stock market is often considered a barometer of economic health. It reflects the collective sentiment of investors about the future prospects of companies and the overall economy. When the stock market is performing well, it is typically seen as a sign of economic strength. Conversely, a declining stock market can indicate economic weakness.

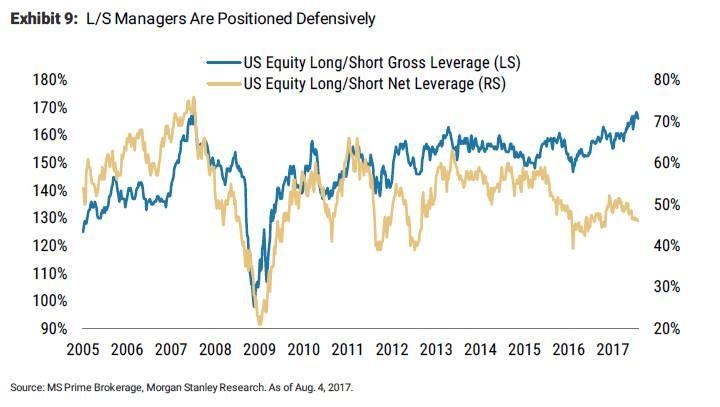

The Graph: A Visual Representation

To understand the relationship between the national debt and the stock market, let's examine a US debt and stock market graph. This graph will illustrate how the two have moved in tandem over the years.

As the graph shows, there is a strong correlation between the national debt and the stock market. When the national debt increases, the stock market tends to rise, and vice versa. This correlation can be attributed to several factors.

Economic Confidence

One factor that contributes to this correlation is economic confidence. When the national debt is rising, it is often a sign that the government is investing heavily in infrastructure, education, and other areas that can stimulate economic growth. This increased spending can boost investor confidence, leading to higher stock prices.

Interest Rates

Another factor is interest rates. When the national debt increases, the government needs to borrow more money, which can put upward pressure on interest rates. Higher interest rates can make borrowing more expensive for consumers and businesses, potentially slowing economic growth. However, in recent years, the Federal Reserve has kept interest rates low to support economic recovery, which has helped to mitigate this effect.

Market Volatility

Market volatility can also play a role in the correlation between the national debt and the stock market. In times of uncertainty, investors may turn to the stock market as a safe haven, leading to higher prices. Conversely, during times of economic turmoil, the stock market may decline, which can also be reflected in the national debt.

Case Study: The 2020 Economic Crisis

A notable case study is the 2020 economic crisis, which was triggered by the COVID-19 pandemic. The U.S. government responded by implementing unprecedented fiscal stimulus measures, which significantly increased the national debt. Despite this, the stock market experienced a strong rally in the following months, driven by hopes of economic recovery.

Conclusion

In conclusion, the US debt and stock market graph provides a clear illustration of the complex relationship between the national debt and the stock market. While there is a strong correlation between the two, it is important to consider various factors that can influence this relationship. As investors and policymakers, understanding this connection is crucial for making informed decisions in the ever-changing world of finance.

so cool! ()

like

- US Marawana Stocks: A Comprehensive Guide to Investing in the Marawana Gold Proje

- US Natural Gas Companies Stock: A Comprehensive Guide to Investment Opportunities

- BD R US Stock: A Comprehensive Guide to Understanding the Investment

- Can You Buy BYD Stock in the US?

- Stocks and US Dollar Are Tanking: What It Means for Your Investment Portfolio

- Is Aurora on the US Stock Exchange?

- Title: Current Risks in the US Stock Market October 2025

- Title: List of All US Stock Symbols: Your Ultimate Guide to Understanding the Fin

- Total US Stock Market Capitalization in 2014: An Insightful Analysis

- Rare Earth US Stocks to Buy: A Comprehensive Guide

- US Stocks Less Than $1: A Comprehensive Guide

- Title: Stock Symbol for US Foods: What You Need to Know

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

US Debt and Stock Market Graph: Unveiling the

US Debt and Stock Market Graph: Unveiling the

Title: TCS on US Stocks: Unveiling the Truth A

Konica Minolta Stock US: A Comprehensive Analy

Title: US Stock Market 2015 Holidays: A Compre

Title: "Biggest US Stock Gainers Toda

Trade Japanese Stocks in the US SEC: A Compreh

Penny Stock News Today US: Unveiling the Hotte

Oil Company Stocks in the US: A Comprehensive

US Marine Corps Stock Video: Capturing the Ess

AAPL US Stock: The Ultimate Guide to Investing

Momentum Stocks: US Large Cap August 2025 Outl

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: TFSA Buy US Stocks: A Guide for Canadia"

- Title: UK Investing in US Stocks: A Boglehead&"

- The Total Number of US Stocks: A Comprehensive"

- Questrade US Stocks: Your Gateway to Diversify"

- http stocks.us.reuters.com stocks fulldescript"

- Softbank US Stock Symbol: Understanding the Ke"

- US Hotel Stock: A Comprehensive Guide to the C"

- US Penny Stock List 2021: A Comprehensive Guid"

- Title: June 4, 2025 US Stock Market Close Summ"

- US Stock Exchange Online: Your Gateway to Glob"