you position:Home > us stock market live > us stock market live

US Stocks Less Than $1: A Comprehensive Guide

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the world of stock trading, there's a unique category that often flies under the radar: stocks priced at less than

What Are US Stocks Less Than $1?

US stocks less than

Understanding Penny Stocks

Penny stocks are typically issued by smaller, less established companies, which can make them riskier investments. While these stocks can offer significant upside potential, they also come with higher risks, including:

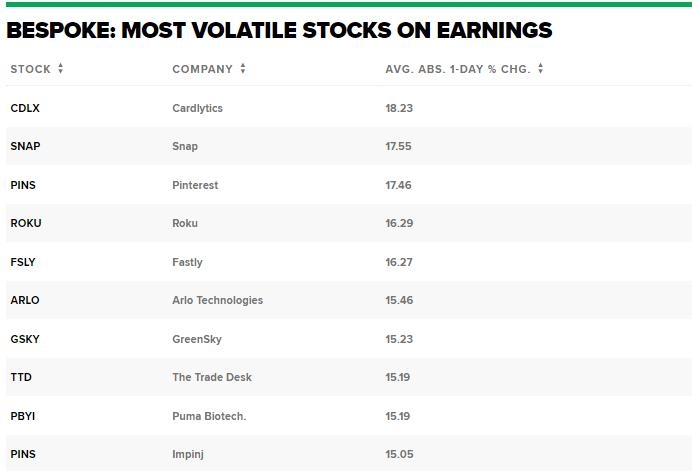

- High Volatility: Penny stocks can experience rapid and extreme price swings, which can be both beneficial and detrimental to investors.

- Lack of Regulation: Companies with stock prices below $1 are often less regulated, which can lead to higher risks of fraud and manipulation.

- Liquidity Issues: Some penny stocks may have low trading volumes, making it difficult to buy or sell shares at desired prices.

Risks and Rewards

Investing in US stocks less than $1 can be lucrative, but it's crucial to understand the risks involved. Here are some key points to consider:

- Potential for High Returns: Successful penny stock investments can lead to substantial gains, as these stocks have the potential to skyrocket in value.

- Speculative Nature: Many penny stocks are speculative, meaning their value is driven by market sentiment rather than fundamental factors.

- Lack of Fundamental Analysis: Due to their speculative nature, penny stocks may not be suitable for investors who rely on fundamental analysis to make investment decisions.

Case Studies

To illustrate the potential of US stocks less than $1, let's look at a few case studies:

- Tesla (TSLA): Once a penny stock, Tesla has since become one of the most valuable companies in the world. Investors who bought Tesla's stock when it was a penny stock have seen their investments grow exponentially.

- Facebook (FB): Before its initial public offering (IPO), Facebook was a penny stock. Investors who bought shares at that time have seen their investments multiply significantly.

Conclusion

US stocks less than $1 can be an exciting and potentially lucrative investment opportunity, but they come with significant risks. As with any investment, it's crucial to do thorough research and understand the potential risks before investing in penny stocks. By doing so, investors can make informed decisions and potentially capitalize on the high-risk, high-reward nature of these stocks.

so cool! ()

last:Title: Stock Symbol for US Foods: What You Need to Know

next:nothing

like

- Title: Stock Symbol for US Foods: What You Need to Know

- Canopy Cannabis Stock: A Comprehensive Analysis of the US Market

- Questrade US Stocks: Your Gateway to Diversifying Your Portfolio

- US Global Investors Stock News: The Latest Insights and Analysis

- Finance US Stock Future: A Comprehensive Guide to Investing in the American Marke

- Momentum Stocks: US Market 5-Day Performance Leaders

- Stock Broker Salary in the US: A Comprehensive Overview

- Title: US Stock Investment App: Revolutionizing the Way You Invest

- Arch Coal US Stocks: A Comprehensive Guide

- US Marine Corps Stock Video: Capturing the Essence of Military Valor

- Stock Trading Seminars in the US: Your Gateway to Financial Success

- Understanding the Dynamics of US Electricity Companies Stocks

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

US Stocks Less Than $1: A Comprehensive Guide

US Stocks Less Than $1: A Comprehensive Guide

Alibaba US Stock: A Comprehensive Guide to Inv

Title: Top 10 Dividend Stocks in the US

How to Short the US Stock Market: A Comprehens

Electronic Arts US Stocks: A Comprehensive Ana

US Stock Market Apps: Your Ultimate Investment

Top Performing US Stocks 2025 Outlook: What to

Buying U.S. Stocks in UK: Understanding the Ta

Pop Mart US Stock: A Comprehensive Guide to In

Small Cap Biotech Upcoming Catalysts: US Stock

Top 3 US Stock Market Indexes: A Comprehensive

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Copper Mining US Stocks: A Comprehensive Guide"

- Title: US Metal Companies Stock: A Comprehensi"

- Adani Stocks in the US Market: A Comprehensive"

- Pure Tech Ventures Stock Price in US Dollars: "

- Best Stock to Invest in the US: Top Picks for "

- Title: Total Value of US Stock Market in 2015:"

- Indian Stocks on the US Stock Exchange: A Comp"

- Model for Us Stock: A Comprehensive Guide to U"

- Toys "R" Us Stocker Job Desc"

- ASX US Stock: Understanding the Intersection o"