you position:Home > us stock market live > us stock market live

Title: Understanding the US Stock Market Average PE Ratio

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Introduction: The stock market is a complex and dynamic entity, and one of the key metrics used to evaluate its health and attractiveness is the Price-to-Earnings (PE) ratio. In this article, we delve into the US stock market average PE ratio, exploring its significance, how it is calculated, and what it reveals about the market's current state.

What is the US Stock Market Average PE Ratio?

The US stock market average PE ratio is a measure of the overall valuation of the stocks listed on the major exchanges, such as the S&P 500. It represents the ratio of the stock market's price to the average earnings of the companies in the index. This ratio is a crucial tool for investors and analysts, as it provides insights into the market's overall valuation and potential future performance.

How is the PE Ratio Calculated?

The PE ratio is calculated by dividing the market price of a stock by its earnings per share (EPS). EPS is the company's net income divided by the number of outstanding shares. For the US stock market average PE ratio, the calculation involves averaging the PE ratios of all the companies in the S&P 500 index.

Significance of the PE Ratio

The PE ratio is a valuable metric for investors, as it helps them determine whether a stock or the entire market is overvalued or undervalued. A high PE ratio indicates that the market is expensive, suggesting that investors are willing to pay a premium for earnings. Conversely, a low PE ratio suggests that the market is undervalued, indicating that investors are not willing to pay as much for earnings.

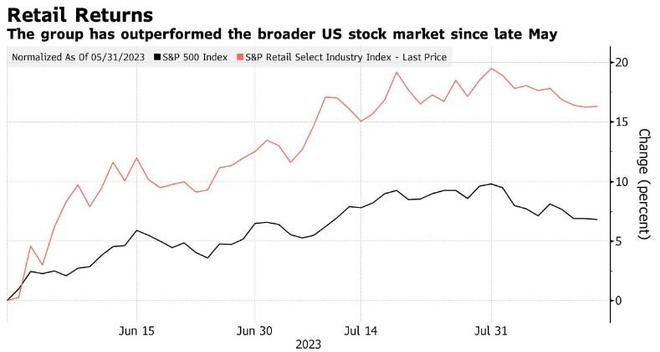

Historical PE Ratios and the Current State of the Market

Historically, the US stock market average PE ratio has fluctuated significantly. In the 1990s, the PE ratio reached historic highs, leading to the dot-com bubble. In contrast, during the financial crisis of 2008, the PE ratio plummeted, indicating a severely undervalued market.

Currently, the US stock market average PE ratio stands at around 23.5, which is considered to be in the middle of its historical range. This suggests that the market is neither overvalued nor undervalued, but rather fairly valued.

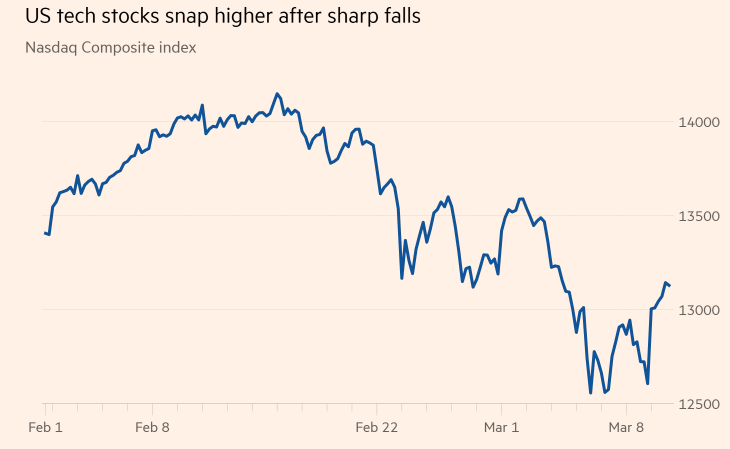

Case Study: Tech Stocks and the PE Ratio

One interesting aspect of the US stock market is the varying PE ratios among different sectors. For example, tech stocks often have higher PE ratios than other sectors, reflecting their high growth potential. In the past few years, tech giants like Apple and Microsoft have seen their PE ratios surge, driven by their impressive earnings growth and market dominance.

Conclusion:

Understanding the US stock market average PE ratio is crucial for investors and analysts looking to gauge the market's valuation and potential future performance. By examining the PE ratio, investors can make more informed decisions about where to allocate their capital. As the market continues to evolve, the PE ratio will remain a vital tool for assessing the overall health and attractiveness of the US stock market.

so cool! ()

like

- Title: US Stock Market Average Dividend Growth: A Deep Dive into the Numbers

- Singapore Companies Traded in US Stock Market: A Comprehensive Overview

- Title: US Metal Companies Stock: A Comprehensive Guide

- Goldman Sachs US Stock Market Outlook 2025: A Comprehensive Analysis

- China-US Marijuana Stocks: The Emerging Investment Opportunity

- List of Sectors in US Stock Market: A Comprehensive Guide

- US Pot Stock News: The Latest Updates on the Cannabis Industry

- Understanding the US Stock Dollar Volume Trade: A Comprehensive Guide

- US Stock Investing from India: A Comprehensive Guide

- Title: Total Value of US Stock Market in 2015: A Comprehensive Overview

- AI Infrastructure Stocks: The Future of Tech Investment in the US

- US Large Cap Stocks ETF: A Comprehensive Guide to Investing in the S&P 50

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- Buy Us Stock from Malaysia: A Lucrative Invest"

recommend

Title: Understanding the US Stock Market Avera

Title: Understanding the US Stock Market Avera

Title: "http stocks.us.reuters.com st

US Stock Market: A CNBC Analysis

Live Us Stock Market TV: Your Ultimate Guide t

Baytex Stock Price: A Comprehensive Analysis

Title: September 1, 2025: A Closer Look at the

Most Popular US Stocks: A Comprehensive Guide

Key US Stock Market Trends, Risks, and Opportu

Title: Highest Priced Stock Share Price in US

Food Delivery Stocks: A Growing Trend in the U

ASX US Stock: Understanding the Intersection o

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Best Platform to Trade US Stocks: A Comprehens"

- Good US Stocks: A Comprehensive Guide to Inves"

- Title: TFSA Buy US Stocks: A Guide for Canadia"

- Title: Best Momentum Stocks to Watch in Octobe"

- Australian Companies on the US Stock Exchange:"

- How to Buy Nintendo Stock in the US: A Compreh"

- Best US-Based Stocks to Watch in 2023"

- US Airways Express Stock: A Comprehensive Guid"

- May 19, 2025 US Stock Market Summary"

- How to Join the Stock Market in the US: A Comp"