you position:Home > us stock market live > us stock market live

US Stock Investing from India: A Comprehensive Guide

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Introduction

In today's interconnected world, investors from all corners of the globe are seeking opportunities in the global financial markets. For Indian investors, the United States stock market has emerged as a prime destination for investment. With its robust economy, diverse sectors, and strong regulatory framework, the US stock market offers numerous opportunities for growth and profit. This article aims to provide a comprehensive guide for Indian investors looking to invest in the US stock market.

Understanding the US Stock Market

The US stock market is one of the largest and most liquid in the world. It is home to some of the most well-known and successful companies, such as Apple, Google, and Microsoft. The market is divided into two primary exchanges: the New York Stock Exchange (NYSE) and the Nasdaq. These exchanges list a wide range of stocks, including large-cap, mid-cap, and small-cap companies.

Investing Options for Indian Investors

Direct Investment: Indian investors can directly purchase stocks on the US exchanges. This requires opening a brokerage account with a US-based brokerage firm that supports international clients. Some popular options include TD Ameritrade, E*TRADE, and Fidelity.

Through a Foreign Exchange-Traded Fund (ETF): An ETF is a type of investment fund that tracks the performance of a specific index, sector, or asset. Indian investors can purchase US ETFs listed on Indian exchanges, which track the performance of the US stock market.

Through a Mutual Fund: Some Indian mutual fund houses offer funds that invest in US stocks. This is a good option for investors who prefer a more hands-off approach.

Key Considerations for Indian Investors

Currency Conversion: Since the US dollar is the currency of the US stock market, Indian investors will need to convert their rupees into dollars. This can be done through a currency exchange service or a brokerage firm.

Tax Implications: Indian investors need to be aware of the tax implications of investing in the US stock market. They may be subject to capital gains tax on their investment gains.

Regulatory Compliance: It is important for Indian investors to ensure that they comply with all regulatory requirements for investing in the US stock market.

Best Practices for US Stock Investing from India

Do Your Research: Before investing, it is crucial to conduct thorough research on the companies and sectors you are interested in. This includes analyzing financial statements, reading company reports, and staying updated on market news.

Diversify Your Portfolio: Diversifying your portfolio can help mitigate risks. Consider investing in a mix of sectors and geographic regions.

Stay Informed: Keep yourself updated with the latest market trends and news. This will help you make informed investment decisions.

Case Study: Investing in Apple Inc.

Consider an Indian investor who decides to invest in Apple Inc., one of the largest companies in the world. By opening a brokerage account with a US-based brokerage firm, the investor can purchase Apple stocks. It is important for the investor to stay informed about Apple's financial performance and market trends to make informed decisions.

Conclusion

Investing in the US stock market from India can be a rewarding endeavor. By understanding the market, following best practices, and staying informed, Indian investors can achieve their investment goals. Remember to conduct thorough research, diversify your portfolio, and stay informed to maximize your returns.

so cool! ()

last:Title: Total Value of US Stock Market in 2015: A Comprehensive Overview

next:nothing

like

- Title: Total Value of US Stock Market in 2015: A Comprehensive Overview

- AI Infrastructure Stocks: The Future of Tech Investment in the US

- US Large Cap Stocks ETF: A Comprehensive Guide to Investing in the S&P 50

- Title: Top US Marijuana Stock: Unveiling the Leaders in the Industry

- Best US-Based Stocks to Watch in 2023

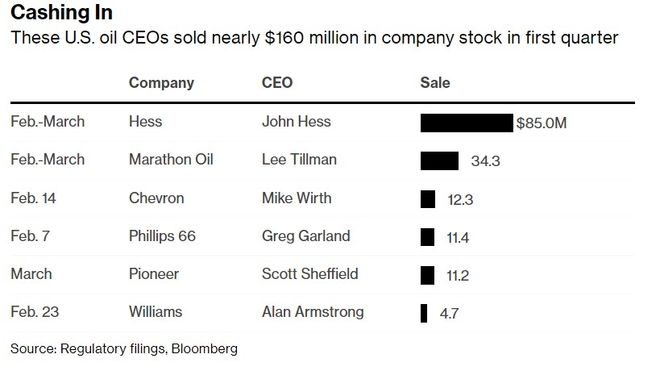

- US Oil Stocks 2017: A Comprehensive Analysis

- Most Traded Stocks in the US: The Top Contenders and Their Impact

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol ggg.v

- Title: September 1, 2025: A Closer Look at the US Stock Market Performance

- Top Performing US Stocks Past Week: Momentum Indicators in Focus

- Title: Unveiling the Legacy of the US Springfield Model 1873 Stock

- Top US Stocks 2014: A Look Back at the Market's Peak Performers

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- Buy Us Stock from Malaysia: A Lucrative Invest"

recommend

US Stock Investing from India: A Comprehensive

US Stock Investing from India: A Comprehensive

Emerging Sectors: US Stock Market 2025 Outlook

US Electrical Infrastructure Stocks: A Lucrati

US Corn Ending Stocks 2025 Statistics: A Compr

Best US Pot Stock: Your Ultimate Guide to Inve

Stock Invest Us: Unleashing the Power of Equit

Title: "US Middle Class Stock Ownersh

Title: "Biggest US Stock Gainers Toda

Title: US Stock Market in 2004: A Look Back at

Chances of a U.S. Stock Market Crash: Understa

Top Momentum Stocks Past Week: US Market Insig

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Impact of US Interest Rate Cuts on US Stock Ma"

- Title: "ADAR 2-15: Why Buying Stock i"

- Top US Stocks Dividend: Your Guide to High-Yie"

- Free Stock Video from US Library: A Treasure T"

- US Airways Express Stock: A Comprehensive Guid"

- US Stock Exchange Online: Your Gateway to Glob"

- Total US Stock Market Vanguard Fund: A Compreh"

- Top Momentum Stocks Past Week: US Market Insig"

- Title: "Biggest US Stock Gainers Toda"

- How to Join the Stock Market in the US: A Comp"