you position:Home > us stock market live > us stock market live

Title: US China Trade War Impact on Stock Markets

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

The ongoing US-China trade war has been a topic of significant concern among investors and economists worldwide. This article delves into the impact of the trade war on stock markets, highlighting the key effects and providing insights into how investors can navigate this volatile landscape.

The Trade War's Origins and Escalation

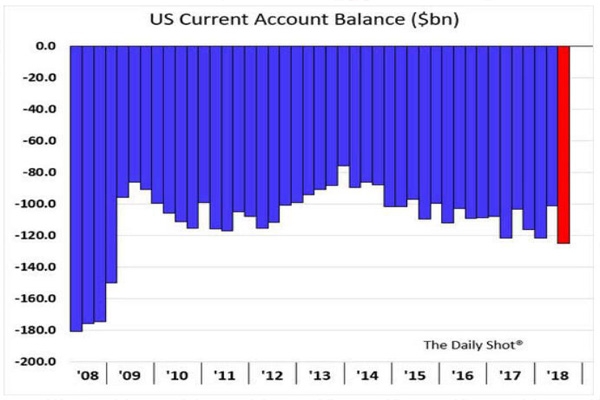

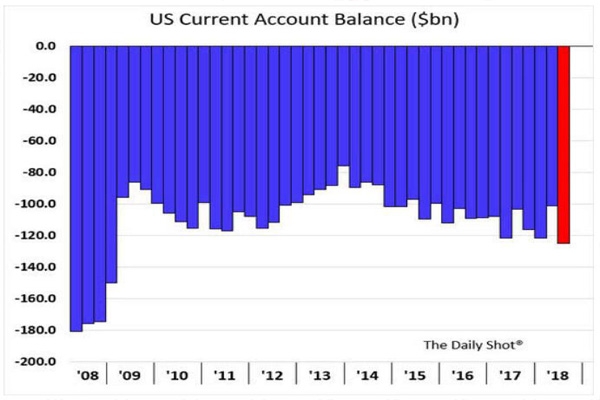

The trade war between the United States and China began in 2018 when President Trump imposed tariffs on Chinese goods. These tariffs were initially aimed at reducing the trade deficit between the two nations and addressing concerns over intellectual property theft. However, the trade war has since escalated, with both sides imposing increasingly stringent tariffs on a wide range of goods.

Impact on Stock Markets

The US-China trade war has had a profound impact on stock markets worldwide, with several key effects:

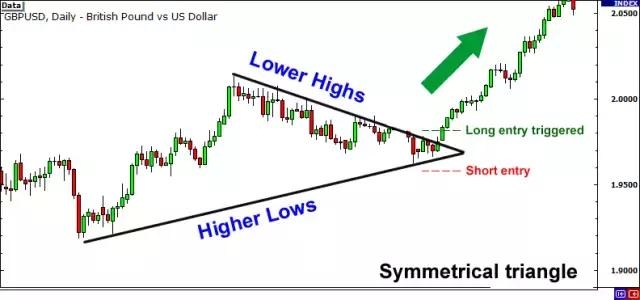

- Volatility: The trade war has led to increased volatility in stock markets, as investors react to the latest news and developments. This volatility can be particularly pronounced in sectors heavily exposed to trade, such as technology and manufacturing.

- Decline in Stock Prices: Many companies with significant exposure to China have seen their stock prices decline as the trade war has progressed. This includes major tech companies like Apple and Microsoft, as well as manufacturers such as Caterpillar and General Motors.

- Sector-Specific Impacts: Certain sectors have been hit harder than others. For example, the technology sector has been particularly affected, as companies like Apple and Qualcomm rely heavily on Chinese manufacturing and sales.

- Currency Fluctuations: The trade war has also led to fluctuations in currency values, as investors react to changes in trade policies and economic conditions. This has had a ripple effect on stock markets worldwide.

Case Studies

Several high-profile companies have been affected by the trade war. Here are a few examples:

- Apple: Apple's stock price has been negatively impacted by the trade war, as the company's supply chain is heavily reliant on Chinese manufacturers. In response, Apple has increased its efforts to diversify its supply chain and reduce its dependence on China.

- Tesla: Tesla has also faced challenges due to the trade war. The company's Shanghai plant, which is critical to its expansion into the Chinese market, has been affected by supply chain disruptions and trade barriers.

- Nike: Nike has experienced a drop in sales in China, as the trade war has led to increased prices for imported goods. The company is working to adjust its strategy to mitigate the impact of the trade war.

Navigating the Volatile Landscape

Investors navigating the volatile landscape of the US-China trade war should consider the following strategies:

- Diversify Your Portfolio: Diversification can help mitigate the impact of the trade war on your portfolio. Consider investing in sectors that are less exposed to trade tensions, such as consumer staples and healthcare.

- Monitor Economic Indicators: Stay informed about economic indicators and trade negotiations to stay ahead of market trends.

- Seek Professional Advice: Consult with a financial advisor to develop a personalized investment strategy that aligns with your goals and risk tolerance.

In conclusion, the US-China trade war has had a significant impact on stock markets worldwide. While the trade war remains a source of uncertainty, investors can navigate this volatile landscape by diversifying their portfolios, monitoring economic indicators, and seeking professional advice.

so cool! ()

like

- US Military Dress Uniform Marching Video: Free Stock Video Download Options

- Understanding the US Grocery Store Stocks: A Comprehensive Guide

- How Much Stock Does the U.S. Government Own?

- Cheap US Bank Stocks: Smart Investments for Savvy Investors

- Title: Minimum Lot Size for US Stocks: What You Need to Know

- Continental Stock Transfer and Trust: Your Ultimate Toll-Free Resource for Secure

- US Holidays 2021 Stock Market: Impact and Insights

- Title: Dyson Stock US: A Deep Dive into the World of Innovation and Financial Suc

- Title: Top Momentum US Stocks September 2025

- Free Stock: Contact Us for Unbeatable Media Assets

- Should I Invest in US Stocks from India?

- Title: "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

Title: US China Trade War Impact on Stock Mark

Title: US China Trade War Impact on Stock Mark

Stocks and US Dollar Are Tanking: What It Mean

Canadian ETFs Holding U.S. Stocks: A Strategic

Chances of a U.S. Stock Market Crash: Understa

Understanding Alibaba's US Stock Ticker:

Lly Us Stock: Unlocking the Potential of Stock

Electronic Arts US Stocks: A Comprehensive Ana

Title: "US Middle Class Stock Ownersh

US Large Cap Stocks Momentum: August 2025 Outl

Top Performing US Stocks Past Week: Momentum I

Title: June 4, 2025 US Stock Market Close Summ

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- How to Move Your Money Offshore and Invest in "

- "Royal Caribbean Stock: What You Need"

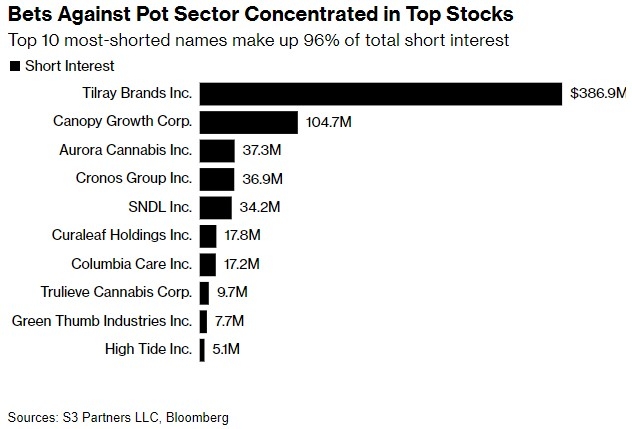

- US Publicly Traded Pot Stocks: A Comprehensive"

- Mu Us Stock: A Comprehensive Guide to Understa"

- March 2020 IPOs: A Deep Dive into the US Stock"

- Momentum Stocks: Top Performers in the US Larg"

- US Penny Stock List 2021: A Comprehensive Guid"

- US Electrical Infrastructure Stocks: A Lucrati"

- Title: Best Non-US Dividend Stocks to Invest I"

- Title: "http stocks.us.reuters.com st"