you position:Home > us stock market live > us stock market live

Title: How Will Tariffs Affect the US Stock Market?

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Introduction:

Understanding Tariffs: To comprehend the potential impact of tariffs on the stock market, it's crucial to understand what tariffs are. Tariffs are taxes imposed on imported goods, intended to protect domestic industries and promote national economic interests. However, they can also lead to higher prices for consumers and create trade tensions between countries.

Impact on Companies: Tariffs can have a significant impact on companies, particularly those with significant exposure to international trade. Companies that rely on imported components or materials may face increased costs, leading to reduced profit margins. This can be particularly damaging for companies in industries such as automotive, electronics, and agriculture.

Rising Costs and Supply Chain Disruptions: As tariffs increase, companies may face higher costs for imported goods, which can lead to increased prices for consumers. This can, in turn, lead to reduced demand for goods and services, negatively impacting corporate earnings. Additionally, tariffs can disrupt global supply chains, causing delays and further increasing costs for companies.

Market Sentiment: The uncertainty surrounding tariffs can also impact market sentiment. Investors may become nervous about the potential for trade wars and the overall economic impact of tariffs. This can lead to increased volatility in the stock market, with investors selling off stocks in anticipation of negative outcomes.

Sector-Specific Impacts: Certain sectors of the stock market may be more vulnerable to the impact of tariffs than others. For example, the technology sector, which relies heavily on international trade, may be particularly sensitive to changes in trade policies. On the other hand, industries such as healthcare and consumer staples may be less affected due to their domestic nature.

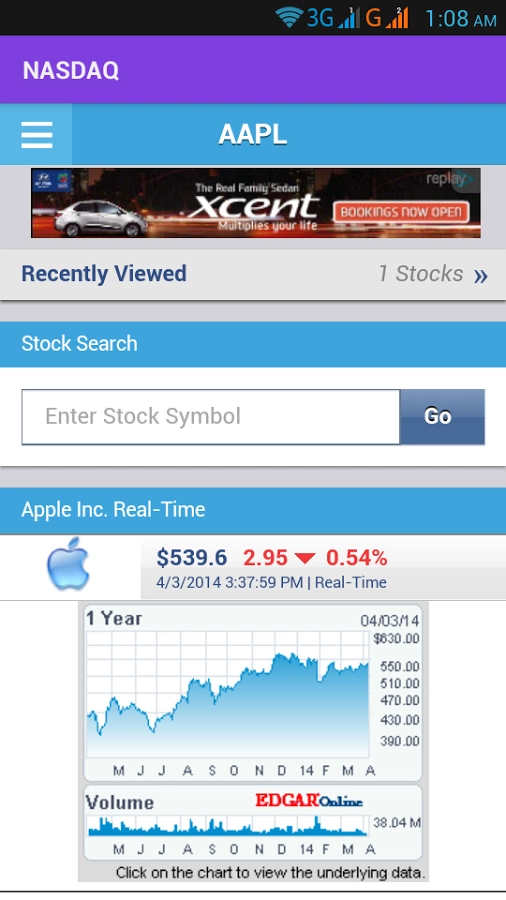

Case Studies: One notable example of the impact of tariffs on the stock market is the recent trade tensions between the United States and China. As the two countries engaged in a trade war, stock markets around the world experienced significant volatility. Companies with significant exposure to the Chinese market, such as Apple and Microsoft, saw their stock prices fluctuate as a result of the uncertainty surrounding tariffs.

Conclusion: While it's challenging to predict the exact impact of tariffs on the US stock market, it's clear that they pose a significant risk. Companies that rely on international trade may face increased costs and reduced profit margins, while the uncertainty surrounding tariffs can lead to volatility in the stock market. As investors, it's crucial to stay informed and monitor the developments in the trade landscape to make informed decisions.

so cool! ()

like

- Pop Mart US Stock: A Comprehensive Guide to Investing in the Popularity Phenomeno

- US Large Cap Momentum Stocks High Volume: The Ultimate Guide to High-Potential In

- Among Us Stocking Fillers: The Ultimate Guide to Fun and Unique Gifts

- CBL US Stock: A Comprehensive Guide to Understanding and Investing in CBL &am

- Stocks Reporting Earnings Today: What You Need to Know

- How to Get Involved in the Stock Market in the US

- US Crude Stocks Fall by the Most This Year: Implications and Analysis

- About Us Stock: Revolutionizing Investment Strategies

- US Pipeline Makers Stock: A Lucrative Investment Opportunity

- Bloomberg Stocks US: A Comprehensive Guide to the American Stock Market

- Best Performing US Stocks Past Week: Momentum to Watch in August 2025

- Tech Stock US: The Future of Innovation and Investment

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

Title: How Will Tariffs Affect the US Stock Ma

Title: How Will Tariffs Affect the US Stock Ma

US Copper Mining Companies Stocks: A Comprehen

Softbank US Stock Symbol: Understanding the Ke

How to Buy US Stocks from the Philippines: A S

How to Buy Stock Outside the US: A Comprehensi

Understanding the US Residential Housing Stock

Strong US Stocks Outlook 2025: What Investors

Title: US Government Shutdown: The Impact on t

How to Search Australian Stocks from the US

The Total Number of US Stocks: A Comprehensive

LMT Stock: US News and Money's Insight on

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- "http stocks.us.reuters.com stocks fu"

- Stocks Reporting Earnings Today: What You Need"

- US Stock Investing from India: A Comprehensive"

- Electronic Arts US Stocks: A Comprehensive Ana"

- Toys "R" Us Stocker Job Desc"

- AI Infrastructure Stocks: The Future of Tech I"

- Best Broker for US Stocks in Singapore: A Comp"

- US Large Cap Stocks Momentum: August 2025 Outl"

- Momentum Stocks: Top Performers in the US Larg"

- US Mid Cap Stocks 2015: A Look Back at the Yea"