you position:Home > us stock market live > us stock market live

How Many People Invest in Stocks in the US?

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In recent years, the world of investing has seen a significant surge in popularity, particularly in the United States. With the rise of online trading platforms and a growing interest in personal finance, many Americans are now considering stocks as a part of their investment strategy. But how many people, exactly, are investing in stocks in the US? Let's delve into this topic and uncover some fascinating insights.

The Rise of Retail Investors

In the past, investing in stocks was considered a domain for the wealthy and seasoned professionals. However, the advent of online brokerage firms and mobile trading apps has democratized the stock market, making it more accessible to the average person. According to a report by the Investment Company Institute, as of 2020, there were approximately 89.3 million US households that owned stocks. This represents a significant increase from just 53.1 million in 1995.

The Influence of Technology

Technology has played a pivotal role in the surge of retail investors. Online platforms like Robinhood, TD Ameritrade, and E*TRADE have made it easier than ever for individuals to buy and sell stocks. These platforms offer low or no-commission trading, user-friendly interfaces, and educational resources, making it more attractive for beginners to enter the market. Moreover, social media and online forums have created communities where investors can share tips, strategies, and experiences.

The Impact of the Pandemic

The COVID-19 pandemic has also accelerated the trend of stock investing. As many individuals faced financial uncertainty, they sought ways to diversify their portfolios and potentially earn returns. The pandemic's impact on the stock market, including the historic rally and subsequent crash, drew significant attention to the world of investing. According to a survey by Charles Schwab, 28% of respondents said they had increased their investment in stocks during the pandemic.

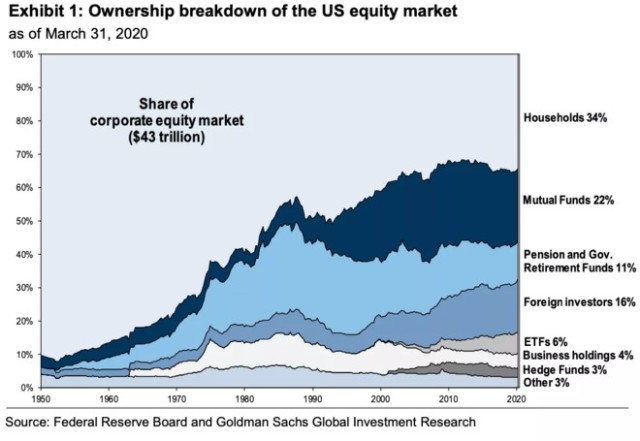

The Distribution of Stock Ownership

While the number of stock investors has surged, the distribution of stock ownership is still quite uneven. According to a report by the Federal Reserve, the top 10% of households own approximately 84% of stocks. This means that the stock market remains largely concentrated among the wealthy. However, the increasing number of retail investors suggests that this trend may be changing.

Case Study: The Robinhood Effect

One of the most notable examples of the democratization of stock investing is the "Robinhood Effect." The app's popularity surged during the pandemic, with millions of new users signing up. Many of these users were young individuals who had never invested before. While some criticized the app for contributing to market volatility, it cannot be denied that Robinhood played a significant role in bringing the stock market to the masses.

Conclusion

In conclusion, the number of people investing in stocks in the US has reached an all-time high. With the help of technology, online platforms, and changing economic conditions, the stock market is now more accessible than ever before. While the distribution of stock ownership remains uneven, the growing number of retail investors suggests that the future of stock investing looks promising. Whether you are a seasoned investor or just starting out, the stock market offers a world of opportunities for those willing to take the plunge.

so cool! ()

like

- Title: Crown Castle US Real Estate Stocks: A Golden Investment Opportunity

- ATVI Stock US: A Comprehensive Guide to Understanding and Investing in Activision

- 2x4 With Us Flag Blowing Stock Video Loop: Capturing the Spirit of American Indep

- http stocks.us.reuters.com stocks ratios.asp rpc 66&symbol smn.v: Unveili

- How to Buy US Stocks Online: A Comprehensive Guide

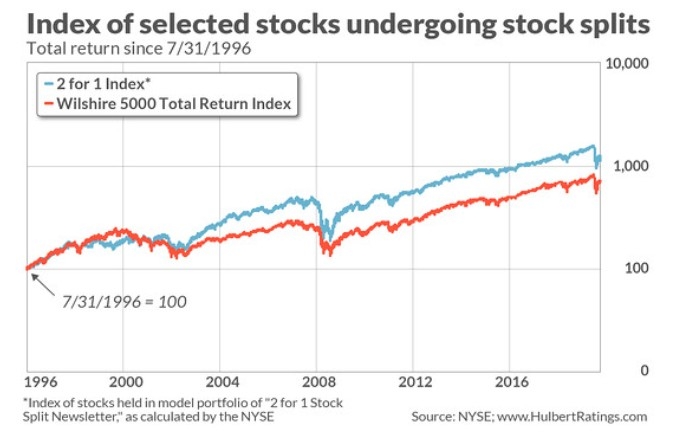

- 2018 US Stock Splits: A Comprehensive Overview

- JNK Stock: A Deep Dive into US News and Market Insights

- Popular US Stocks: Your Guide to Investment Opportunities

- US Stock Futures Hours During Labor Day: What You Need to Know

- Title: Best EV Stocks in US

- Can US Citizens Invest in Indian Stocks?

- Rare Earth US Stock: A Lucrative Investment Opportunity in the Emerging Tech Sect

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

How Many People Invest in Stocks in the US?

How Many People Invest in Stocks in the US?

Tomorrow Us Stock Market: What Investors Shoul

Piperdoll US Stock: A Comprehensive Analysis o

Small Cap Biotech Upcoming Catalysts: US Stock

Title: Best Non-US Dividend Stocks to Invest I

Metatrader US Stocks: The Ultimate Trading Sol

Food Delivery Stocks: A Growing Trend in the U

US Stock 3D Sublimation Vacuum Heat Press: Rev

Title: Crown Castle US Real Estate Stocks: A G

Title: Top 10 Dividend Stocks in the US

Can Mexicans Invest in the US Stock Market?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Mu Us Stock: A Comprehensive Guide to Understa"

- Nintendo Stock US Price: What You Need to Know"

- Best Performing US Stocks Last 5 Days: Momentu"

- US Small Cap Biotech Stocks: A Lucrative Inves"

- Understanding the Average Growth of the US Sto"

- Stock Broker Salary in the US: A Comprehensive"

- Enterprise Stocks in the US: A Comprehensive G"

- US Stock Cartridge Bore Sighter: A Comprehensi"

- Among Us Stocking Fillers: The Ultimate Guide "

- Title: Best EV Stocks in US"