you position:Home > us stock market live > us stock market live

Understanding the Average Growth of the US Stock Market

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

The US stock market has long been a beacon of financial growth and stability for investors around the world. Understanding the average growth of this market is crucial for anyone looking to make informed investment decisions. In this article, we delve into the factors that influence stock market growth, provide historical data, and offer insights into potential future trends.

Historical Growth: A Look Back

Over the past century, the US stock market has experienced varying levels of growth. The average growth rate can be attributed to several key factors, including technological advancements, economic cycles, and regulatory changes. For instance, the Great Depression of the 1930s saw a significant downturn in the stock market, while the dot-com bubble of the late 1990s and the financial crisis of 2008 resulted in substantial losses.

However, despite these challenges, the US stock market has generally shown strong resilience and growth over the long term. From 1926 to 2021, the S&P 500 – a widely followed index representing the top 500 companies in the United States – has experienced an average annual return of approximately 10%. This figure highlights the potential for long-term growth in the US stock market.

Factors Influencing Stock Market Growth

Several factors contribute to the average growth of the US stock market. Here are some of the most significant:

Economic Growth: When the economy is growing, companies tend to experience higher profits, leading to increased stock prices. Conversely, during economic downturns, stock prices often decline.

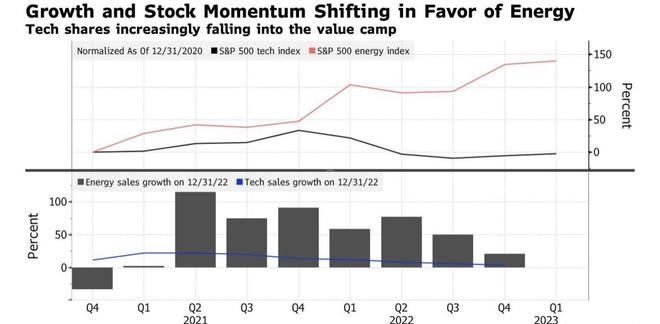

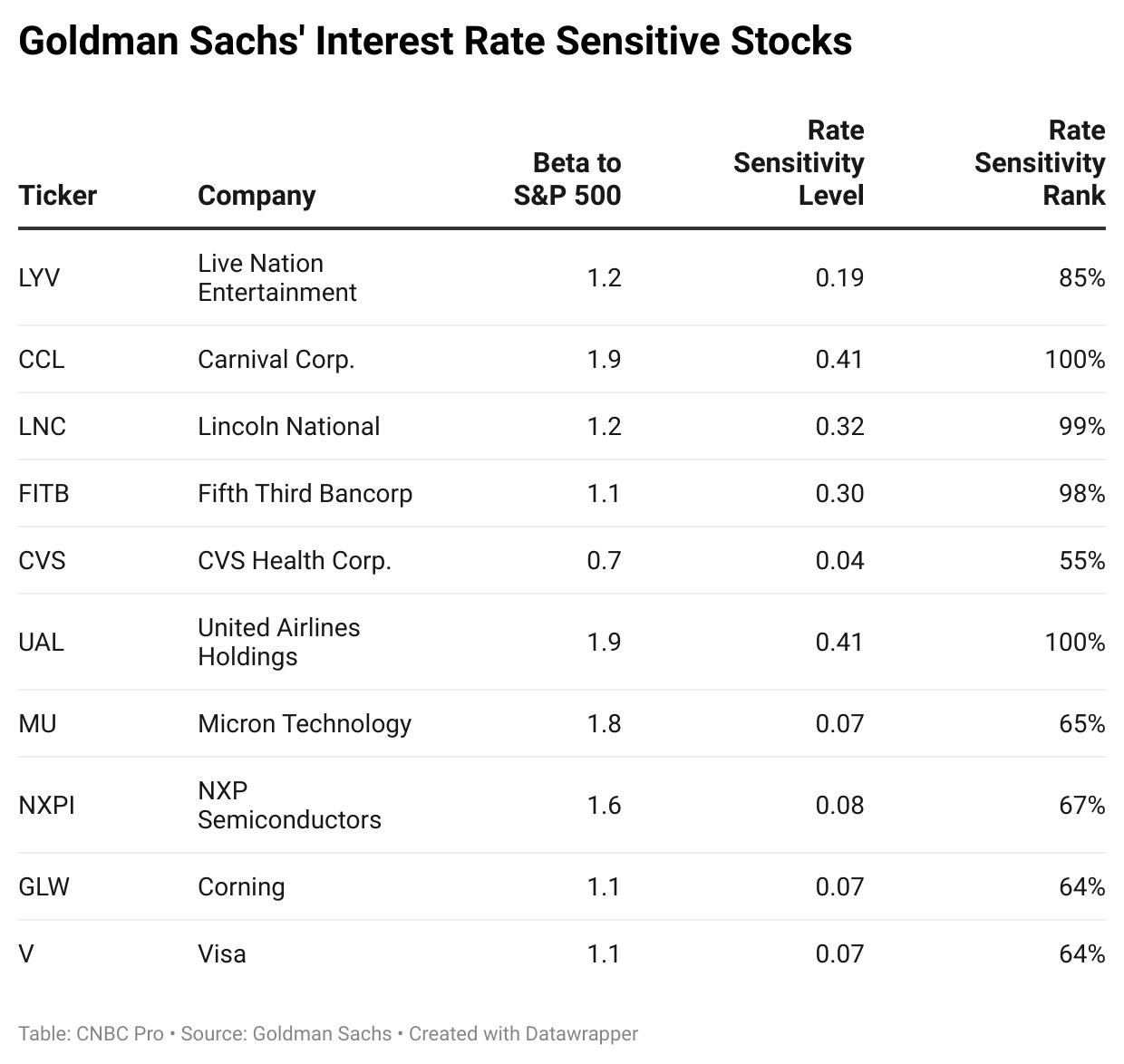

Interest Rates: The Federal Reserve's monetary policy, including interest rate adjustments, can significantly impact the stock market. Lower interest rates can lead to increased borrowing and investment, while higher rates can dampen economic activity and reduce stock prices.

Inflation: High inflation can erode purchasing power, leading to lower stock prices. Conversely, low inflation can boost stock prices as the real value of corporate earnings increases.

Technological Advancements: The US has been at the forefront of technological innovation, with numerous groundbreaking advancements contributing to stock market growth. Companies in sectors like technology, healthcare, and energy have seen substantial growth as a result.

Market Sentiment: Investor confidence plays a crucial role in the stock market. Positive sentiment can lead to increased buying and higher stock prices, while negative sentiment can result in selling and lower prices.

Case Studies: Real-World Examples

To illustrate the average growth of the US stock market, let's consider a few real-world examples:

Apple Inc.: Since its initial public offering in 1980, Apple has experienced remarkable growth, with its stock price increasing by thousands of percent over the years. This growth can be attributed to its innovative products and strong market position.

Amazon.com Inc.: Similarly, Amazon has seen significant growth since its inception in 1994. The company's expansion into various markets, including cloud computing and streaming services, has contributed to its impressive stock price performance.

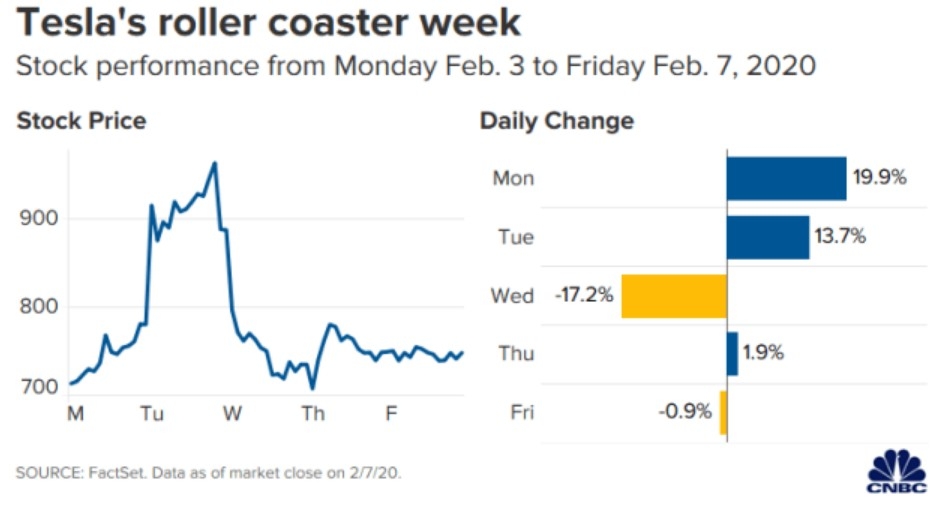

Tesla, Inc.: Tesla, known for its electric vehicles and renewable energy solutions, has experienced rapid growth in recent years. The company's commitment to innovation and sustainability has attracted investors, leading to substantial stock price gains.

Conclusion

Understanding the average growth of the US stock market is essential for investors looking to make informed decisions. By examining historical data, key factors, and real-world examples, we can gain valuable insights into the potential for future growth. As always, it's important to conduct thorough research and consult with financial professionals before making any investment decisions.

so cool! ()

last:10 Companies Whose Stock Influences Current Events in the US

next:nothing

like

- 10 Companies Whose Stock Influences Current Events in the US

- Best US Airline Stocks: A Comprehensive Guide to Investment Opportunities

- Title: State Az US Stocking Schedule: The Ultimate Guide to Efficient Inventory M

- Total Value of US Housing Stock: A Comprehensive Overview

- Title: US Government Shutdown: The Impact on the Stock Market

- Title: Best Momentum Stocks to Watch in October 2025: A Deep Dive into the US Mar

- Title: "https://github.com/christsaizyt/us-stock-market-prediction-by-ls

- Top US Stocks Dividend: Your Guide to High-Yield Investments

- Best Undervalued US Stocks to Buy Now: Seizing Opportunities in the Market

- Can I Buy US Stocks in Singapore? A Comprehensive Guide

- Copper Mining US Stocks: A Comprehensive Guide to Investing in the Red Metal

- Good US Stocks: A Comprehensive Guide to Investment Opportunities

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Buy Us Stock from Malaysia: A Lucrative Invest"

- NVEI US Stock: Unveiling the Investment Potent"

- The Price of US Oil Stock: What You Need to Kn"

- Title: UK Investing in US Stocks: A Boglehead&"

- Holidays of the US Stock Market: Understanding"

- How a US Citizen Can Invest in the African Sto"

recommend

Understanding the Average Growth of the US Sto

Understanding the Average Growth of the US Sto

1357VOYA US Stock Index Portfolio: An In-Depth

Buy Us Stock from Malaysia: A Lucrative Invest

Total Value of US Housing Stock: A Comprehensi

Best Platform to Trade US Stocks: A Comprehens

Title: Graphene Companies Stock US: A Growing

Best US Airline Stocks: A Comprehensive Guide

Best US Tech Stocks to Buy Right Now

Title: US Government Shutdown: The Impact on t

US Biggest Stock Exchange: A Comprehensive Ove

MedMen US Stock Market: A Comprehensive Analys

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- How to Trade on the NATO US Stock Exchange"

- http stocks.us.reuters.com stocks fulldescript"

- Title: State Az US Stocking Schedule: The Ulti"

- Holidays of the US Stock Market: Understanding"

- Title: Best Momentum Stocks to Watch in Octobe"

- Multibagger Penny Stocks in the US Market: You"

- US Stock Cartridge Bore Sighter: A Comprehensi"

- Bullish News for US Stocks Under $7: Pre-Marke"

- Understanding the Average Growth of the US Sto"

- How to Search Australian Stocks from the US"