you position:Home > us energy stock > us energy stock

What Happen to the Stock Market: Understanding Recent Fluctuations

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The stock market is a complex and dynamic entity, constantly responding to global economic changes and market sentiments. As investors, staying informed about the market trends and understanding the factors influencing them is crucial for making sound investment decisions. In this article, we delve into the recent fluctuations in the stock market and analyze the factors that have contributed to these changes.

Historical Context and Current Status

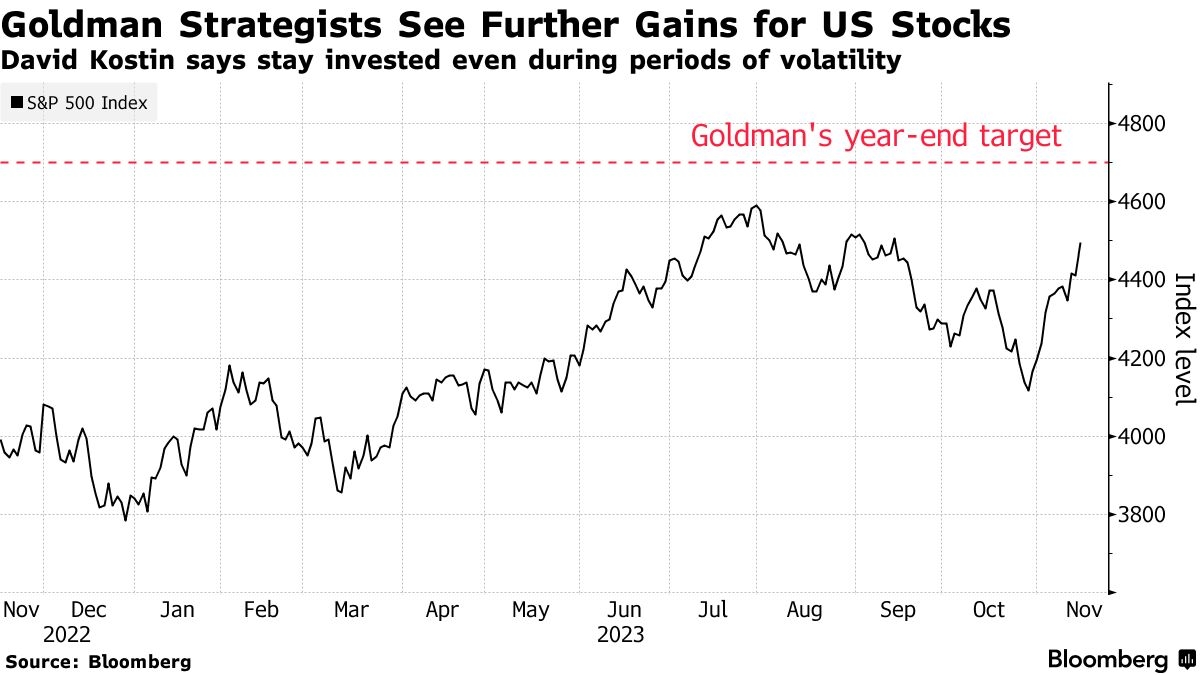

To appreciate the current state of the stock market, it's essential to look back at the historical trends. The market has seen periods of growth and decline over the years, with recent fluctuations being particularly dramatic. The year 2020, for instance, saw an unprecedented drop due to the COVID-19 pandemic, followed by a rapid recovery in 2021. This recovery can be attributed to several factors, including monetary policy measures and vaccination progress.

Monetary Policy and its Impact

One of the most significant factors affecting the stock market is the Federal Reserve's monetary policy. In response to the economic downturn caused by the pandemic, the Federal Reserve lowered interest rates and implemented quantitative easing, which increased liquidity in the market. These measures were instrumental in stabilizing the stock market during the early stages of the pandemic.

However, as the economy gradually recovered, concerns arose regarding the potential inflationary pressures. To combat this, the Federal Reserve started to taper its bond buying program and signaled potential rate hikes in the near future. These measures have led to some uncertainty in the stock market, as investors grapple with the possibility of a slowing economy and higher borrowing costs.

Global Economic Factors

Global economic conditions also play a pivotal role in determining stock market movements. Issues such as trade wars, geopolitical tensions, and changes in exchange rates can impact market sentiment and investment trends. For instance, the ongoing tensions between the United States and China have raised concerns about global supply chains and the potential for disruptions in various sectors.

Technological Advancements and Disruptions

Technological advancements have revolutionized the stock market, with new disruptive technologies and innovations constantly emerging. These advancements have not only provided new investment opportunities but have also reshaped traditional market sectors. The rise of cryptocurrencies, for instance, has sparked considerable debate and investment in this nascent sector.

Case Studies

One of the most notable case studies in recent stock market history is the meteoric rise of tech giants like Amazon and Apple. These companies, once small startups, have become behemoths of the stock market, showcasing the potential of innovative businesses to generate significant wealth for investors. Conversely, the fall of companies like WeWork and Tesla provides lessons on the risks associated with high valuations and over-reliance on specific technologies.

Conclusion

Understanding the factors influencing the stock market is crucial for investors looking to navigate the complexities of this dynamic environment. By analyzing historical trends, monetary policy, global economic factors, and technological advancements, investors can make informed decisions and mitigate risks. As the stock market continues to evolve, staying informed and adapting to changes remains key to achieving long-term success in the market.

so cool! ()

last:US Stock Futures Flat: What It Means for Investors

next:nothing

like

- US Stock Futures Flat: What It Means for Investors

- Stock Exchange US Now: The Future of Trading in the Heartland

- Global Stock Market Update: May 17, 2025

- Index Chart: The Ultimate Guide to Financial Analysis

- S&P 500 All-Time High: What It Means for Investors and the Market

- Follow Us Free Stock Photo: Unlock a World of Visual Inspiration

- Navigating the Business & Finance Landscape: Strategies for Success&q

- What Percentage Did the Stock Market Drop Today?

- Stock Trading Times: A Comprehensive Guide for U.S. Investors"

- 1903A3 US Smith Corona Rifle Stocks: A Comprehensive Guide

- Stocks to Buy Today: Top Picks for US Investors

- Top US Stocks to Invest in Right Now: A Comprehensive Guide"

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

What Happen to the Stock Market: Understanding

What Happen to the Stock Market: Understanding

Short Sell US Stock: A Comprehensive Guide

HDFC Securities Invests in US Stocks: A Strate

Can an Iranian Own Stock in the US? A Comprehe

Clinuvel Stock US: A Comprehensive Guide to In

Best US Large Cap Stocks to Watch for Momentum

UK Yahoo Finance: Your Ultimate Guide to Inves

Title: Quantitative Easing and Its Impact on t

Understanding the Tata Motors US Stock Market:

Kia Motors Stock in US: A Comprehensive Analys

Stocks of CRSP US Large Cap Growth Index Holdi

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Is the Stock Market Open Tomorrow in the US? K"

- After Market Stock US M1917: Enhancing the Cla"

- Top Momentum Stocks to Watch in the US Market "

- Capital Gain Percent on Stocks in the US: What"

- US Stock Market Symbol for IVN: Everything You"

- Understanding US Stock Exchange Market Hours i"

- US Large Cap Stocks Best Momentum 5 Days Perfo"

- Logitech C920s in Stock US: Your Ultimate Stre"

- Chevron Dividend: A Comprehensive Guide to Und"

- Understanding US Capital Stock Securities: A C"