you position:Home > us energy stock > us energy stock

Us Stock Futures Current Status: A Comprehensive Analysis"

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

The stock market is a dynamic environment, and staying informed about the current status of US stock futures is crucial for investors. In this article, we will provide a comprehensive analysis of the current status of US stock futures, exploring recent trends, potential risks, and opportunities. By the end of this article, you will have a better understanding of the market's current state and be equipped to make informed investment decisions.

Understanding US Stock Futures

US stock futures are financial contracts that allow investors to buy or sell shares of a particular stock at a predetermined price on a specified future date. These futures are often used by traders to hedge their portfolios, speculate on market movements, or gain exposure to a specific stock without owning the actual shares.

Current Trends

1. Stock Market Rally: In recent months, the US stock market has experienced a significant rally, driven by strong economic data, supportive monetary policy, and a positive outlook for corporate earnings. This has had a positive impact on US stock futures, with many contracts reaching record highs.

2. Technology Sector Leading the Charge: The technology sector has been a major driver of the stock market rally, with companies like Apple, Amazon, and Microsoft leading the pack. This trend is expected to continue, as these companies continue to innovate and grow their market share.

3. Economic Recovery: The economic recovery from the COVID-19 pandemic has also played a significant role in the current status of US stock futures. As the economy improves, corporate earnings are expected to rise, further boosting stock prices.

Potential Risks

Despite the positive trends, there are several risks that investors should be aware of:

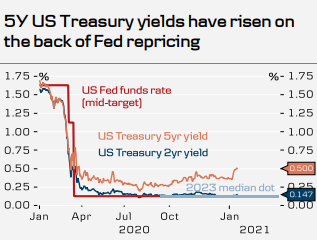

1. Inflation Concerns: As the economy recovers, there is a growing concern about inflation. Higher inflation can erode the purchasing power of investors, and may lead to a decrease in stock prices.

2. Geopolitical Tensions: Tensions between major economies, such as the US and China, could impact global markets and US stock futures. Trade disputes and political instability can lead to market volatility.

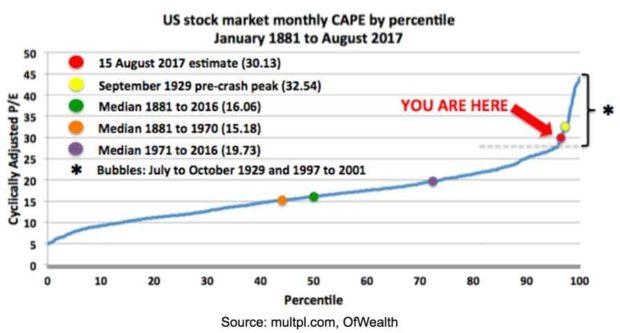

3. Market Valuations: The stock market is currently valued at record levels, which may make it vulnerable to a correction. Overvaluation can lead to a decrease in stock prices, as investors become concerned about future earnings growth.

Opportunities for Investors

Despite the risks, there are still opportunities for investors in the current status of US stock futures:

1. Sector Rotation: As the economy recovers, investors may benefit from rotating their investments into sectors that are poised to benefit from the recovery, such as consumer discretionary and financials.

2. Dividend Stocks: Dividend-paying stocks can provide investors with a stable income stream, even during periods of market volatility.

3. International Exposure: Investing in international stock futures can provide investors with diversification and exposure to different markets and economies.

Case Study: Apple Stock Futures

One of the most prominent examples of US stock futures is Apple. As one of the largest companies in the world, Apple has seen its stock futures surge in recent months, driven by strong sales and product innovation. However, there are still concerns about the company's valuation and the potential impact of trade tensions with China.

Conclusion

In conclusion, the current status of US stock futures is characterized by a strong rally, driven by economic recovery and sector growth. However, investors should remain cautious of potential risks, such as inflation and market valuations. By staying informed and making informed investment decisions, investors can navigate the dynamic stock market landscape and achieve their investment goals.

so cool! ()

last:US Polls Stock Market: What You Need to Know

next:nothing

like

- US Polls Stock Market: What You Need to Know

- US Brokers That Trade London Stock Exchange: Your Ultimate Guide

- Safest US Stocks to Buy: Top Picks for Investors Seeking Stability

- Unlocking the Power of US Steel Tracking Stock: A Comprehensive Guide

- US Stock Halted: What You Need to Know About Trading Halts

- Fanuc US Stock Location: Optimizing Your Manufacturing Process

- Latest US Stock News: Key Developments and Market Insights

- US Government Buys Intel Stock: What You Need to Know

- Top 5 US Healthcare Stocks to Watch in 2023

- Highest Stock Market Earnings in One Year: US Companies Lead the Charge

- US Stock Honey Extractor: The Ultimate Guide to Efficient Beekeeping

- TRP US SM CP Core EQ TR D Stock: A Comprehensive Guide

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Us Stock Futures Current Status: A Comprehensi

Us Stock Futures Current Status: A Comprehensi

PointsBet US Stock: A Comprehensive Guide to I

US Stock Holiday 2023: What You Need to Know

Good US Stocks to Buy Now for Long-Term Invest

Title: Total US Stock Market Capitalization Oc

Logitech C920s in Stock US: Your Ultimate Stre

Title: US Digital Currency Stock: The Future o

After Market Stock US M1917: Enhancing the Cla

Paytm Money US Stocks: A Comprehensive Guide f

Best US Stock Broker in Australia: Your Ultima

Title: "Total Market Cap of All US St

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Understanding the US Ecology Stock Symbol: A C"

- PLTR Price Target: What You Need to Know"

- US Lumber Stock Symbol: Understanding the Inve"

- Can I Still Buy Stocks When the US Market Clos"

- Best Performing US Stocks Last 5 Days: Momentu"

- US Stock Market 2014 Graph: A Comprehensive An"

- Understanding the Value ETF: A Comprehensive G"

- US Listed Rare Earth Stocks: A Comprehensive G"

- CATL Stock Buy in US: A Smart Investment for t"

- CS Stock Price: What You Need to Know"