you position:Home > us energy stock > us energy stock

Unlock the Future: A Comprehensive Guide to INX Futures

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the rapidly evolving world of financial markets, staying ahead of the curve is crucial. One of the most innovative and exciting areas of investment is through futures contracts, particularly those related to the digital currency known as INX. This article delves into the intricacies of INX futures, providing you with a comprehensive guide to understand, trade, and profit from this unique investment opportunity.

Understanding INX Futures

Firstly, let's clarify what INX futures are. INX is a digital currency designed to facilitate secure, instant, and cost-effective transactions. INX futures are contracts that allow investors to buy or sell INX at a predetermined price on a specific date in the future. This type of investment is particularly appealing to those looking to capitalize on the potential growth of digital currencies without owning the actual INX coins.

Benefits of Investing in INX Futures

There are several advantages to investing in INX futures:

- Leverage: Similar to other futures contracts, INX futures allow investors to control a larger amount of INX than they would with a traditional investment. This means higher potential returns, but also higher risk.

- Diversification: By investing in INX futures, you can diversify your portfolio and reduce exposure to traditional assets, such as stocks and bonds.

- Market Access: INX futures provide access to the digital currency market, which is one of the fastest-growing sectors in the world.

How to Trade INX Futures

Trading INX futures is relatively straightforward. Here's a step-by-step guide:

- Choose a Broker: Select a reputable broker that offers INX futures trading. Ensure they have a good track record and offer competitive fees.

- Open an Account: Create an account with your chosen broker and fund it with the necessary capital.

- Understand the Platform: Familiarize yourself with the trading platform provided by your broker. This is where you will place your trades.

- Place Your Trade: Decide whether you want to buy or sell INX futures. Consider market trends and your investment strategy before placing your trade.

- Monitor Your Investment: Keep an eye on the market and adjust your position as needed.

Case Study: Investing in INX Futures

Let's consider a hypothetical scenario to illustrate the potential of INX futures. Imagine you invested

Risks and Considerations

While INX futures offer potential for high returns, it's important to be aware of the risks involved:

- Market Volatility: The digital currency market is highly volatile, which means prices can fluctuate rapidly.

- Regulatory Risk: The regulatory landscape for digital currencies is still evolving, which could impact the future of INX and its futures contracts.

- Liquidity Risk: Depending on the market conditions, there may be limited liquidity in INX futures, making it difficult to enter or exit positions.

Conclusion

Investing in INX futures can be a lucrative opportunity for those looking to capitalize on the growth of digital currencies. By understanding the market, utilizing leverage responsibly, and managing risks effectively, you can potentially earn significant returns. Remember to do thorough research and consider consulting with a financial advisor before making any investment decisions.

so cool! ()

last:Semiconductor Stocks: The US Market's Leading Players and Future Outlook

next:nothing

like

- Semiconductor Stocks: The US Market's Leading Players and Future Outlook

- Did Stocks Fall Today? A Comprehensive Analysis of Today's Market Movement

- Indian Stocks to Buy in the US: A Comprehensive Guide

- US Troop Transportations to Afghanistan: The Logistics Behind the Scenes

- Down Jones History: Unveiling the Evolution of Wall Street's Benchmark Index

- Maximizing Returns with Pyr Stock US: Your Ultimate Guide

- Bond Market Up or Down Today: Key Insights and Predictions

- Best American Stocks to Watch in 2023

- Samsung Stock: US ADR - A Comprehensive Guide to Investing

- Ticker Symbol Search: Master the Art of Stock Research"

- Legal & General Group Stock: A Comprehensive Guide on the US Exchange

- Maximizing Capital Gains on Stocks in the US: Strategies and Insights

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Unlock the Future: A Comprehensive Guide to IN

Unlock the Future: A Comprehensive Guide to IN

Best US Stock Broker Singapore: Your Ultimate

Stock Market News October 19, 2025: US Markets

Meituan Stock US: The Rise and Future of China

Best Brokerage for US Stocks in Singapore: You

AI Stocks: A Game-Changing Trend in the US Mar

Unlocking Potential: The Rise of Oil Refinery

Follow Us Free Stock Photo: Unlock a World of

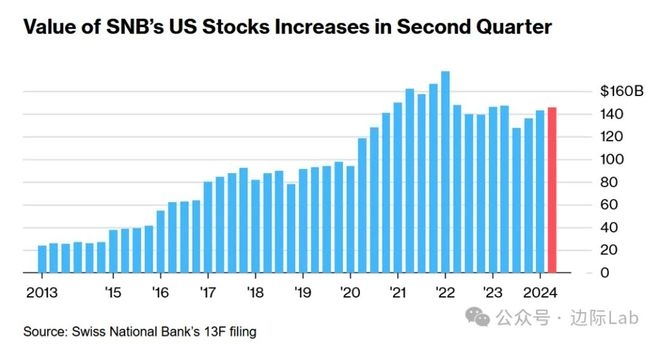

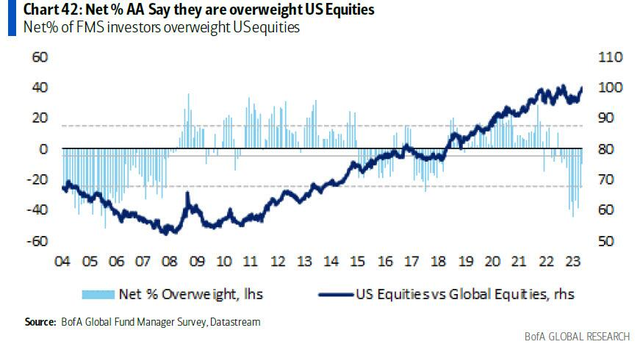

Does the US Government Own Stocks? Unveiling t

FTX US Stocks: The Ultimate Guide to Investing

US AI Stocks Momentum: The Future of Investmen

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Unveiling the Power of the US Stock Exchange A"

- Understanding the US Stock Market Average Dail"

- Can Canadians Invest in US Stocks? A Comprehen"

- US Steel Stock Drop in 1929: The Significance "

- Stocks of CRSP US Large Cap Growth Index Holdi"

- New York Stock Exchange Life US Index: A Compr"

- Military Stocks: A Smart Investment for Savvy "

- How to Buy Wise Stock in the US"

- Pharmacielo Stock US: A Breakdown of the Inves"

- Main US Stock Indices: A Comprehensive Guide t"