you position:Home > us energy stock > us energy stock

Understanding the US Stock Futures: A Comprehensive Guide

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In the fast-paced world of finance, staying ahead of the curve is crucial. One of the most dynamic and volatile markets is the US stock futures market. Whether you're an experienced trader or a beginner looking to dip your toes into the stock market, understanding how US stock futures work is essential. In this article, we'll delve into the basics, explore the benefits, and provide insights into trading strategies.

What are US Stock Futures?

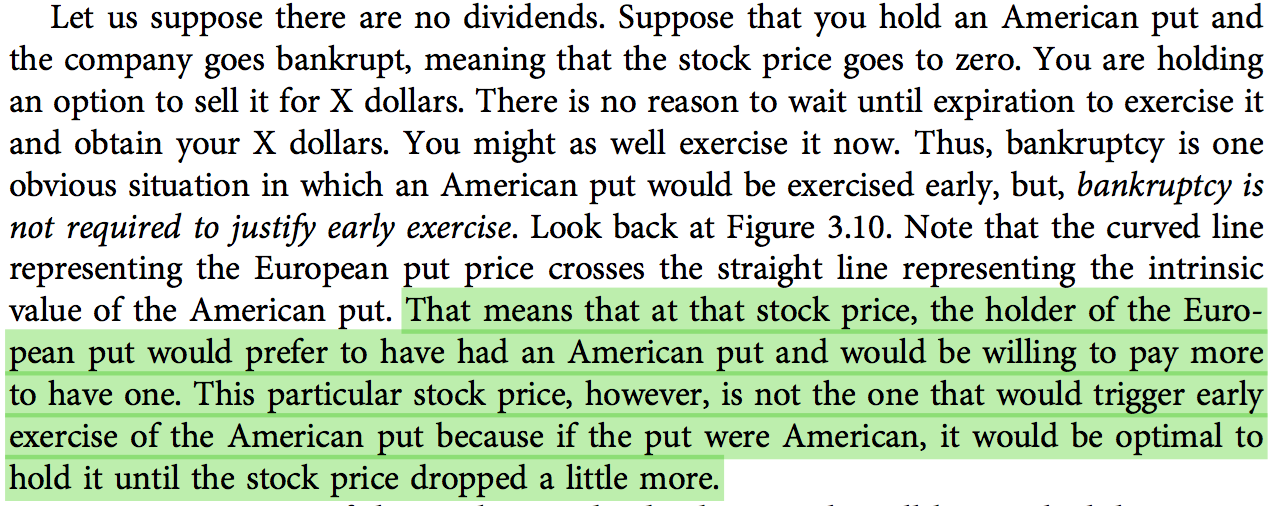

US stock futures are financial contracts that allow investors to buy or sell a specific number of shares of a stock at a predetermined price on a specified future date. Unlike stocks, which are actual ownership of a company, futures represent a contract between two parties to buy or sell an asset at a future date. This makes them a popular tool for traders looking to speculate on stock prices or hedge their investments.

Benefits of Trading US Stock Futures

1. Leverage: One of the most significant advantages of trading futures is the ability to control a large amount of stock with a relatively small amount of capital. This leverage can amplify profits, but it also increases the risk of losses.

2. Flexibility: Futures allow traders to enter and exit positions quickly, providing flexibility and the opportunity to capitalize on short-term market movements.

3. Access to Global Markets: US stock futures give investors access to global markets, allowing them to trade stocks from companies around the world.

4. Risk Management: Futures can be used as a hedging tool to protect against potential losses in the underlying stock positions.

How to Trade US Stock Futures

1. Choose a Broker: The first step is to find a reputable broker that offers US stock futures trading. Look for a broker with low fees, a user-friendly platform, and excellent customer service.

2. Educate Yourself: Understanding the basics of trading, including market analysis, technical analysis, and risk management, is crucial for success in the futures market.

3. Develop a Trading Plan: A well-defined trading plan outlines your strategy, risk tolerance, and exit criteria. Stick to your plan to avoid making impulsive decisions.

4. Start Small: If you're new to trading, start with a small amount of capital and gradually increase your exposure as you gain experience.

Case Study: Hedging with US Stock Futures

Imagine you own 100 shares of Company XYZ, which you believe will increase in value over the next few months. However, you're concerned about potential market volatility. To hedge against potential losses, you decide to sell a US stock futures contract for Company XYZ.

If the stock price of Company XYZ falls, your futures contract will increase in value, offsetting some of your losses. This strategy allows you to protect your investment while still benefiting from potential gains.

Conclusion

US stock futures offer a unique way to trade the stock market with leverage, flexibility, and access to global markets. By understanding the basics, developing a trading plan, and managing risk effectively, you can capitalize on the opportunities provided by this dynamic market. Remember, education and discipline are key to success in the futures market.

so cool! ()

last:Understanding the US Bank Corp Stock Price: A Comprehensive Guide

next:nothing

like

- Understanding the US Bank Corp Stock Price: A Comprehensive Guide

- Title: US Century Bank Stock Symbol: Everything You Need to Know

- US Stock Future Live: The Ultimate Guide to Understanding and Trading Stock Futur

- US Manufacturing Stock: The Rising Star of Investment Opportunities

- Title: Toys "R" Us Highest Stock Price: A Look Back at the Reta

- Recent IPO Stocks in the US: A Deep Dive into the Emerging Market Trends

- US Defensive Stocks: A Strategic Approach to Market Volatility

- Best Performing Sectors in US Stocks 2025: A Deep Dive

- Stock Watering Definition: A Deep Dive into US History

- Lowes Stock US: A Comprehensive Guide to Understanding the Market Dynamics

- CATL Stock Buy in US: A Smart Investment for the Future

- Top US Momentum Stocks September 2025: Your Guide to Investment Opportunities

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Understanding the US Stock Futures: A Comprehe

Understanding the US Stock Futures: A Comprehe

Title: Toyo Solar Stock in South Carolina: A S

Nintendo US Stock on NASDAQ: An In-Depth Analy

US Military Suppliers Stock: The Backbone of N

Canadian ETFs Traded on US Stock Exchanges: A

Title: US Digital Currency Stock: The Future o

Best US Stocks Under $10: A Smart Investment S

Is the US Stock Market in Trouble?

Title: Are Foreign Stock Sales Reported to Us?

Best US-Based Drone Companies Stock: A Compreh

How to Invest in US Stocks from Pakistan

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Economy Stock 2018: A Comprehensive Review"

- US Food Holding Stock: A Comprehensive Guide t"

- Solar Stocks: A Lucrative Investment in the Fu"

- Major US Stock Indexes Rise After a Three-Day "

- Fibonacci Retracement: A Game-Changing Tool fo"

- US Stock Market: A Decade-by-Decade Analysis O"

- Nearmap Stock US: A Comprehensive Analysis"

- RIO US Stock: A Comprehensive Guide to Investi"

- Micron US Stock: A Comprehensive Guide to Inve"

- 6 Major US OTC Marijuana Stocks to Watch in 20"