you position:Home > us energy stock > us energy stock

US Stock Futures: A Comprehensive Guide to Dow Jones Predictions

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In the fast-paced world of finance, staying ahead of market trends is crucial. One of the most influential indicators of market sentiment is the Dow Jones Industrial Average (DJIA), often referred to as the "Dow." For investors and traders, keeping an eye on US stock futures can provide valuable insights into the potential direction of the Dow. This article delves into the intricacies of US stock futures and how they can be used to predict movements in the Dow Jones.

Understanding US Stock Futures

US stock futures are financial contracts that allow investors to buy or sell a specific number of shares of a stock at a predetermined price on a future date. These contracts are traded on various exchanges, including the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT). By trading futures, investors can speculate on the future price of a stock without owning the actual shares.

The Role of Stock Futures in Predicting the Dow

The Dow Jones Industrial Average is a price-weighted average of 30 large, publicly traded companies in the United States. It serves as a benchmark for the overall performance of the stock market. US stock futures can be a powerful tool for predicting movements in the Dow for several reasons:

Market Sentiment: US stock futures often reflect the current sentiment of the market. If investors are optimistic about the future of the stock market, they are more likely to buy futures contracts, driving up prices. Conversely, if investors are pessimistic, they may sell futures contracts, leading to lower prices.

Volume: The volume of trading in US stock futures can provide insights into the level of interest in a particular stock or sector. High trading volumes often indicate significant market activity and can be a sign of potential movement in the Dow.

Price Movements: The price movements of US stock futures can be a leading indicator of potential movements in the Dow. For example, if the price of a Dow component's futures contract is rising, it may indicate that the stock is expected to perform well, potentially driving up the overall value of the Dow.

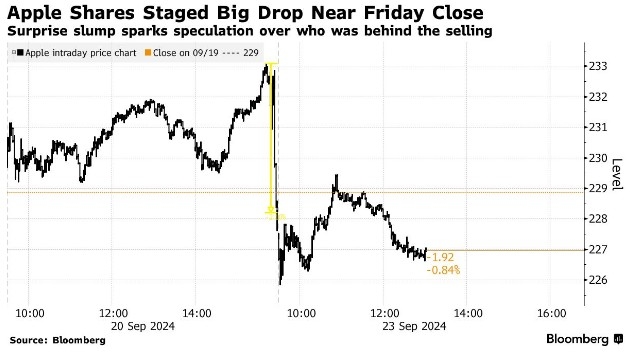

Case Study: Apple Inc. (AAPL)

To illustrate the impact of US stock futures on the Dow, let's consider a case study involving Apple Inc. (AAPL), one of the 30 components of the Dow. In January 2021, US stock futures for AAPL were showing strong gains. This optimism was driven by several factors, including positive earnings reports and strong demand for Apple's products.

As a result, the price of AAPL's futures contracts increased, leading to a rise in the value of the Dow. This example demonstrates how US stock futures can influence the overall performance of the Dow Jones Industrial Average.

Conclusion

US stock futures offer a valuable tool for investors and traders looking to predict movements in the Dow Jones Industrial Average. By analyzing market sentiment, trading volumes, and price movements, investors can gain valuable insights into the potential direction of the stock market. Whether you are a seasoned investor or just starting out, understanding the role of US stock futures in predicting the Dow can help you make more informed investment decisions.

so cool! ()

last:Top Insights on Philips US Stock: Everything You Need to Know

next:nothing

like

- Top Insights on Philips US Stock: Everything You Need to Know

- Is the US Stock Market Open on June 19, 2024? Your Ultimate Guide

- US Steel Stock Quote RSS: Real-Time Updates for Investors

- Exploring the Potential of MPLX: A Deep Dive into the Energy Sector with Reuters

- Top Performing US Large Cap Stocks in October 2025: Momentum and Insights

- Title: Top Stocks to Buy Now: US Market Analysis

- How Did US Stocks Perform Today? A Comprehensive Look"

- How to Invest in US Stocks from Nigeria: A Step-by-Step Guide

- Trading US Stocks in UAE: A Comprehensive Guide

- Stocking Sizes in the U.S.: A Comprehensive Guide to Finding the Perfect Fit

- Hartnett BOFA US Stock Market: A Deep Dive into Investment Opportunities

- Understanding US Stock Extended Hours: A Comprehensive Guide

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Stock Futures: A Comprehensive Guide to Dow

US Stock Futures: A Comprehensive Guide to Dow

US Banc Stock Historical P/E: A Comprehensive

Apple Stock Post US-China Trade War: The Impac

Infosys US Stock Price: A Comprehensive Analys

Alb.us Stock: Unveiling the Potential of This

AFI US Stock: Your Ultimate Guide to American

Bump Stock Ban: The US Federal Decision That S

Top Performing US Stocks Q1 2025: A Deep Dive

Motley Fool Us Stocks: Unveiling the Investmen

The US Stock Market is Like a Drunken Party

Good US Stocks to Buy Now for Long-Term Invest

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Healthcare ETF: A Comprehensive Guide to Inves"

- Rivian Stock Forecast: What the Future Holds f"

- Best US Stock Broker in Australia: Your Ultima"

- How Malaysians Buy US Stock: A Comprehensive G"

- Can Non-US Citizens Invest in Stocks?"

- How to Open a US Stock Account in Canada: A Co"

- Momentum Stocks: Top Performers in the US Larg"

- Stocks That Benefit from US Interest Rate Cuts"

- Pharmacielo Stock US: A Breakdown of the Inves"

- Title: "http stocks.us.reuters.com st"