you position:Home > us energy stock > us energy stock

US Steel Peak Stock Price: A Comprehensive Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

The stock market is a dynamic and unpredictable realm, where the value of shares can skyrocket or plummet in a matter of days. One such company that has seen its stock price fluctuate dramatically is U.S. Steel (NYSE: X). In this article, we will delve into the factors that contributed to the peak stock price of US Steel and analyze its impact on the market.

Understanding the Peak Stock Price

The peak stock price of US Steel refers to the highest trading price recorded for its shares on the New York Stock Exchange (NYSE). This milestone is often a result of various factors, including the company's financial performance, market trends, and industry-specific developments.

Financial Performance

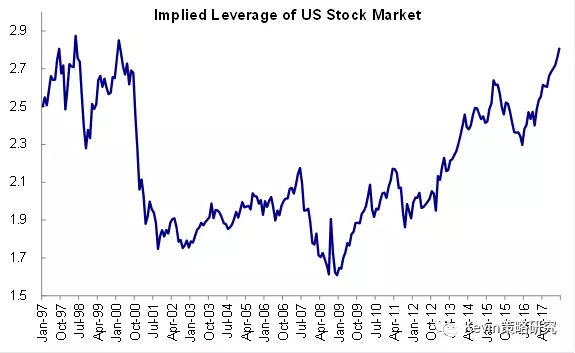

US Steel's financial performance has been a key driver behind its peak stock price. The company's revenue and earnings have shown significant growth over the years, primarily due to its focus on high-quality steel products and its expansion into new markets. This growth has led to increased investor confidence and a higher valuation of the company's shares.

Market Trends

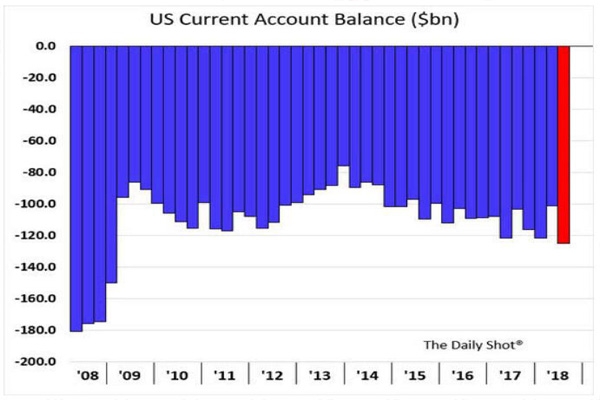

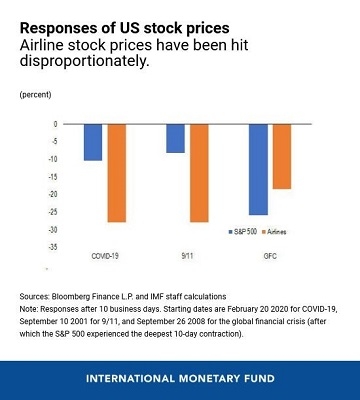

The steel industry has experienced a series of fluctuations in demand and supply over the years, which has directly impacted US Steel's stock price. For instance, during the construction boom in the early 2000s, the demand for steel surged, leading to a sharp increase in US Steel's stock price. Conversely, during the global financial crisis of 2008, the industry faced a severe downturn, resulting in a significant drop in US Steel's stock price.

Industry-Specific Developments

Several industry-specific developments have contributed to the peak stock price of US Steel. One such development is the company's focus on sustainable practices and innovation. US Steel has made significant investments in renewable energy and has developed new steel-making technologies that reduce emissions and improve energy efficiency. This commitment to sustainability has garnered positive attention from investors and has contributed to the company's higher stock price.

Case Studies

To illustrate the impact of market trends on US Steel's stock price, let's consider two case studies:

Construction Boom (2000s): During the early 2000s, the construction industry experienced a significant boom, driven by the housing market. This surge in demand for steel led to a peak stock price of US Steel, which reached approximately $70 per share in 2004.

Global Financial Crisis (2008): The global financial crisis of 2008 had a profound impact on the steel industry, with demand for steel plummeting. As a result, US Steel's stock price dropped to around $15 per share in 2009.

Conclusion

The peak stock price of US Steel is a testament to the company's resilience and adaptability in the face of market challenges. By focusing on financial performance, market trends, and industry-specific developments, US Steel has been able to achieve remarkable growth and secure a strong position in the steel industry. As the market continues to evolve, it will be interesting to see how US Steel's stock price performs in the future.

so cool! ()

last:Trinity Industries US Railroad Stocks: A Comprehensive Analysis

next:nothing

like

- Trinity Industries US Railroad Stocks: A Comprehensive Analysis

- US Shale Oil Stocks: A Comprehensive Guide to Investing in the Future of Energy

- Analyst Picks: US Stocks with Short-Term Momentum

- Title: Pharma Stocks US: A Deep Dive into the Market's Potential

- US Dividend Stocks: RRSP or TFSA – Which is Best for Your Portfolio?

- Shipping Company Stocks US: Exploring the Impact and Opportunities

- US Large Cap Stocks Best Momentum 5 Days Performance

- US Grid Stocks: Powering the Future of Energy

- Title: Swiss Central Bank and US Stock Market: Unveiling the Intriguing Connectio

- Is It Good to Invest in US Stocks from India?

- Best US-Based Drone Companies Stock: A Comprehensive Guide

- Title: Strong Buy Rated US Stocks: The Ultimate Investment Opportunity

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Steel Peak Stock Price: A Comprehensive Ana

US Steel Peak Stock Price: A Comprehensive Ana

US Graphene Companies Stock: A Comprehensive O

Current US Stock Market Capitalization: Unders

Title: US Stock Market Indices Today: A Compre

Title: Australia US Stock: A Comprehensive Gui

Title: Chinese Stocks in US List: A Comprehens

HMMJ.CA: Unveiling the US Stock Symbol of HMM,

Title: Stock BJJN US: Unveiling the Potential

How Major US Stock Indexes Fared Wednesday

Logitech C920s in Stock US: Your Ultimate Stre

US Stock Holidays 2025: A Comprehensive Guide

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: Leveraged ETFs: Your Gateway to High-Yi"

- Title: Profitable US Pot Stocks: A Guide to In"

- NVDA Stock Forecast 2025: What the Future Hold"

- Block Stock: The Ultimate Guide to Understandi"

- Understanding US Stock Exchange Market Hours i"

- Title: Stock Taxation in the United States: Un"

- Title: Best US Penny Stocks to Buy Right Now"

- US Stock APA Yahoo: A Comprehensive Guide to S"

- US Penny Stocks to Watch in 2021: Your Guide t"

- Toys "R" Us Public Stock: A "