you position:Home > us energy stock > us energy stock

Analyst Picks: US Stocks with Short-Term Momentum

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the fast-paced world of the stock market, identifying stocks with short-term momentum is crucial for investors looking to capitalize on quick gains. Analysts play a pivotal role in this process, providing insights and recommendations that can help investors make informed decisions. This article delves into the strategies employed by analysts to pick US stocks with short-term momentum and offers a glimpse into some of the top picks for 2023.

Understanding Short-Term Momentum

Before we dive into the picks, let's clarify what we mean by "short-term momentum." Short-term momentum refers to a stock's upward or downward trend over a relatively brief period, typically a few months. Investors often look for stocks with strong momentum as they anticipate a continued rise in share price.

Key Factors Considered by Analysts

Analysts use a variety of factors to identify stocks with short-term momentum. These include:

- Technical Analysis: This involves analyzing historical price and volume data to identify patterns and trends. Analysts look for indicators such as moving averages, relative strength index (RSI), and volume spikes.

- Fundamental Analysis: This involves evaluating a company's financial health, including revenue, earnings, and debt levels. Analysts also consider industry trends and macroeconomic factors.

- News and Events: Significant news or events can trigger short-term momentum. Analysts closely monitor earnings reports, product launches, and regulatory decisions.

Top Short-Term Momentum Picks for 2023

Based on these factors, here are some of the top US stocks with short-term momentum for 2023:

- Tesla (TSLA): As the leader in electric vehicles, Tesla has been a strong performer in recent years. Analysts anticipate continued growth as the company expands its product line and increases production capacity.

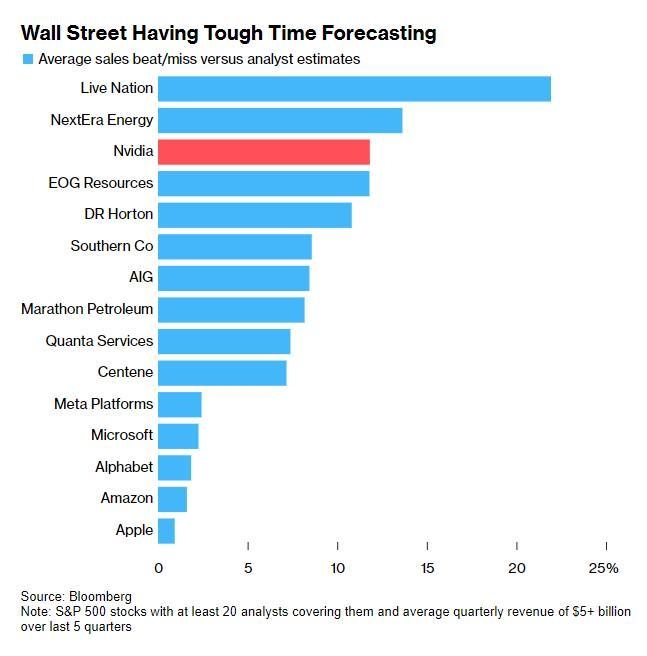

- NVIDIA (NVDA): This chipmaker has seen a surge in demand for its graphics processing units (GPUs) due to the rise of artificial intelligence and gaming. Analysts expect NVDA to maintain its momentum as it continues to innovate and capture market share.

- Amazon (AMZN): The e-commerce giant has been a consistent performer, and analysts believe it will continue to grow as it expands into new markets and diversifies its revenue streams.

- Berkshire Hathaway (BRK.B): Warren Buffett's investment company has a diverse portfolio of stocks, including insurance, utilities, and manufacturing. Analysts see BRK.B as a stable investment with potential for short-term gains.

- Meta Platforms (META): The parent company of Facebook has faced challenges in recent years, but analysts believe it is well-positioned for a comeback as it invests in new technologies and expands its advertising business.

Case Study: NVIDIA (NVDA)

To illustrate the impact of short-term momentum, let's consider NVIDIA's recent performance. In the past year, NVDA has seen a significant increase in share price, driven by strong demand for its GPUs. Analysts attribute this growth to the surge in artificial intelligence and gaming, as well as the company's successful product launches.

Conclusion

Identifying stocks with short-term momentum requires a combination of technical and fundamental analysis, as well as a keen eye for news and events. By following the picks of experienced analysts, investors can capitalize on the potential for quick gains in the stock market. As always, it's important to do your own research and consult with a financial advisor before making any investment decisions.

so cool! ()

last:Title: Pharma Stocks US: A Deep Dive into the Market's Potential

next:nothing

like

- Title: Pharma Stocks US: A Deep Dive into the Market's Potential

- US Dividend Stocks: RRSP or TFSA – Which is Best for Your Portfolio?

- Shipping Company Stocks US: Exploring the Impact and Opportunities

- US Large Cap Stocks Best Momentum 5 Days Performance

- US Grid Stocks: Powering the Future of Energy

- Title: Swiss Central Bank and US Stock Market: Unveiling the Intriguing Connectio

- Is It Good to Invest in US Stocks from India?

- Best US-Based Drone Companies Stock: A Comprehensive Guide

- Title: Strong Buy Rated US Stocks: The Ultimate Investment Opportunity

- Best US Stocks for Day Trading in 2025: Your Ultimate Guide

- How to Buy Wise Stock in the US

- Trade U.S. Stocks from Thailand: A Comprehensive Guide

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Analyst Picks: US Stocks with Short-Term Momen

Analyst Picks: US Stocks with Short-Term Momen

AAPL Stock US: A Deep Dive into Apple's F

US Best Performing Stocks: Top Investments to

Atvi Stock US: A Comprehensive Guide to Unders

ADRs: Unlocking the Potential of U.S. Stocks f

RSI Analysis of US Stocks in July 2025: Predic

Best US Stock Market App: Your Ultimate Invest

Ferrari Stock Price US: A Comprehensive Analys

How Much of the US Stock Is Owned by China?

Best US Food Stock: A Comprehensive Guide to T

Best Stocks to Own Outside the US

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Technology ETF: A Comprehensive Guide to Inves"

- Penny Stocks in the Oil Sector: US-Based Oppor"

- Title: Unveiling the US Dividend Stock Phenome"

- Nike Earnings: The Latest Breakdown and Analys"

- US Food Holding Stock: A Comprehensive Guide t"

- Home Depot Dividend: A Golden Yield for Invest"

- Drone Stocks: The Future of Aviation Investing"

- Title: "Isrg Us Stock Price: A Compre"

- Data Center Stocks: The Future of Tech Investm"

- Best Energy Stocks: Top Picks for Investors in"