you position:Home > us energy stock > us energy stock

US Representative Stock Trades: Strategies for Profitable Investment

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the world of finance, understanding the nuances of stock trading is crucial for anyone looking to make a profit. When it comes to US representative stock trades, there are several key strategies and considerations that investors should be aware of. This article delves into the essentials of stock trading in the United States, offering insights and practical tips for both beginners and seasoned investors.

Understanding the US Stock Market

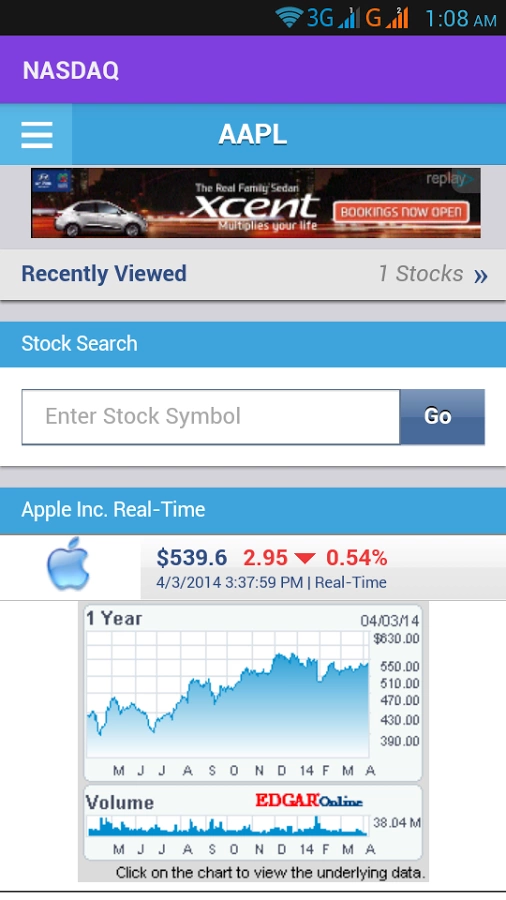

The US stock market is one of the most dynamic and largest in the world. It includes exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ, where companies list their shares for trading. To participate in this market, investors need to have a solid understanding of the basics, including stock types (like common and preferred shares), market capitalization, and the various financial ratios used to evaluate companies.

Key Strategies for US Stock Trades

Research and Analysis: Thorough research is the cornerstone of successful stock trading. Investors should analyze a company's financial statements, earnings reports, and industry trends. This includes looking at key metrics like price-to-earnings (P/E) ratio and earnings per share (EPS).

Risk Management: Risk management is critical in stock trading. Investors should diversify their portfolios to spread out risk and avoid overexposure to any single stock. Using stop-loss orders can also help limit potential losses.

Long-Term Investing vs. Short-Term Trading: Depending on your investment strategy, you may choose to be a long-term investor or engage in short-term trading. Long-term investing requires patience and a focus on the company's long-term growth potential, while short-term trading involves more frequent buying and selling of stocks to capitalize on short-term market movements.

Keeping Up with News and Events: Staying informed about news and events that could impact the stock market is crucial. Economic indicators, political developments, and corporate announcements can all significantly influence stock prices.

Case Studies: Successful US Stock Trades

One notable example is the case of Apple Inc. (AAPL). Investors who recognized the company's innovative potential and strong financial performance early on have seen significant returns over the years. Similarly, those who invested in Tesla, Inc. (TSLA) when it first went public have also seen substantial gains.

On the other hand, investors who missed out on these opportunities might have considered companies like Amazon.com, Inc. (AMZN) or Microsoft Corporation (MSFT), which have been consistent performers and have grown significantly over time.

Conclusion:

Engaging in US representative stock trades requires a combination of knowledge, discipline, and patience. By understanding the market, implementing effective strategies, and staying informed, investors can increase their chances of success. Whether you're a beginner or a seasoned trader, always remember to research thoroughly, manage risk wisely, and keep abreast of market news to make informed investment decisions.

so cool! ()

like

- Asia-US Industrial Joint Stock Company: A Promising Partnership for Global Succes

- Us Steel Stock Price: A Comprehensive Analysis

- Best Stock to Invest in the US: A Comprehensive Guide

- Title: Market Sentiment and US Stocks: Understanding the Dynamics

- Honour Us Latex Stocking Size: Finding the Perfect Fit for Your Fashion Needs

- Title: Stock BJJN US: Unveiling the Potential of This Emerging Market

- Global X SuperDividend US ETF Stock: A Comprehensive Guide

- Fidelity Canada US Stock: A Comprehensive Guide

- US Steel Corporation Stocks: A Comprehensive Guide to Investing in the Steel Gian

- US Steel Stock News Today: Key Updates and Analysis

- Toys "R" Us Stock Crew Job Review: What You Need to Know

- Title: Top ETFs for US Stocks: Your Ultimate Guide to Investment Success

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Representative Stock Trades: Strategies for

US Representative Stock Trades: Strategies for

Understanding the iShares Total U.S. Stock Mar

US Small Cap Stock Picks: Unveiling the Hidden

Title: US Stock Earnings Today: Key Highlights

AFI US Stock: Your Ultimate Guide to American

Operational Non-US Stock Index Fund: A Strateg

http://stocks.us.reuters.com/stocks/fulldescri

Emerging Markets and Global Growth vs. US Stoc

How to Invest in the London Stock Exchange fro

US Medical Equipment Stocks: A Comprehensive G

Gold Stocks in the US: A Comprehensive Guide t

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Understanding the Value ETF: A Comprehensive G"

- Title: Stock X Contact Us: Your Gateway to Exc"

- Title: Japan Stock Banks in US Markets: Opport"

- Best Energy Stocks: Top Picks for Investors in"

- Honour Us Latex Stocking Size: Finding the Per"

- AFI US Stock: Your Ultimate Guide to American "

- The Stock and Flow of US Firearms: Understandi"

- Title: "Isrg Us Stock Price: A Compre"

- Nike Stock Forecast: What the Experts Are Sayi"

- Should I Buy Stocks Now?"