you position:Home > us energy stock > us energy stock

US Growth Stocks: The Ultimate Guide to High-Potential Investments

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, US growth stocks have become a popular choice for investors seeking high-potential returns. These stocks represent companies with strong revenue growth and the potential for significant capital appreciation. In this comprehensive guide, we'll explore what makes a growth stock, how to identify them, and why they might be a valuable addition to your investment portfolio.

Understanding Growth Stocks

Growth stocks are characterized by their ability to consistently increase their revenue and earnings over time. These companies often reinvest their profits back into the business to fuel further expansion and innovation. Unlike value stocks, which are typically undervalued and have a stable business model, growth stocks often come with higher price-to-earnings (P/E) ratios and are considered riskier investments.

Key Characteristics of Growth Stocks

To identify a potential growth stock, look for the following characteristics:

- Strong Revenue Growth: Companies with a history of increasing revenue are more likely to continue growing in the future.

- Profitability: A company that generates consistent profits is more likely to reinvest those profits into the business.

- Innovation: Companies that are at the forefront of innovation are more likely to capture market share and grow their revenue.

- Market Position: Companies with a strong market position and a competitive advantage are more likely to succeed in the long term.

Identifying Growth Stocks

There are several ways to identify potential growth stocks:

- Research: Conduct thorough research on companies in your industry of interest. Look for companies with a strong track record of growth and a promising future.

- Financial Analysis: Analyze a company's financial statements, including revenue, earnings, and cash flow, to determine its growth potential.

- Market Trends: Stay informed about market trends and identify companies that are poised to benefit from these trends.

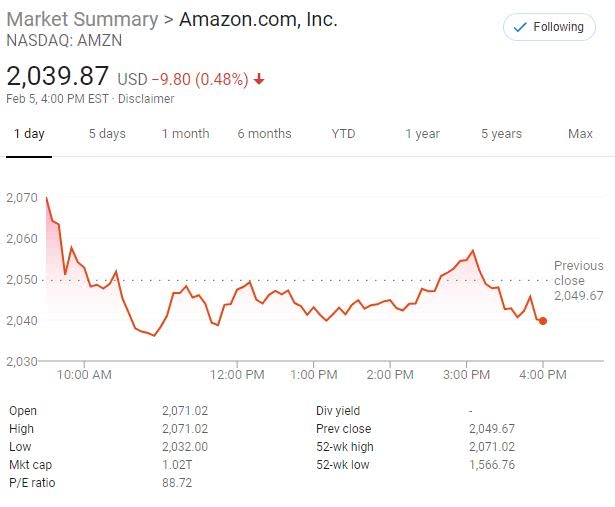

Case Study: Amazon

A prime example of a successful growth stock is Amazon. Since its inception in 1994, Amazon has grown into one of the largest companies in the world. The company's focus on innovation, expansion into new markets, and strong revenue growth have made it a highly sought-after investment.

Risks of Investing in Growth Stocks

While growth stocks offer the potential for high returns, they also come with higher risks. Here are some of the risks to consider:

- Market Volatility: Growth stocks can be highly volatile, experiencing significant price swings.

- Economic Factors: Economic downturns can impact the growth of these companies.

- Regulatory Changes: Changes in regulations can affect the operations and profitability of growth stocks.

Conclusion

US growth stocks can be a valuable addition to your investment portfolio if you do your homework and understand the risks involved. By identifying companies with strong revenue growth, profitability, and innovation, you can potentially benefit from significant capital appreciation. Remember to conduct thorough research and stay informed about market trends to make informed investment decisions.

so cool! ()

last:How Many US Listed Stocks Are There? A Comprehensive Overview

next:nothing

like

- How Many US Listed Stocks Are There? A Comprehensive Overview

- Understanding the US Stock Close Time: Key Factors and Implications

- Barron's Market Data: Your Ultimate Guide to US Stocks

- August 29, 2025: US Stock Market Close Summary

- US Gillette Stock: A Comprehensive Analysis of the Company's Performance and

- Top US Stocks to Invest In: Your Ultimate Guide to High-Potential Investments

- Moncler Stock US: A Comprehensive Guide to Investing in the Luxury Brand

- Cannabis US Stocks: A Comprehensive Guide to Investing in the Green Rush

- Top Momentum Stocks Past 5 Days: US Large Cap Analysis

- US Stock 20000: Unveiling the Opportunities and Challenges

- Us Healthvest Stock: The Future of Healthcare Investing

- How to Get Involved in the Stock Market in the U.S."

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Growth Stocks: The Ultimate Guide to High-P

US Growth Stocks: The Ultimate Guide to High-P

Current US Stock Market Capitalization: Unders

Micron US Stock: A Comprehensive Guide to Inve

Ogi Us Stock: Your Ultimate Guide to Understan

Is China Buying All US Stocks? A Closer Look a

Alb.us Stock: Unveiling the Potential of This

August 29, 2025: US Stock Market Close Summary

US Stock Market AI Bubble Concerns: Is It Time

Us Machine Gun Stock Adapter: The Ultimate Gui

Cannabis US Stocks: A Comprehensive Guide to I

Top Momentum Stocks Past 5 Days: US Large Cap

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Stock Future Live: The Ultimate Guide to Un"

- Title: Toyo Solar Stock in South Carolina: A S"

- US Stock Market in the Past 3 Months: A Compre"

- Solar Energy Stocks: A Lucrative Investment Op"

- Dow ETF: A Comprehensive Guide to Investing in"

- US Stock Futures: A Comprehensive Guide to Dow"

- Revenue Growth: Strategies to Skyrocket Your B"

- RSI Analysis of US Stocks in July 2025: Predic"

- Best Performing US Stocks Past Week: Momentum "

- Buy Samsung Stock in US: A Strategic Investmen"