you position:Home > us energy stock > us energy stock

Top US Value Stocks to Watch in 2023: A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, identifying top value stocks can be a game-changer for investors seeking long-term growth. The United States, with its robust economy and diverse industries, offers a plethora of opportunities for value investors. This article delves into some of the top US value stocks that investors should consider adding to their portfolios in 2023.

Understanding Value Stocks

Before we dive into the list, let's clarify what makes a stock a "value stock." Value stocks are characterized by their low price-to-earnings (P/E) ratio, indicating they are undervalued compared to their fundamentals. These stocks often belong to companies with strong financial health and potential for future growth, making them attractive picks for value investors.

Top US Value Stocks to Watch in 2023

Apple Inc. (AAPL)

- Fundamentals: With a P/E ratio of around 30, Apple continues to be a solid value pick. The tech giant boasts a strong balance sheet, substantial cash reserves, and a diversified product line.

- Analysis: Despite recent challenges, Apple's ecosystem and global brand recognition make it a reliable investment.

Amazon.com Inc. (AMZN)

- Fundamentals: Amazon's P/E ratio stands at approximately 70, which may seem high but is justified by its dominant position in the e-commerce sector and growing cloud services business.

- Analysis: Amazon's expansion into new markets and its ongoing innovation keep it a top pick for value investors.

Johnson & Johnson (JNJ)

- Fundamentals: With a P/E ratio of around 35, Johnson & Johnson is a healthcare powerhouse known for its stable dividend payments and strong product portfolio.

- Analysis: The company's diversified business model, including pharmaceuticals, consumer goods, and medical devices, provides a buffer against market fluctuations.

Procter & Gamble (PG)

- Fundamentals: Procter & Gamble, with a P/E ratio of about 27, is a consumer goods giant with a history of steady growth and strong brand power.

- Analysis: The company's diverse product range, including beauty, grooming, and health care, ensures resilience in various economic conditions.

Microsoft Corporation (MSFT)

- Fundamentals: Microsoft, with a P/E ratio of around 33, is a leader in the tech industry, offering a range of products and services, from software to cloud computing.

- Analysis: The company's strong fundamentals and consistent revenue streams make it a solid value investment.

Exxon Mobil Corporation (XOM)

- Fundamentals: As one of the world's largest oil and gas companies, Exxon Mobil has a P/E ratio of approximately 22, making it an attractive value pick.

- Analysis: The company's vast resources and diversified energy portfolio provide stability and growth potential.

Intel Corporation (INTC)

- Fundamentals: With a P/E ratio of about 22, Intel is a tech giant with a long history of innovation in the semiconductor industry.

- Analysis: Despite facing challenges from competitors, Intel's R&D efforts and market presence ensure it remains a valuable investment.

Conclusion

Investing in top US value stocks requires thorough research and a long-term perspective. The companies mentioned above have demonstrated strong fundamentals and potential for future growth. As with any investment, it's crucial to conduct your own due diligence and consider your investment goals and risk tolerance before making any decisions.

Note: This article is for informational purposes only and should not be considered financial advice. Always consult with a financial advisor before making investment decisions.

so cool! ()

last:Trading Samsung Stock in the US: A Comprehensive Guide

next:nothing

like

- Trading Samsung Stock in the US: A Comprehensive Guide

- 5G Related US Stocks: The Future of Connectivity and Investment

- Mitsubishi Motors Stock US: A Comprehensive Guide to Investing in the Japanese Au

- Title: Top 5 US High Dividend Stocks ETFs to Watch in 2023

- Short-Term Gain: Unlocking the Potential of US Stocks"

- Unlocking the Potential of Chevron Stock: A Comprehensive Guide

- TheRateTechnologies Stock US: A Comprehensive Guide to Understanding and Investin

- How to Trade on the London Stock Exchange from the US

- Stock Crash in the US: What You Need to Know"

- US Large Cap Stocks RSI Momentum Indicators: A Comprehensive Analysis for October

- Can Canadians Invest in US Stocks? A Comprehensive Guide

- Sunrun US Solar Stocks: A Comprehensive Guide to Investment Opportunities

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Top US Value Stocks to Watch in 2023: A Compre

Top US Value Stocks to Watch in 2023: A Compre

How Low Will US Steel Stock Go?

Good US Stocks to Buy Now for Long-Term Invest

Best US Stock Broker Singapore: Your Ultimate

Top Insights on Philips US Stock: Everything Y

US Large Cap Stocks: Momentum Best Performers

Chinese Shares Delisted from US Stock Exchange

CP Rail Stock US: A Comprehensive Guide to the

Ark Pharm US Stock: A Comprehensive Analysis

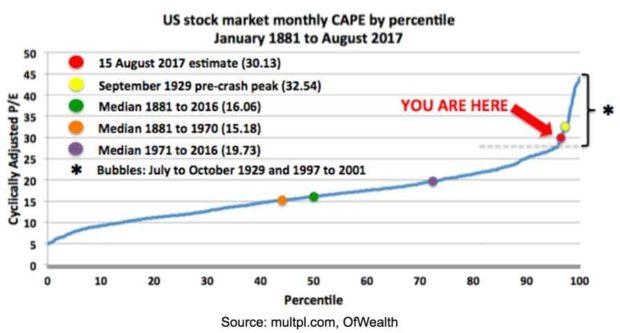

US Stock Market Bubble Indicators: October 202

Transfer Your US Stocks from UAE Brokerage to

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- 2025 US Stock Recommendations: May 2025 Outloo"

- Title: Mastering Price Action: A Comprehensive"

- Prison Stocks: The Hidden Investment Opportuni"

- US Nickel Mining Stocks: A Golden Opportunity "

- Title: "http stocks.us.reuters.com st"

- Understanding the US Bancorp Preferred Stock C"

- Understanding US Capital Stock Securities: A C"

- Unlocking the Potential of JPMorgan Chase: A D"

- Early Movers: Top US Stocks to Watch in 2023"

- Day Trading for Beginners: A Comprehensive Gui"