you position:Home > us energy stock > us energy stock

Title: Is the US Stock Market Overvalued in 2019?

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Introduction: In 2019, the question on everyone's mind was whether the US stock market was overvalued. With record-high stock prices and a seemingly endless bull market, many investors were left wondering if it was time to pull out or if the market was just getting started. This article delves into the factors that contributed to the overvaluation and the implications for investors.

Market Performance in 2019 Last year, the US stock market experienced one of its strongest years on record. The S&P 500 index, a benchmark for the performance of large companies in the United States, soared to new heights. However, the rapid increase in stock prices raised concerns about whether the market was overvalued.

Factors Contributing to Overvaluation Several factors contributed to the overvaluation of the US stock market in 2019. One of the primary factors was low interest rates. The Federal Reserve cut interest rates multiple times throughout the year, making it cheaper for companies to borrow money and invest in their businesses. This, in turn, led to increased earnings and higher stock prices.

Another factor was strong corporate earnings. Companies reported robust profits, driven by factors such as tax cuts and a strong economy. However, some investors argued that the market was pricing in these earnings, leaving little room for growth.

Evaluating Market Valuations To determine if the US stock market was overvalued in 2019, investors looked at various valuation metrics. One of the most commonly used metrics is the price-to-earnings (P/E) ratio. This ratio compares the current stock price to the company's earnings per share. In 2019, the S&P 500's P/E ratio was around 20, which is higher than its historical average of about 15. This suggested that the market was overvalued.

Another metric used to evaluate market valuations is the cyclically adjusted price-to-earnings (CAPE) ratio. The CAPE ratio is a measure of the market's price relative to the average inflation-adjusted earnings of the past 10 years. The CAPE ratio for the S&P 500 in 2019 was around 32, which is significantly higher than its long-term average of about 16. This further indicated that the market was overvalued.

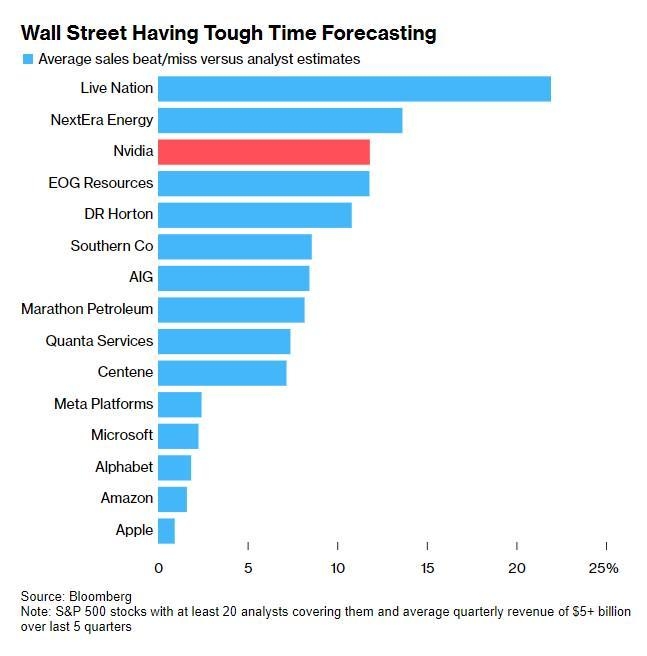

Case Studies: Tech Stocks One of the most notable sectors contributing to the overvaluation was the technology industry. Companies like Apple, Microsoft, and Amazon saw their stock prices soar to unprecedented levels. However, some investors were concerned that these tech giants were overvalued.

For example, Apple's stock price surged by more than 60% in 2019, reaching an all-time high. While the company's strong earnings and innovative products contributed to its growth, some investors questioned whether the stock was overvalued.

Similarly, Amazon's stock price surged by more than 50% in 2019, driven by its strong e-commerce and cloud computing businesses. However, critics argued that the stock's valuation was unsustainable, given the company's massive investments in new projects and increasing competition.

Conclusion: In 2019, the US stock market was widely considered to be overvalued. Factors such as low interest rates, strong corporate earnings, and record-high stock prices contributed to this assessment. While the market has since experienced volatility, the concerns about overvaluation remain. Investors should carefully consider the risks and rewards of investing in an overvalued market.

so cool! ()

last:Title: Current Time in US Stock Market: What You Need to Know

next:nothing

like

- Title: Current Time in US Stock Market: What You Need to Know

- Today's Momentum Stocks in the US Market

- Trading US Stocks from NZ: A Comprehensive Guide

- RSI Momentum Analysis of US Stocks: A Look into September 2025

- Title: US Stock Market After Trump: A Comprehensive Analysis

- Top Steel Stocks in the US: A Comprehensive Guide for Investors

- Title: US Middle Market Stocks: A Golden Opportunity for Investors

- US Momentum Stocks 5-Day Performance Analysis: July 2025

- Momentum Stocks 5-Day Performance: US Large Cap September 2025

- Top US Mid Cap Stocks: Your Guide to Investment Opportunities

- March 2020 IPO List: A Deep Dive into the US Stock Market

- US Stock Analysis Websites: Your Ultimate Guide to Making Informed Investment Dec

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Title: Is the US Stock Market Overvalued in 20

Title: Is the US Stock Market Overvalued in 20

Tesla Stock Risks from US Election

US Stock Heatpress: The Ultimate Guide to Choo

Title: "http mdcdiamonds.com earringd

Canadian ETFs Traded on US Stock Exchanges: A

Intel US Stocks: A Comprehensive Guide to Inve

Title: Unveiling the US Dividend Stock Phenome

Green Energy Stocks in the US: A Lucrative Inv

Does Daimler Stock Trade in US? Understanding

Hy Stock Prices Declined: A Deep Dive into US

Unveiling the Secrets of US History with Stock

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Coca-Cola Dividend: Understanding the Power of"

- Understanding the US Dollar Stock Chart: A Com"

- Title: Understanding the Market Bubble: Causes"

- Best Value Stocks: How to Identify and Invest "

- Understanding Put Options: A Comprehensive Gui"

- RSI Momentum Analysis of US Stocks: A Look int"

- Fibonacci Retracement: A Game-Changing Tool fo"

- Sustainable Investing: A Path to Profit and a "

- RSI Analysis of US Stocks in July 2025: Predic"

- Understanding US Foods Stock Options: A Compre"