you position:Home > us energy stock > us energy stock

Title: US Stock Market After Trump: A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Introduction: The election of Donald Trump as the 45th President of the United States in 2016 brought about significant changes in the country's political landscape. One of the most notable impacts was observed in the US stock market. This article aims to provide a comprehensive analysis of the US stock market after Trump's presidency, highlighting key trends, market performance, and potential future directions.

Stock Market Performance During Trump's Presidency

The US stock market experienced a remarkable bull run during Trump's presidency. The S&P 500, a widely followed benchmark index, saw a substantial increase in its value. From January 20, 2017, when Trump took office, to January 20, 2021, when his term ended, the S&P 500 delivered a total return of over 80%. This performance outpaced the average return over the previous ten years.

Several factors contributed to this strong market performance. Tax cuts were a significant factor, as the Tax Cuts and Jobs Act of 2017 reduced corporate tax rates from 35% to 21%. This move provided businesses with additional capital to invest in expansion, research, and development, ultimately boosting market sentiment.

Trade Policies and Tariffs

One of the most controversial aspects of Trump's presidency was his trade policies. Tariffs imposed on various countries, including China, Mexico, and the European Union, created uncertainty and volatility in the market. While some companies benefited from the tariffs, others faced increased costs and reduced competitiveness.

Despite the trade tensions, the US stock market managed to maintain its upward trajectory. This can be attributed to the strong fundamentals of the economy, including low unemployment rates, strong consumer spending, and robust corporate earnings.

Impact of the COVID-19 Pandemic

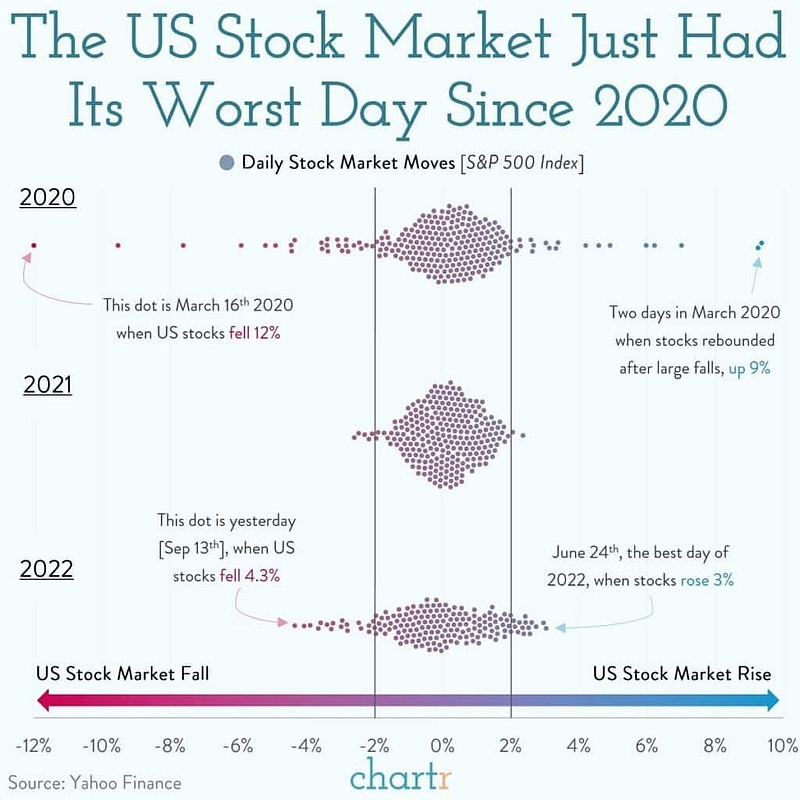

The COVID-19 pandemic had a profound impact on the US stock market during Trump's presidency. The outbreak led to widespread lockdowns, causing a sharp decline in economic activity and market volatility. However, the Federal Reserve's aggressive monetary policy and stimulus measures helped stabilize the market.

The stock market experienced a significant rebound after the initial downturn. The S&P 500, for instance, recovered to its pre-pandemic levels within a few months. This resilience can be attributed to the strong fundamentals of the market, as well as the swift response from policymakers to address the economic challenges posed by the pandemic.

Potential Future Directions

The US stock market's future direction after Trump's presidency remains uncertain. Several factors could influence market performance, including the outcome of the 2020 presidential election, economic policies, and global events.

One potential area of concern is the increasing level of national debt. The US national debt has surged to record levels during Trump's presidency, raising concerns about the country's long-term fiscal health. This could lead to higher interest rates and reduced investor confidence in the market.

Another factor to consider is the evolving political landscape. The incoming administration's policies and priorities could have a significant impact on the market. For instance, a more aggressive approach to regulation or tax increases could negatively affect certain sectors of the market.

Conclusion: The US stock market after Trump's presidency has demonstrated remarkable resilience and growth. Despite challenges such as trade tensions and the COVID-19 pandemic, the market has managed to maintain its upward trajectory. However, the future direction of the market remains uncertain, with several factors that could influence its performance. As investors, it is crucial to stay informed and adapt to the evolving landscape.

so cool! ()

last:Top Steel Stocks in the US: A Comprehensive Guide for Investors

next:nothing

like

- Top Steel Stocks in the US: A Comprehensive Guide for Investors

- Title: US Middle Market Stocks: A Golden Opportunity for Investors

- US Momentum Stocks 5-Day Performance Analysis: July 2025

- Momentum Stocks 5-Day Performance: US Large Cap September 2025

- Top US Mid Cap Stocks: Your Guide to Investment Opportunities

- March 2020 IPO List: A Deep Dive into the US Stock Market

- US Stock Analysis Websites: Your Ultimate Guide to Making Informed Investment Dec

- Title: Stocks US Market: A Comprehensive Guide to Understanding the American Stoc

- Can U.S. Citizens Invest in U.S. Stocks in Taiwan?

- Title: "http mdcdiamonds.com earringdetails.cfm stock fea17rg&co

- Glaxosmithkline Stock Price US: A Comprehensive Guide

- Best Offshore Stock Brokers for US Clients: How to Choose the Right One

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Title: US Stock Market After Trump: A Comprehe

Title: US Stock Market After Trump: A Comprehe

US Large Cap Stocks Momentum Leaders: July 202

Ocado Stock US: A Closer Look at the Future of

US Industrials Stocks: A Comprehensive Guide t

How Will US Stocks Fare in a Dollar Collapse?

Fidelity Small Cap US Stock Fund: A Comprehens

Companies Listed on US Stock Markets: A Compre

How Can an Indian Invest in US Stocks?

US Shipping Company Stocks: A Comprehensive Gu

Ogi Us Stock: Your Ultimate Guide to Understan

Title: "http mdcdiamonds.com earringd

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Glaxosmithkline Stock Price US: A Comprehensiv"

- Current US Stock Market Conditions June 2025"

- Trading US Stocks from Dubai: A Comprehensive "

- Lucid Stock: Unveiling the Future of Trading"

- Operational Non-US Stock Index Fund: A Strateg"

- Tesla Stock: A NASDAQ US Investment Highlight"

- NVDA Price Target: What You Need to Know"

- http://stocks.us.reuters.com/stocks/fulldescri"

- Title: List of All Stocks Traded in the US: A "

- What Are the Stock Markets in the US?"