you position:Home > us energy stock > us energy stock

Title: Best US Dividend Stocks to Buy

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Introduction: Are you looking to invest in the best US dividend stocks to boost your portfolio? Dividend stocks can provide a steady stream of income and potentially increase your wealth over time. In this article, we will explore some of the top dividend stocks in the United States that you should consider adding to your investment portfolio.

Johnson & Johnson (JNJ) Johnson & Johnson is a well-established pharmaceutical and consumer goods company that has been paying dividends for over a century. The company's diverse product portfolio, strong brand recognition, and consistent growth make it a reliable dividend stock. With a current dividend yield of 2.7%, JNJ offers investors a steady income stream and the potential for capital appreciation.

Procter & Gamble (PG) Procter & Gamble is another household name in the consumer goods industry, known for its products such as Tide, Pampers, and Gillette. The company has a long history of paying dividends and has increased its dividend for 65 consecutive years. With a current dividend yield of 2.4%, PG is a solid choice for income investors seeking stability and growth.

Walmart (WMT) Walmart is the world's largest retailer and has a strong presence in the US and internationally. The company offers a dividend yield of 1.8% and has increased its dividend for 45 consecutive years. Walmart's ability to generate consistent profits and pay dividends makes it an attractive option for income investors.

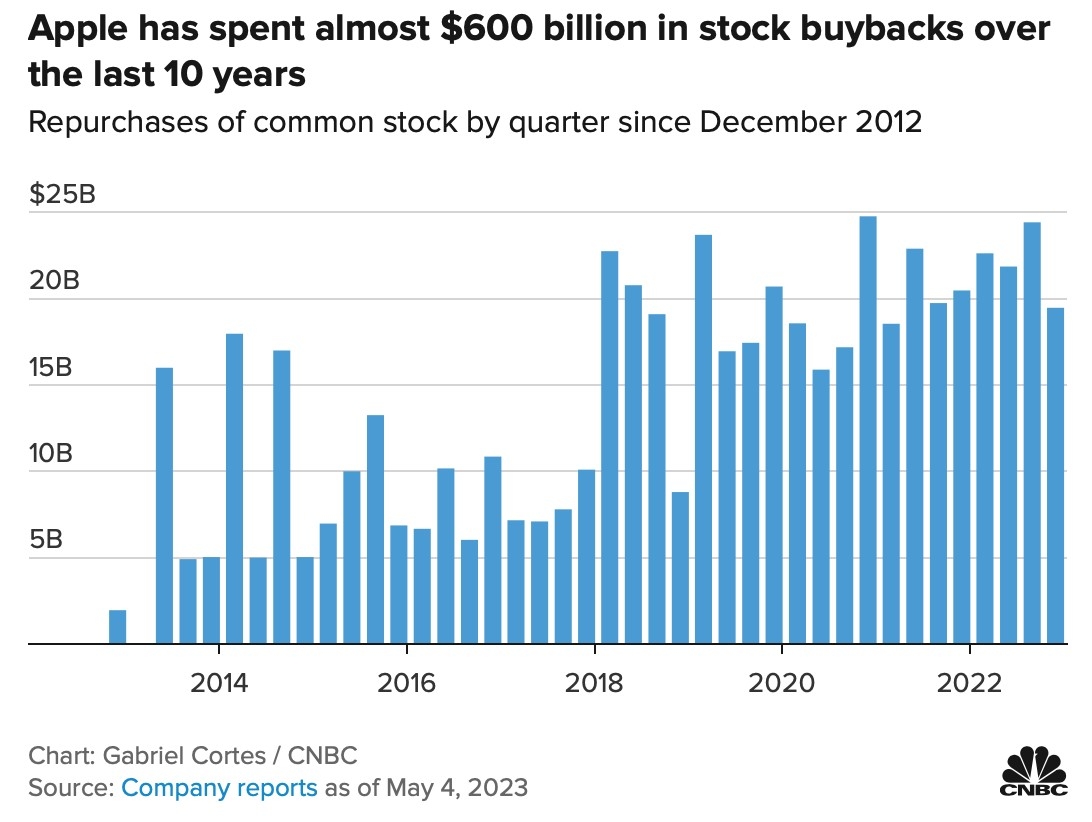

Apple (AAPL) Apple is the world's largest technology company and has been paying dividends since 2012. The company's strong financial position and consistent growth have made it a favorite among dividend investors. With a current dividend yield of 1.3%, AAPL offers investors a combination of income and capital appreciation potential.

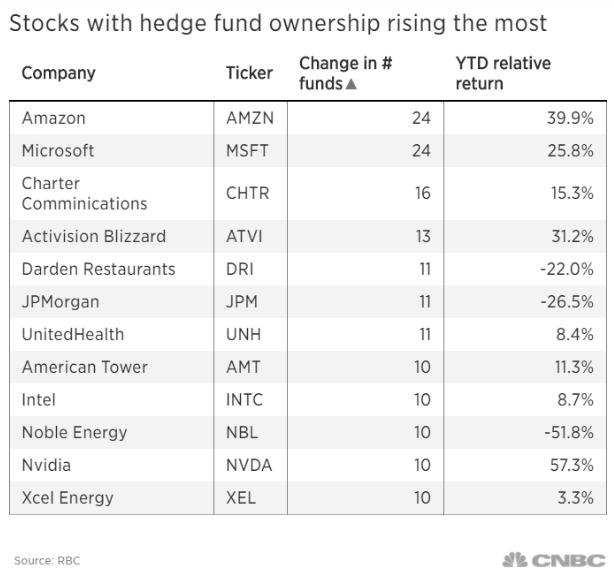

Microsoft (MSFT) Microsoft is a leading technology company known for its Windows operating system, Office productivity suite, and cloud computing services. The company has been paying dividends since 2003 and has increased its dividend for 16 consecutive years. With a current dividend yield of 1.2%, MSFT is a solid choice for income investors seeking stability and growth.

ExxonMobil (XOM) ExxonMobil is one of the world's largest oil and gas companies and has been paying dividends for over a century. The company's strong financial position and consistent dividend increases make it an attractive option for income investors. With a current dividend yield of 2.4%, XOM offers investors a steady income stream and the potential for capital appreciation.

Conclusion: Investing in dividend stocks can be a great way to generate income and potentially increase your wealth over time. By considering the best US dividend stocks, such as Johnson & Johnson, Procter & Gamble, Walmart, Apple, Microsoft, and ExxonMobil, you can build a diversified portfolio that provides stability and growth. Remember to do your research and consult with a financial advisor before making any investment decisions.

so cool! ()

last:US Stock Market Performance on April 7, 2025: A Comprehensive Analysis

next:nothing

like

- US Stock Market Performance on April 7, 2025: A Comprehensive Analysis

- US Stock Close Today: A Comprehensive Look at the Market's Performance

- PFE US Stock: A Comprehensive Guide to Understanding Pfizer's Stock Performa

- Understanding US Stock Exchange Listings: A Comprehensive Guide

- Status of the US Stock Market Today: A Comprehensive Analysis

- US Stock Market Analysis 2016: A Year of Volatility and Opportunities

- US Stock Exchange Holiday 2023: A Comprehensive Guide

- Uber Stock Price: A Comprehensive Analysis

- Title: The Effect of Sino-US Talks on Stocks

- Lysogene Stock: A Comprehensive Analysis

- US Real Estate Stock List: Top Picks for Investors

- US Government Buys Stocks: A Strategic Move for Economic Stability

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Title: Best US Dividend Stocks to Buy

Title: Best US Dividend Stocks to Buy

US Stock Earnings This Week: Key Highlights an

Title: Unveiling the US Dividend Stock Phenome

2025 US Stock Recommendations: May 2025 Outloo

5G US Army Stock: Revolutionizing Military Com

Green Energy Stocks in the US: A Lucrative Inv

Title: Stock BJJN US: Unveiling the Potential

US Steel Marathon Stock Split: What It Means f

Us Steel Stock Price: A Comprehensive Analysis

Tata Motors Stock US: A Comprehensive Guide

The US Stock Market is Like a Drunken Party

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- NB US Stock: The Ultimate Guide to Investing i"

- Understanding US Stock Market Breadth: A Compr"

- Current US Stock Market Conditions June 2025"

- US Military Stock: A Comprehensive Guide to Un"

- US Stock Holiday 2023: What You Need to Know"

- US Stock Exchange Holiday 2023: A Comprehensiv"

- Covered Calls: A Strategic Approach to Enhanci"

- Title: Natural Gas Companies Stock Us: The Gro"

- NTIOF Stock: Understanding OTC Markets in the "

- After Hours Trading: Unlocking the Potential o"