you position:Home > us energy stock > us energy stock

Stocks in the US Tied with Turkey: A Surprising Parallel

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

In the ever-evolving world of finance, it's not uncommon for markets across the globe to mirror each other in unexpected ways. One such intriguing parallel has emerged between the stock markets of the United States and Turkey. This article delves into the reasons behind this surprising connection and examines the potential implications for investors.

Economic Factors at Play

Several economic factors have contributed to the alignment between the US and Turkish stock markets. One of the primary reasons is the strong correlation between the two countries' currency values. As the US dollar and the Turkish lira fluctuate, it directly impacts the performance of their respective stock markets.

Dollar Strength and the US Stock Market

The US dollar has been on a steady rise against the Turkish lira, making US stocks more attractive to Turkish investors. This trend has been bolstered by the Federal Reserve's aggressive monetary policy, which has led to higher interest rates and a stronger dollar. Consequently, the US stock market has seen significant gains, with indices like the S&P 500 reaching record highs.

Lira Weakness and the Turkish Stock Market

On the other hand, the Turkish lira has been struggling against the dollar, leading to a decrease in the value of Turkish stocks. The Turkish government's economic policies, coupled with political instability, have eroded investor confidence in the country's currency. This has prompted Turkish investors to seek refuge in the more stable US stock market.

Impact on Global Investors

The tie between the US and Turkish stock markets has significant implications for global investors. Those with exposure to Turkish stocks may find their investments negatively impacted by the weak lira. Conversely, investors looking to diversify their portfolios may find opportunities in the US market, especially if they believe the dollar's strength will continue.

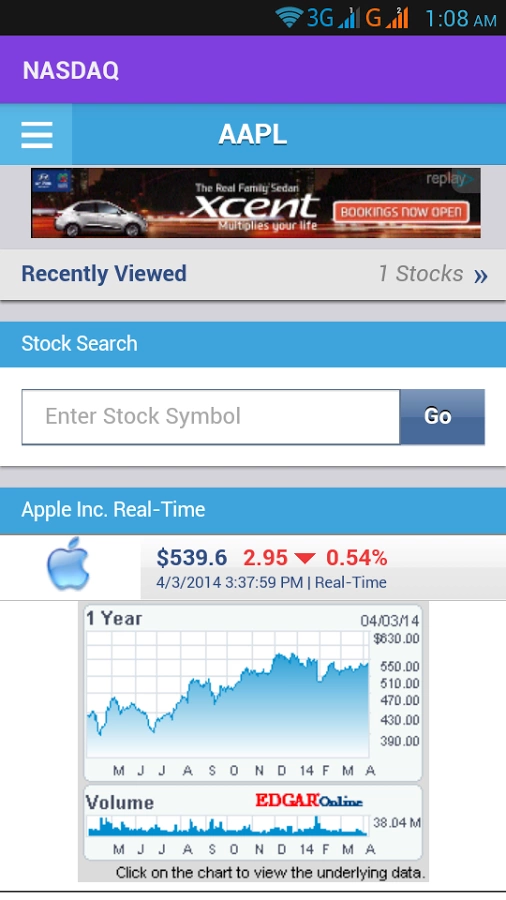

Case Study: Apple Inc.

One notable example of the correlation between the US and Turkish stock markets is the performance of Apple Inc. As the world's largest technology company, Apple has a significant presence in both markets. When the US stock market surged, Apple's stock followed suit, benefiting from the strong dollar. Similarly, when the Turkish lira weakened, Apple's stock in Turkey suffered, reflecting the broader trend in the Turkish market.

Conclusion

The surprising tie between the US and Turkish stock markets highlights the interconnectedness of global financial markets. While the reasons behind this correlation are complex, it's clear that economic factors play a crucial role. Investors should stay vigilant and consider the potential risks and opportunities presented by this unique situation.

so cool! ()

last:Top US Dividend Stocks 2021: A Guide to Investment Opportunities

next:nothing

like

- Top US Dividend Stocks 2021: A Guide to Investment Opportunities

- US Steel Stock Drop 2016: What Caused the Decline and What Does It Mean for Inves

- Selling Out the US for Good Stock Market: The Unseen Costs of Profitability

- Short US Stock Market: Opportunities and Risks Unveiled

- Best US Rare Earth Stocks: Your Guide to Investment Opportunities

- Hedge Fund Stocks in the US: Top Picks for 2023

- Best FMCG Stocks in the US: Top Picks for Investment

- AI Stocks: A Game-Changing Trend in the US Market

- Top US Banks Stocks: A Comprehensive Guide to Investment Opportunities

- Prison Stocks: The Hidden Investment Opportunity in US Corrections

- US Large Cap Stocks Momentum Analysis: Top Performers for September 2025

- Unlocking Opportunities: The Growing Potential of Copper Stocks in the US

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Stocks in the US Tied with Turkey: A Surprisin

Stocks in the US Tied with Turkey: A Surprisin

Title: Toys "R" Us Highest S

Title: Unveiling the Intricacies of US Stock I

Pre-Market US Stock News: Your Gateway to Earl

US Shariah Stock List: A Comprehensive Guide t

Target Corporation Stock on February 7, 2019:

AXP Stock Price: Understanding the Trends and

Can Chinese Companies Have Stock in Both US an

Understanding US Securities and Exchange Commi

Best US Rare Earth Stocks: Your Guide to Inves

Can SoftBank Stock Be Purchased on US Markets?

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- International Stocks Outperform US in 2025: Wh"

- Glaxosmithkline Stock Price US: A Comprehensiv"

- Australian Marijuana Stocks Traded in US: A Lu"

- Sunniva Stock US: Unveiling the Potential of T"

- Title: List of US Marijuana Stocks: Your Ultim"

- Title: Defense Stocks: A Secure Investment in "

- Stock Buybacks: A Strategic Move for Investors"

- How Many US Companies Are Buying Back Their Ow"

- Cyclical Stocks: The Key to Riding Economic Wa"

- Title: Cyber Security Stocks: A Wise Investmen"