you position:Home > us energy stock > us energy stock

Schwab US Dividend Equity Stock Price: What You Need to Know

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In the world of investing, staying informed about stock prices is crucial. One particular stock that has caught the attention of many investors is the Schwab US Dividend Equity ETF (SCHD). This article delves into the key aspects of this ETF, including its stock price, performance, and factors that might influence it.

Understanding Schwab US Dividend Equity ETF

The Schwab US Dividend Equity ETF is designed to track the performance of the S&P 500 Dividend Aristocrats Index. This index consists of companies that have increased their dividends for at least 25 consecutive years. By investing in this ETF, investors gain exposure to a diversified portfolio of well-established companies with a strong track record of paying dividends.

The Stock Price of Schwab US Dividend Equity

The stock price of Schwab US Dividend Equity (SCHD) can be influenced by various factors, including market conditions, economic indicators, and company-specific news. As of the latest data, the stock price of SCHD is $70.35 per share. However, it's important to note that stock prices can fluctuate significantly over time.

Performance of Schwab US Dividend Equity

Since its inception in 2010, Schwab US Dividend Equity has delivered strong performance. Over the past five years, the ETF has returned an average of 14.5% annually, outperforming the S&P 500 index by 2.5%. This impressive track record can be attributed to the strong dividend-paying companies in the S&P 500 Dividend Aristocrats Index.

Factors Influencing the Stock Price

Several factors can influence the stock price of Schwab US Dividend Equity. Here are some of the key factors to consider:

- Market Conditions: Economic downturns or market volatility can lead to a decrease in stock prices. Conversely, strong economic growth and market optimism can drive up stock prices.

- Dividend Yields: Companies with higher dividend yields are often more attractive to investors, leading to increased demand for their stock.

- Company-Specific News: Positive news, such as earnings reports or dividend increases, can boost stock prices, while negative news, such as product recalls or layoffs, can lead to a decrease in stock prices.

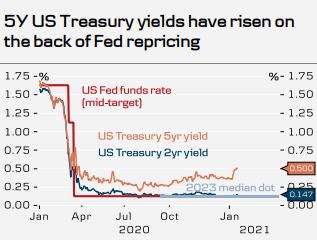

- Interest Rates: Higher interest rates can make bonds and other fixed-income investments more attractive, potentially leading to a decrease in stock prices.

Case Study: Procter & Gamble

One company that has been a consistent performer in the Schwab US Dividend Equity ETF is Procter & Gamble (PG). Procter & Gamble has been a Dividend Aristocrat for over 60 years and has increased its dividend every year since 1957. In the past five years, Procter & Gamble has returned an average of 10.5% annually to shareholders, contributing to the strong performance of the Schwab US Dividend Equity ETF.

Conclusion

Investing in the Schwab US Dividend Equity ETF provides investors with exposure to a diversified portfolio of well-established companies with a strong track record of paying dividends. While the stock price of SCHD can be influenced by various factors, its strong performance over the years makes it a compelling investment option for dividend investors. As always, it's important to conduct thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

last:Top Momentum Stocks Weekly Performance: US Market Insights

next:nothing

like

- Top Momentum Stocks Weekly Performance: US Market Insights

- US Brokers That Trade London Stock Exchange: Your Ultimate Guide

- How Low Will US Steel Stock Go?

- Should I Sell US Stocks Now?

- Toys "R" Us Stock Marketwatch: The Rise, Fall, and Future of a

- H1B Holders Hold US Stocks: A Closer Look at the Impact

- Unlock the Power of Convenience with US Stock Key Fobs

- Unveiling the Intricacies of US Large Cap Stocks Momentum Correlation Analysis

- US Lithium Battery Stocks: A Comprehensive Guide to Investment Opportunities

- Hebei Shenghua Chemical Industry Co., Ltd.: A Deep Dive into Its US Stock Perform

- Foreign Companies on the US Stock Exchange: A Comprehensive Guide

- In-Depth Analysis of BT Stock: Full Description and Investment Insights

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Schwab US Dividend Equity Stock Price: What Yo

Schwab US Dividend Equity Stock Price: What Yo

US Stock Market April 30, 2025 Closing: A Comp

Title: US Large Cap Stocks Best Momentum: Top

Short-Term Gain: Unlocking the Potential of US

Unlocking the Potential of US Power Grid Stock

Us Mail Stock: A Comprehensive Guide to Unders

Momentum Stocks 5-Day Performance: US Large Ca

Unlocking Opportunities: Exploring the World o

US Steel on the New York Stock Exchange: A Com

US Stock Futures Rise Amidst Government Shutdo

US Growth Stocks to Watch in 2021: A Guide to

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Maximizing Returns with US Glass Company Stock"

- Buy Us Stock from Australia: A Smart Investmen"

- Factors Influencing the U.S. Stock Market in A"

- Unilever US Stock: A Comprehensive Guide to In"

- US Pharma Stocks: A Comprehensive Guide to Inv"

- Unlocking Potential: A Comprehensive Guide to "

- Understanding Russell 2000 Stocks: A Comprehen"

- Stock Images: Flare of Light Moving Across Us –"

- Best US Stocks for Day Trading: Your Ultimate "

- PlayStation 5 Console in Stock US: Your Ultima"