you position:Home > us energy stock > us energy stock

Foreign Companies on the US Stock Exchange: A Comprehensive Guide

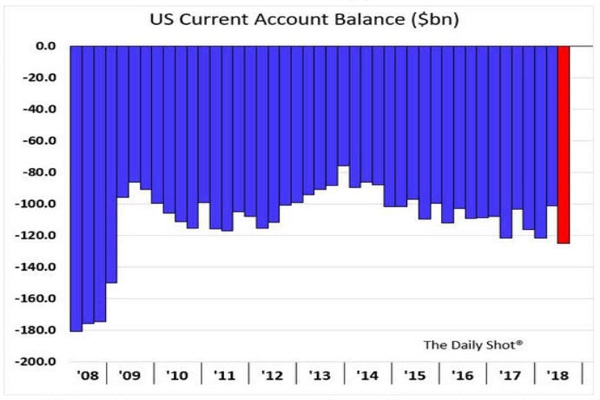

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In today's globalized economy, the US stock exchange has become a hub for foreign companies looking to expand their presence in the American market. This article delves into the intricacies of foreign companies listing on the US stock exchange, highlighting the benefits, challenges, and key considerations for these businesses.

Understanding the Landscape

The US stock exchange, particularly the New York Stock Exchange (NYSE) and the NASDAQ, has long been a preferred destination for foreign companies. These exchanges offer a platform for companies to raise capital, enhance their brand visibility, and attract a diverse pool of investors. However, navigating the regulatory landscape and understanding the cultural nuances can be daunting.

Benefits of Listing on the US Stock Exchange

Access to Capital: One of the primary reasons for foreign companies to list on the US stock exchange is the access to a vast pool of capital. The US market is known for its liquidity and investor confidence, making it easier for companies to raise substantial funds.

Enhanced Brand Visibility: Listing on a major US stock exchange can significantly boost a company's brand visibility. It signals to investors and consumers that the company is serious about its global aspirations and has the backing of a reputable market.

Attracting Talent: A listing on the US stock exchange can make a company more attractive to top talent, both domestically and internationally. Employees often view working for a publicly-traded company as a career opportunity with significant growth potential.

Challenges and Considerations

Regulatory Compliance: Foreign companies must comply with stringent regulatory requirements, including financial reporting, disclosure, and corporate governance. Understanding and adhering to these regulations is crucial to avoid legal and financial repercussions.

Cultural Differences: The cultural nuances between the US and the company's home country can pose challenges. This includes understanding investor expectations, market trends, and communication styles.

Market Volatility: The US stock market is known for its volatility. Foreign companies must be prepared to navigate market fluctuations and manage investor sentiment effectively.

Case Studies

Alibaba Group Holding Limited: The Chinese e-commerce giant successfully listed on the NYSE in 2014, raising $21.8 billion. The listing helped Alibaba expand its global footprint and attract a diverse range of investors.

Tencent Holdings Limited: The Chinese tech giant listed on the Hong Kong Stock Exchange in 2004 and later listed its American Depositary Shares (ADS) on the NASDAQ in 2014. The dual listing strategy helped Tencent raise significant capital and enhance its global presence.

Conclusion

Listing on the US stock exchange offers numerous benefits for foreign companies, but it also comes with its own set of challenges. Understanding the regulatory landscape, navigating cultural differences, and managing market volatility are crucial for success. By carefully planning and executing their strategy, foreign companies can leverage the US stock exchange to achieve their global aspirations.

so cool! ()

last:In-Depth Analysis of BT Stock: Full Description and Investment Insights

next:nothing

like

- In-Depth Analysis of BT Stock: Full Description and Investment Insights

- Russian Companies on US Stock Exchange: A Comprehensive Overview

- How Did the US Stock Market Crash: A Comprehensive Analysis

- FCA Stock Price US: A Comprehensive Guide to Understanding the Latest Trends

- US Stock Earnings Reports Calendar: Your Ultimate Guide to Market Insights

- Has the Stock Market Recovered? A Comprehensive Analysis

- US Butter Stocks: Current Trends and Insights

- Us Marijuana Stock Prices Today: A Comprehensive Guide

- Graphene Stocks in the US: A Lucrative Investment Opportunity

- US Large Cap Stocks: Momentum Best Performers Over 5 Days

- Master the Art of Stock Market Analysis: A Comprehensive Model for US Stocks

- Toys "R" Us Off Hours Stock Crew Application: Your Gateway to E

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Foreign Companies on the US Stock Exchange: A

Foreign Companies on the US Stock Exchange: A

US Largest Stock Markets: A Comprehensive Guid

US Large Cap Stocks: Momentum Best Performers

Unlocking the Potential of Amoug Us Stocks: A

US Stock Futures Mixed Ahead of Inflation Data

US Listed Stock AI Accelerator Unveils Revolut

Southern Lithium Stock Symbol: A Comprehensive

Us a Laughing Stock: The Importance of Avoidin

Is the US Stock Market Open on Good Friday 201

Master the Art of Stock Market Analysis: A Com

Average Return on the Dow Jones: What Investor

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Value Stocks: The Key to Long-Term Wealth Buil"

- US 4th Qtr 2018 Stock Market: A Comprehensive "

- SGEN US Stock Price: What You Need to Know"

- Quote S&P: Unveiling the Power of Stoc"

- Costco Dividend: Why It's a Smart Investm"

- Russian Companies Listed on US Stock Exchange:"

- Dogecoin US Stock: The Emerging Crypto Investm"

- Understanding the iShares Total U.S. Stock Mar"

- History of the US Stock Market Chart: A Compre"

- US Fabric Stock: Your Ultimate Guide to the Be"