you position:Home > us energy stock > us energy stock

Outlook for the US Stock Market in 2025

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Introduction

As we approach the final year of the 2020s, investors are eagerly anticipating the outlook for the US stock market in 2025. With technological advancements, economic shifts, and geopolitical changes, the future of the market remains a topic of intense debate. In this article, we will explore the potential trends and factors that could shape the US stock market in 2025.

Economic Growth and Inflation

One of the key factors influencing the stock market is economic growth. According to the Federal Reserve, the US economy is expected to grow at a moderate pace in the coming years. This growth could be driven by factors such as increased consumer spending, business investment, and a strong labor market.

However, economic growth is often accompanied by inflation. The Federal Reserve has been closely monitoring inflation and has indicated that it will take measures to control it. The stock market may face challenges if inflation remains high, as it could erode the purchasing power of investors.

Technological Advancements

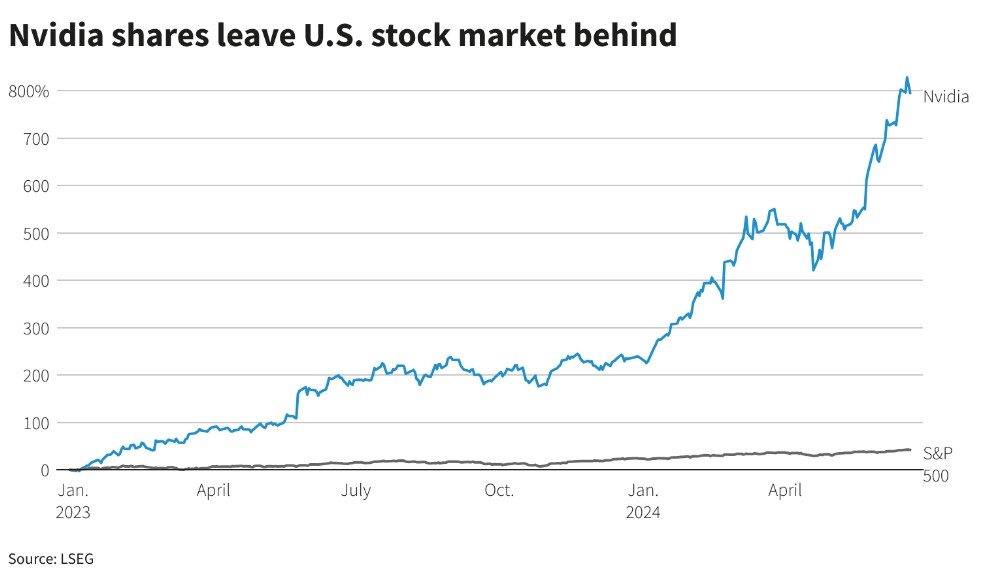

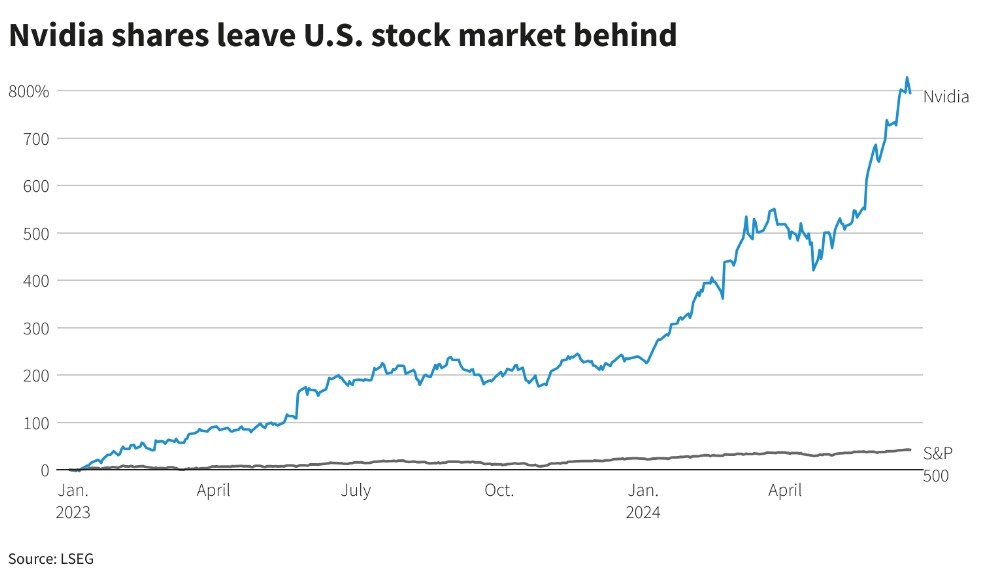

Technological advancements have been a major driver of stock market growth in recent years. In 2025, we can expect to see continued innovation in areas such as artificial intelligence, robotics, and biotechnology. Companies in these sectors are likely to see significant growth, as they leverage these technologies to improve efficiency and create new products and services.

Geopolitical Changes

Geopolitical changes can have a significant impact on the stock market. In 2025, we may see increased tensions between major economies, which could lead to trade wars and other disruptions. However, these challenges could also create opportunities for companies that specialize in global trade and supply chain management.

Sector Performance

In 2025, certain sectors are expected to outperform others. Tech stocks, particularly those in the cloud computing and artificial intelligence sectors, are likely to see strong growth. Additionally, healthcare and biotech companies may benefit from increased investment in research and development.

Case Studies

To illustrate the potential trends in the US stock market in 2025, let's consider a few case studies:

- Amazon: As a leader in e-commerce and cloud computing, Amazon is well-positioned to benefit from the expected growth in these sectors. The company's investment in technology and logistics infrastructure could further enhance its competitive advantage.

- Tesla: Tesla's leadership in electric vehicles and renewable energy is expected to drive significant growth in the coming years. The company's expansion into new markets and the development of new products could solidify its position as a leader in the industry.

- Moderna: As a leader in mRNA vaccine technology, Moderna has seen significant growth in recent years. The company's potential to develop new vaccines and therapies could further boost its market value.

Conclusion

The outlook for the US stock market in 2025 is complex and multifaceted. While economic growth, technological advancements, and geopolitical changes present both opportunities and challenges, investors who stay informed and adapt to the evolving market conditions are likely to achieve success. By focusing on sectors that are poised for growth and companies that are well-positioned to capitalize on these trends, investors can navigate the complex landscape of the US stock market in 2025.

so cool! ()

like

- Title: RSX US Stock Price: Understanding the Market Dynamics and Investment Oppor

- Nearmap Stock US: A Comprehensive Analysis

- US 30 Carbine E2 Stock: The Ultimate Guide

- Latitude 64 Opto Air Bolt in Stock at US Retailers: The Ultimate Dart Experience

- How Can an Indian Invest in US Stocks?

- US Stock Market Bubble Indicators: October 2025

- Us Stock Market 2016 Growth: An In-Depth Analysis

- US Solar Stock Index: A Comprehensive Guide to Solar Energy Investment

- AFI US Stock: Your Ultimate Guide to American Film Industry Investments

- Best Performing US Stocks Last 5 Days: Momentum to Watch in August 2024

- High Yield Dividend US Stocks: The Ultimate Guide to Maximizing Returns

- US Offshore Drilling Stocks: A Deep Dive into the Ocean's Goldmine

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Outlook for the US Stock Market in 2025

Outlook for the US Stock Market in 2025

Abx Stock US: A Comprehensive Guide to Underst

US Offshore Drilling Stocks: A Deep Dive into

How Much of the US Stock Is Owned by China?

Is the US Stock Market Open Today?

http stocks.us.reuters.com stocks fulldescript

Title: Best Performing US Stocks Past Week: Mo

US Real Estate Stock Market: A Comprehensive G

Best US Rare Earth Stocks: A Guide to Investme

Title: Current CAPE Ratio in the US Stock Mark

Is the US Stock Market Trading Today?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Medical Equipment Stocks: A Comprehensive G"

- Chip Stocks: The Future of Technology and Inve"

- Space Stocks: The Future of Investing in Space"

- Mckesson US Pharma Stocks: A Comprehensive Gui"

- Momentum Stocks in the US Market: September 20"

- FLST US Stock Exchange: A Comprehensive Guide "

- Understanding Energy ETFs: A Comprehensive Gui"

- Airline Stocks: A Comprehensive Guide to Inves"

- Best US Dividend Stocks: Top Picks for Income "

- AMC Stock Invest US: Understanding the Potenti"