you position:Home > us energy stock > us energy stock

Ondo Finance Tokenized US Stocks: Revolutionizing Ethereum's Potential

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In the rapidly evolving world of cryptocurrencies, Ondo Finance has introduced a groundbreaking innovation that bridges the gap between traditional and digital assets. By tokenizing US stocks on the Ethereum blockchain, Ondo Finance is set to revolutionize how investors access and trade equities. This article delves into the concept of Ondo Finance Tokenized US Stocks, exploring its implications for Ethereum's potential and the broader crypto market.

Understanding Ondo Finance Tokenized US Stocks

Ondo Finance Tokenized US Stocks (OTUS) represent a new era of investment opportunity. These tokens are backed by actual US stocks, providing investors with exposure to the US equity market without the need for a traditional brokerage account. By leveraging Ethereum's blockchain technology, OTUS offers a transparent, secure, and efficient way to invest in US stocks.

The Power of Ethereum

Ethereum's blockchain technology serves as the backbone of Ondo Finance's OTUS. Ethereum's smart contracts enable the creation of OTUS, which are fungible and can be traded on decentralized exchanges. This not only reduces the risk of fraud but also increases liquidity, allowing investors to enter and exit positions with ease.

Benefits of OTUS

- Accessibility: OTUS makes US stocks accessible to a broader audience, including those who may not have access to traditional financial services.

- Liquidity: Ethereum's decentralized exchanges offer high liquidity, allowing investors to trade OTUS at competitive prices.

- Transparency: The blockchain ensures that all transactions are transparent, providing investors with peace of mind.

- Efficiency: Smart contracts automate the process of buying and selling OTUS, reducing the time and cost associated with traditional stock transactions.

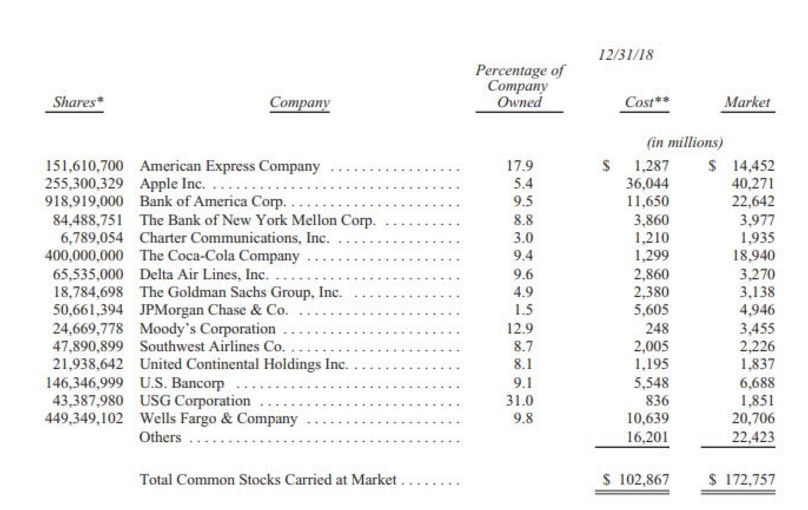

Case Study: Apple Inc. (AAPL)

To illustrate the potential of OTUS, let's consider an example using Apple Inc. (AAPL). Suppose an investor wishes to gain exposure to the world's largest company without purchasing physical shares. By purchasing OTUS, this investor can achieve the same outcome while enjoying the benefits of Ethereum's blockchain.

Potential Challenges

While Ondo Finance's OTUS presents numerous benefits, there are also potential challenges to consider:

- Regulatory Hurdles: The tokenization of traditional assets is a relatively new concept, and regulatory frameworks are still evolving.

- Market Volatility: The crypto market is known for its volatility, and OTUS may be subject to similar fluctuations.

- Adoption: The widespread adoption of OTUS and other tokenized assets will require education and awareness among investors.

Conclusion

Ondo Finance Tokenized US Stocks represents a significant step forward in the world of digital assets. By leveraging Ethereum's blockchain technology, OTUS offers a transparent, efficient, and accessible way to invest in US stocks. As the crypto market continues to evolve, the potential of tokenized assets like OTUS will likely become more pronounced, providing new opportunities for investors worldwide.

so cool! ()

last:Maximizing Returns: A Comprehensive Guide to Investing in Li Us Stock

next:nothing

like

- Maximizing Returns: A Comprehensive Guide to Investing in Li Us Stock

- Tem Us Stock Price Prediction: Advanced Techniques and Future Prospects

- US Critical Materials Stock: The Essential Guide to Securing Your Future

- Samsung Stock: US ADR - A Comprehensive Guide to Investing in Samsung's Amer

- Us Anesthesia Partners Stock Symbol: A Comprehensive Guide

- ResMed US Stock Price: A Comprehensive Analysis

- Unlocking the Potential of SGNT.O: A Comprehensive Analysis of Singapore Telecom

- US Stock and Bond Markets' Status on Columbus Day

- Stock Market Crash Definition: A Quizlet Journey Through US History

- How to Buy US Stocks from Myanmar: A Comprehensive Guide

- Are Stock and Bonds Regulated by the US Securities Exchange?

- Understanding the Impact of US Stock Exchange Stocks: A Closer Look at JBLU

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Ondo Finance Tokenized US Stocks: Revolutioniz

Ondo Finance Tokenized US Stocks: Revolutioniz

LG Chem Stock US: A Comprehensive Guide to Inv

US Stock Market Analysis 2016: A Year of Volat

How to Open a Stock Market Account in the US:

Atvi Stock US: A Comprehensive Guide to Unders

Understanding the CA Stock Price in the US Mar

Buy HCMC Stock US: A Comprehensive Guide to In

Current Market Sentiment: A Deep Dive into US

Top US Dividend Stocks 2021: A Guide to Invest

Size of the US Stock Market in 2022: A Compreh

Share Bazar Today: The Ultimate Shopping Exper

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Top US Banks Stocks: A Comprehensive Guide to "

- SQ Stock: A Comprehensive Guide to Understandi"

- US Oil Stocks 2019: A Comprehensive Analysis o"

- Understanding the DIA ETF: A Comprehensive Gui"

- Money Invested in the US Stock Market by Forei"

- Top US Dividend Stocks 2021: Secure Your Finan"

- Unlocking the Potential of US Green Coffee Sto"

- US Smokeless Tobacco Company Stock: A Comprehe"

- Understanding Russell 2000 Stocks: A Comprehen"

- US Stock Futures Flat: What It Means for Inves"