you position:Home > us energy stock > us energy stock

How Global Events Influence the US Stock Exchanges

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In a rapidly interconnected world, global events can have a profound impact on the US stock exchanges. From geopolitical tensions to economic crises, these events can sway investor sentiment and drive market movements. Understanding how these global occurrences influence the US markets is crucial for investors to make informed decisions. In this article, we will explore the various factors that contribute to this influence and provide real-life examples to illustrate the interconnectedness of global and US stock exchanges.

Geopolitical Events

Geopolitical events, such as elections, political upheaval, and conflicts, can have significant repercussions on the US stock exchanges. For instance, the 2016 US presidential election led to volatility in the markets as investors worried about the potential policies of the new administration. Similarly, the ongoing tensions between the United States and China have caused fluctuations in the stock market, as investors weigh the potential impact on trade relations.

Economic Crises

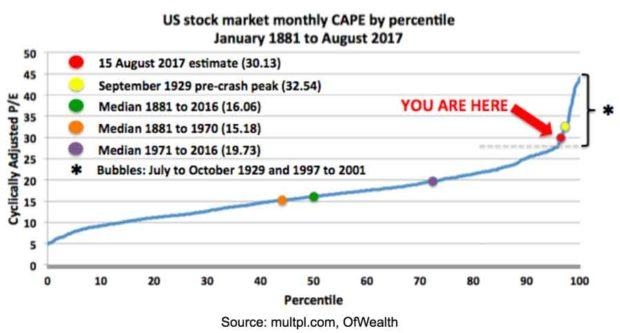

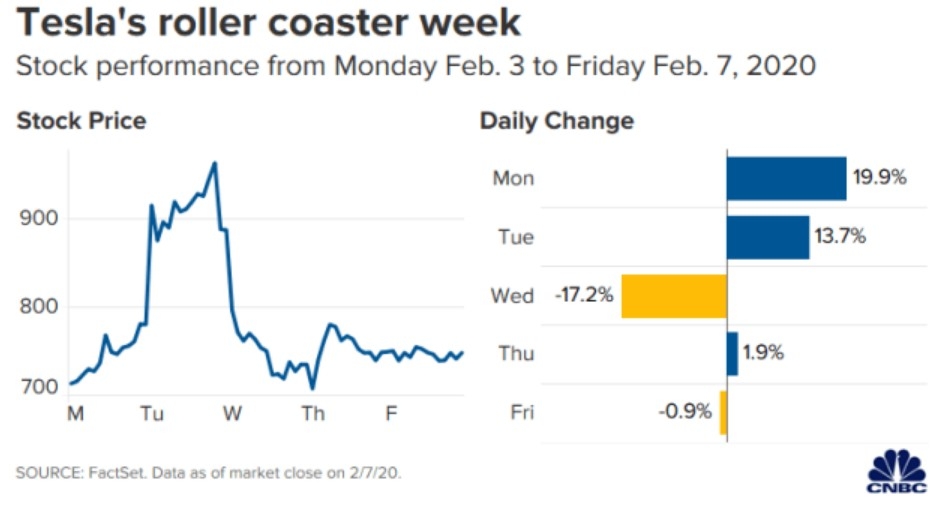

Economic crises, such as the 2008 financial crisis and the recent COVID-19 pandemic, have had a substantial impact on the US stock exchanges. During these times, investors become increasingly risk-averse, leading to widespread sell-offs. In the case of the 2008 crisis, the stock market plummeted as the financial system teetered on the brink of collapse. The COVID-19 pandemic has also caused significant market disruptions, with investors reacting to news about the virus's spread, vaccination efforts, and economic reopenings.

Interest Rate Changes

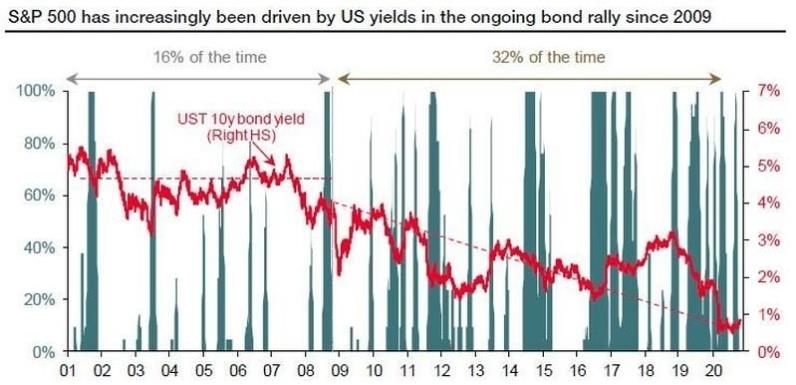

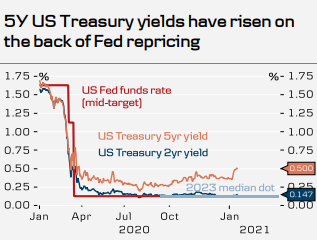

Interest rate changes in major economies, particularly the United States and China, can significantly impact the US stock exchanges. When central banks raise interest rates to combat inflation, borrowing costs increase, which can lead to a decrease in consumer spending and business investment. Conversely, when central banks lower interest rates, it can stimulate economic growth and boost stock prices.

Currency Fluctuations

Currency fluctuations can also play a crucial role in influencing the US stock exchanges. A stronger US dollar can make American exports more expensive and less competitive, which can negatively impact the stock prices of multinational corporations. Conversely, a weaker dollar can boost the earnings of these companies, leading to higher stock prices.

Case Studies

One notable example of global events influencing the US stock exchanges is the 2010 Gulf oil spill. The spill, which occurred in the United States, had widespread consequences on the oil industry. As a result, the stock prices of major oil companies plummeted, and the broader market experienced significant volatility.

Another example is the 2020 US-China trade war. The conflict between the two nations led to tariffs and trade barriers, causing disruptions in global supply chains and affecting the stock prices of various companies involved in the affected industries.

Conclusion

Global events have a profound impact on the US stock exchanges. Understanding these influences is essential for investors to navigate the market effectively. By staying informed about geopolitical developments, economic crises, interest rate changes, currency fluctuations, and their impact on the stock market, investors can make more informed decisions and mitigate potential risks.

so cool! ()

like

- Canadian Cannabis Penny Stocks in the US Market: A Lucrative Investment Opportuni

- Inverted US Yield Curve: Not Always Gloomy for Stocks

- US Foods Stock: Buy or Sell? A Comprehensive Analysis

- Best India ETF to Invest on US Stock Market: Your Ultimate Guide

- US Graphite Stock: A Comprehensive Guide to Investing in the Graphite Market

- How Long Has the US Outperformed Foreign Stocks?

- Unveiling the Power of NASDAQ US Stock Market: Your Ultimate Guide"

- How Much Has the US Stock Market Lost Today?

- Ukraine and US Stock Market: Impact and Investment Insights"

- Aphria Stock Quote: Unveiling the Latest on Canada's Leading Cannabis Stock

- Top Performing US Stocks: 5-Day Momentum Analysis for October 2025"

- Does the US Government Own Stocks? Unveiling the Truth"

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

How Global Events Influence the US Stock Excha

How Global Events Influence the US Stock Excha

Understanding the Minimum Lot Size for US Stoc

Title: US Government Stocks to Buy: Top Invest

Unlocking the Potential of AG US Stock Investm

February 2020 IPOs: A Deep Dive into the US St

SMR Stocks: Exploring the Potential of US Smal

Meituan Stock US: The Rise and Future of China

Title: "Total Market Cap of All US St

Exploring Canadian Marijuana Stocks on the US

Highest Stock Market Earnings in One Year: US

How to Buy US Steel Stock: A Comprehensive Gui

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- Ev Stocks: The Future of Transportation and En"

- ASML Stock Forecast: What to Expect in the Sem"

- Can You Check Stock at Toys "R&qu"

- How Much Stock Does the U.S. Government Own? U"

- Dates of US Stock Market Crashes: A Comprehens"

- Teck US Stock Price: A Comprehensive Analysis"

- How to Buy Dogecoin Stock in the US: A Compreh"

- US Stock Market Analysis 2016: A Year of Volat"

- Hanwha Stock US: A Comprehensive Guide to Inve"

- US Stock Fuse: Understanding the Importance of"