you position:Home > us energy stock > us energy stock

Does the US Government Own Stocks? Unveiling the Truth"

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In today's investment landscape, it's not uncommon for individuals to question whether the US government owns stocks. The topic raises intriguing questions about the government's role in the stock market and its impact on economic stability. In this article, we will delve into this topic, providing insights into whether the US government does indeed own stocks and the potential implications of such investments.

Understanding Government Ownership of Stocks

The government's ownership of stocks is a complex issue. While the US government does not own stocks in the same sense that individuals or private corporations do, it does have a significant presence in the stock market through various programs and investments.

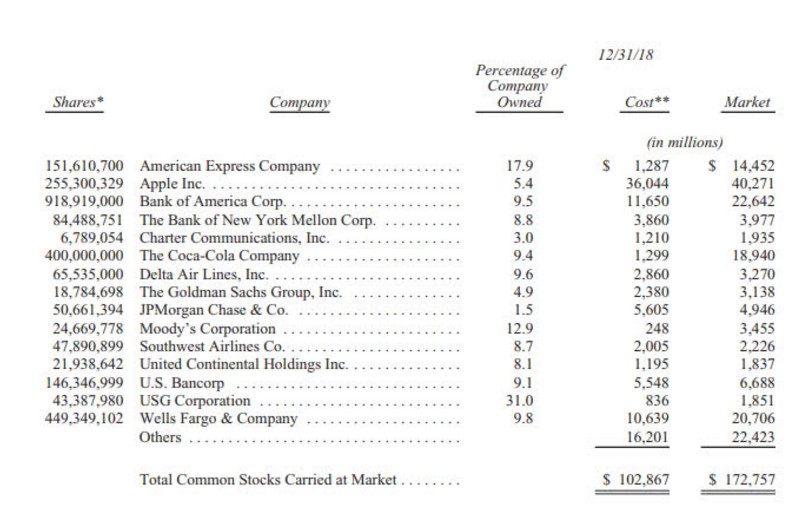

One of the primary ways the government invests in the stock market is through the Pension Benefit Guaranty Corporation (PBGC). The PBGC is responsible for insuring the pensions of millions of American workers. It holds a considerable amount of stock in various companies as part of its investment strategy to ensure the financial security of these pension plans.

Another way the government invests in the stock market is through its Social Security Trust Fund. The Social Security Trust Fund is a major holder of U.S. government securities, such as Treasury bills, notes, and bonds. While these securities are not stocks in the traditional sense, they represent government debt and are a significant investment for the Social Security system.

The Role of Government Investments in Economic Stability

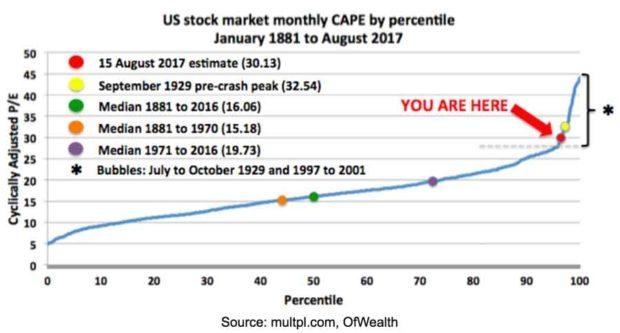

The government's investments in the stock market play a crucial role in economic stability. By investing in stocks, the government can potentially generate higher returns on its investments, which can be used to fund government programs and services. Moreover, the government's investment in stocks can also have a positive impact on the stock market itself.

For instance, the government's participation in the stock market can provide a level of confidence to investors. This confidence can lead to increased investment activity, which, in turn, can stimulate economic growth.

Case Study: Government Investments in Financial Crisis

One notable case study of government investments in the stock market is the financial crisis of 2008. During this period, the US government took unprecedented steps to stabilize the economy, including investing in the stock market. By purchasing shares in financial institutions and providing stimulus packages, the government helped prevent a further collapse of the economy.

This case demonstrates the government's willingness to intervene in the stock market to ensure economic stability. However, it also raises questions about the long-term implications of such interventions and their potential impact on market efficiency.

Conclusion

While the US government does not own stocks in the traditional sense, it does have a significant presence in the stock market through various programs and investments. These investments play a crucial role in economic stability and can potentially generate higher returns for government programs. As the government continues to navigate the complexities of the stock market, it is essential to understand the potential implications of these investments on both the market and the economy.

so cool! ()

last:US Momentum Stocks Today: Top Picks for Investors

next:nothing

like

- US Momentum Stocks Today: Top Picks for Investors

- Nel Hydrogen: A Leading Stock in the US

- How Many Companies Are Listed in the US Stock Market?

- Is US Bank a Good Stock? A Comprehensive Analysis

- BBC US Stock Market: Latest Trends and Analysis

- How to Invest in the US Stock Market from Dubai: A Step-by-Step Guide

- US-China Trade War and the Impact on Tech Stocks

- Size 58 Hat in US Stocking Cap: The Ultimate Guide

- The Rising Number of US Individuals Investing in Stocks: A Comprehensive Look

- Foreigner Invest in US Stock: A Comprehensive Guide for International Investors

- How to Start Investing in US Stocks: A Step-by-Step Guide"

- Momentum Stocks: Unveiling the 5-Day Performance in the US Market

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Does the US Government Own Stocks? Unveiling t

Does the US Government Own Stocks? Unveiling t

Understanding the Tax Treatment of Stock Optio

Alb.us Stock: Unveiling the Potential of This

US Navy Vietnam Veteran Stocking Cap: A Symbol

US Stock Market: A Decade-by-Decade Analysis O

Title: US Stock Market Indices Today: A Compre

Hanwha Stock US: A Comprehensive Guide to Inve

US Stock Market Performance on April 7, 2025:

Paytm Money US Stocks: A Comprehensive Guide f

Indian Apps to Invest in US Stocks: Your Ultim

US Defensive Stocks: A Strategic Approach to M

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- US Bank Stock Price Today: What You Need to Kn"

- Average Dividend Yield in the US Stock Market "

- How to Buy US Stocks from Kuwait: A Step-by-St"

- Toys "R" Us Public Stock: A "

- Best US Stock Broker in Australia: Your Ultima"

- Blue Chip US Dividend Stocks: Top Picks for Lo"

- Stock Market US Prediction: What to Expect in "

- US Large Cap Momentum Stocks RSI Analysis Sept"

- November 2019 IPOs: US Stock Symbols You Need "

- Title: CSL Behring US Stock: An In-Depth Look"