you position:Home > us energy stock > us energy stock

Goldman Says US Stocks Have Likely Bottomed

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

In a significant move that could impact the trajectory of the stock market, Goldman Sachs has recently announced that U.S. stocks have likely hit bottom. This assessment comes amidst a period of market volatility and uncertainty, making it a topic of great interest for investors and market watchers alike.

Understanding the Bottoming Out of US Stocks

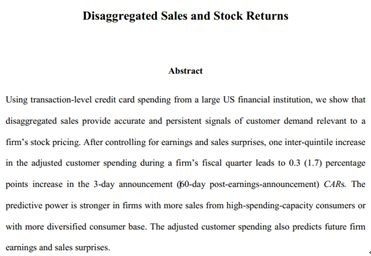

According to Goldman Sachs, the U.S. stock market has reached a point where it is likely to stabilize and potentially start rising again. This conclusion is based on a variety of factors, including economic indicators, corporate earnings, and market sentiment.

Economic Indicators Point to Stabilization

Goldman Sachs' analysts have cited several economic indicators that suggest the U.S. stock market has reached a bottom. These include low unemployment rates, strong consumer spending, and improving corporate earnings. Additionally, they have noted that inflation has started to cool off, which is a positive sign for the market.

Corporate Earnings Show Promise

One of the key factors in Goldman Sachs' assessment is the strong performance of corporate earnings. Many companies have reported better-than-expected earnings, which has helped to boost investor confidence. This trend is expected to continue, providing further support for the stock market.

Market Sentiment Improves

Another factor that has contributed to the belief that the U.S. stock market has bottomed is the improvement in market sentiment. After a period of uncertainty and volatility, investors are starting to feel more optimistic about the market's future. This shift in sentiment can have a significant impact on stock prices.

Case Studies

To illustrate the impact of these factors on the stock market, let's look at a couple of case studies.

*Case Study 1: Apple Inc.

Apple Inc., one of the world's largest companies, has seen its stock price stabilize and even rise in recent months. This is partly due to the strong performance of its earnings, which have been beating market expectations. Additionally, the company's products have remained in high demand, further boosting investor confidence.

*Case Study 2: Tesla Inc.

Tesla Inc., another major player in the stock market, has also seen its stock price stabilize. This is largely due to the company's successful expansion into new markets and its continued innovation in electric vehicles. As Tesla continues to grow and evolve, its stock price is likely to remain strong.

Conclusion

Goldman Sachs' assessment that U.S. stocks have likely bottomed is based on a variety of factors, including economic indicators, corporate earnings, and market sentiment. While it's impossible to predict the future of the stock market, these factors provide a strong foundation for optimism. As investors and market watchers continue to monitor these indicators, it will be interesting to see how the U.S. stock market performs in the coming months.

so cool! ()

last:US Small Cap Stocks News Today: Key Updates and Insights"

next:nothing

like

- US Small Cap Stocks News Today: Key Updates and Insights"

- Coal Company Stocks: The Rising Trend in US Investments

- Stock Market News October 19, 2025: US Markets in Focus

- Kver Stock: Contact Us for Exceptional Investment Solutions

- The Impact of US Credit Downgrade on Stocks: A Comprehensive Analysis

- Buy Foxconn Stock in US: A Smart Investment Opportunity

- How to Trade on the US Stock Market from Jamaica: A Comprehensive Guide

- Does the U.S. Government Own Intel Stock?

- US Cellular Note 5 Stock Firmware: The Ultimate Guide for Users

- Alfalfa Exports as a Percentage of US Ending Stocks: A Comprehensive Analysis

- Should I Invest in US Stocks When the Dollar Is Weakening?

- US Bank Stock Price Today: What You Need to Know

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Goldman Says US Stocks Have Likely Bottomed

Goldman Says US Stocks Have Likely Bottomed

Title: Top ETFs for US Stocks: Your Ultimate G

Google News US Stock Market: The Ultimate Guid

Stocks That Benefit from US Interest Rate Cuts

Title: Stock X Contact Us: Your Gateway to Exc

How Many Individuals Are Invested in the US St

Title: "Clinton Campaign's Misst

US Stock Market Hits 25,000 Milestone on Febru

Unlocking the Potential of SaaS US Stock: A Co

Pharmacielo Stock US: A Breakdown of the Inves

Unlocking Potential: The Power of US Defense F

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- US Government Buys Stocks: A Strategic Move fo"

- Top 5 Highest Percentage Dividend Stocks in th"

- US Graphene Companies Stock: A Comprehensive O"

- Russian Companies Listed on US Stock Exchange:"

- Unlocking Potential: The Thriving Landscape of"

- US Stock Market Apps: The Ultimate Guide to Tr"

- US Stock Market Performance on April 7, 2025: "

- Toys R Us and Babies R Us Daytime Stock Associ"

- Dividend History: A Comprehensive Guide to Und"

- Title: Stock Market US Election 2016: How the "