you position:Home > us energy stock > us energy stock

Can a Canadian Invest in US Stocks? A Comprehensive Guide

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

Are you a Canadian investor looking to expand your portfolio? Investing in U.S. stocks can be a lucrative opportunity, but it's essential to understand the process and regulations. In this article, we'll explore whether a Canadian can invest in U.S. stocks, the benefits of doing so, and the steps involved.

Understanding the Basics

Can a Canadian Invest in US Stocks? The answer is yes, a Canadian can invest in U.S. stocks. However, it's crucial to understand the legal and tax implications. The U.S. Securities and Exchange Commission (SEC) regulates the purchase of U.S. stocks by foreign investors, including Canadians.

Benefits of Investing in U.S. Stocks

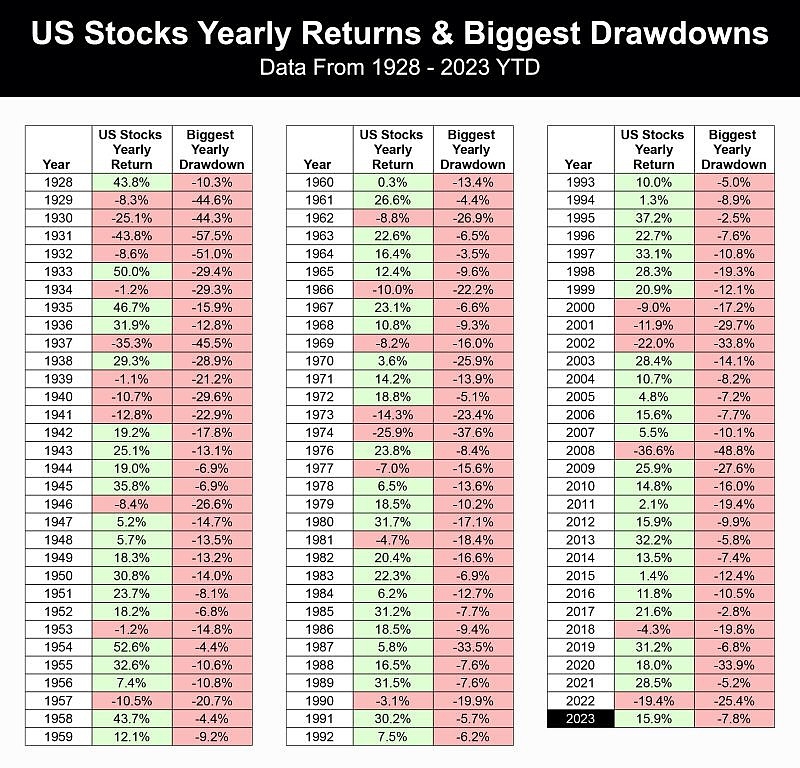

- Diversification: Investing in U.S. stocks can provide a valuable diversification to your Canadian portfolio, as the markets may perform differently.

- Access to World-Class Companies: The U.S. stock market is home to some of the world's largest and most successful companies, offering exposure to a wide range of industries.

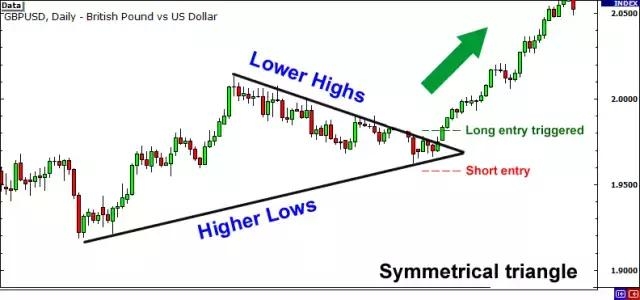

- Potential for Higher Returns: Historically, the U.S. stock market has provided higher returns than many other markets, making it an attractive option for investors.

Steps to Invest in U.S. Stocks as a Canadian

- Open a Brokerage Account: To invest in U.S. stocks, you'll need a brokerage account. There are several reputable online brokers that offer accounts for Canadian investors, such as TD Ameritrade, E*TRADE, and Charles Schwab.

- Understand the Tax Implications: When you invest in U.S. stocks, you may be subject to U.S. tax laws. It's important to consult with a tax professional to understand your obligations and potential tax liabilities.

- Research and Select Stocks: Once you have your brokerage account, you can start researching and selecting stocks to invest in. Consider factors such as the company's financial health, industry trends, and market performance.

- Monitor Your Investments: Regularly monitor your investments to ensure they align with your investment goals and risk tolerance.

Case Study: Investing in Apple Inc.

Let's consider a hypothetical scenario where a Canadian investor decides to invest in Apple Inc., one of the world's most valuable companies. By opening a brokerage account with a U.S.-based broker, the investor can purchase shares of Apple Inc. and benefit from its growth potential.

Conclusion

Investing in U.S. stocks can be a valuable addition to your Canadian investment portfolio. By understanding the process and regulations, you can make informed decisions and potentially achieve higher returns. Remember to consult with a financial advisor or tax professional to ensure compliance with all legal and tax requirements.

so cool! ()

last:US Automaker Traded on Stock Exchange: A Comprehensive Guide

next:nothing

like

- US Automaker Traded on Stock Exchange: A Comprehensive Guide

- US Penny Stock News Today: Key Updates and Insights

- LPSN Stock Price: LivePerson Inc Stock Quote, US NASDAQ MarketWatch

- Fuel Cell Stocks: The Future of Clean Energy in the US

- Lumber Stock US: A Comprehensive Guide to Buying and Selling Lumber in the USA

- US Stock Exchange Holidays 2020: A Comprehensive Guide

- Unlocking the Potential of US 1903 Stocks: A Comprehensive Guide

- Toys R UsNintendo Switch Stock Local: What You Need to Know

- US Pork Companies Stock: Trends, Insights, and Investment Opportunities

- Maximizing Your Investment Potential: Understanding U.S. OTC Stocks

- Schwab US Dividend Equity Stock Price: What You Need to Know

- Top Momentum Stocks Weekly Performance: US Market Insights

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Can a Canadian Invest in US Stocks? A Comprehe

Can a Canadian Invest in US Stocks? A Comprehe

Title: Japan Stock Banks in US Markets: Opport

Does the U.S. Government Own Intel Stock?

Investing in US Stocks from Australia: A Compr

BlackRock US Stocks Outlook: Tariffs Pause and

Legal & General Group Stock: A Compreh

The Devastating Stock Market Crash of 2008: Un

Unlocking the Potential of Canadian Apartment

US Listed South American Stocks: A 2019 Review

Halifax Stocks and Shares ISA Contact Us: Your

Total US Stocks Surpass 20,000: A Deep Dive in

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- 3 Major US Stock Indexes Record Highs: What It"

- Netflix Earnings Beat Boosts US Stock Futures"

- Schwab US Dividend Equity Stock Price: What Yo"

- S&P 500 Index US Stock Futures: A Comp"

- Title: US Middle Market Stocks: A Golden Oppor"

- Unlocking Potential: The Power of US Defense F"

- Top ETFs: Your Guide to Diversifying Your Port"

- Top Performing US Stocks Momentum in August 20"

- Amneal US Stocks: A Deep Dive into the Potenti"

- Railroad Stocks: A Strategic Investment for th"