you position:Home > us energy stock > us energy stock

Big Short in US Stocks Needs Watching

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

The stock market is a dynamic entity, constantly shifting with the tides of economic news and investor sentiment. However, there is a growing concern among market watchers that the US stock market might be heading for a "big short," a situation where a large number of investors collectively bet against the market, potentially leading to a significant downturn. This article delves into the reasons behind this concern and why it needs to be closely watched.

What is a "Big Short"?

A "big short" refers to a scenario where a substantial number of investors, often institutional investors or hedge funds, believe that the market is overvalued and will soon plummet. These investors borrow shares and sell them, expecting to buy them back at a lower price, pocketing the difference. If enough investors participate in this practice, it can put downward pressure on the market, leading to a significant drop in stock prices.

Reasons for Concern

Several factors are contributing to the growing concern of a "big short" in the US stock market:

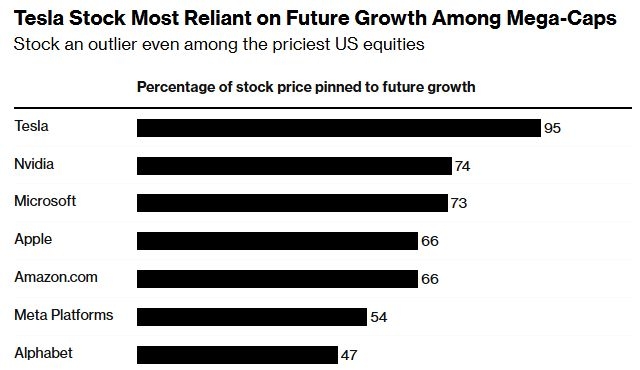

- Record High Valuations: The US stock market has been on a bull run for years, reaching record highs. This has led to concerns that the market might be overvalued, making it susceptible to a downturn.

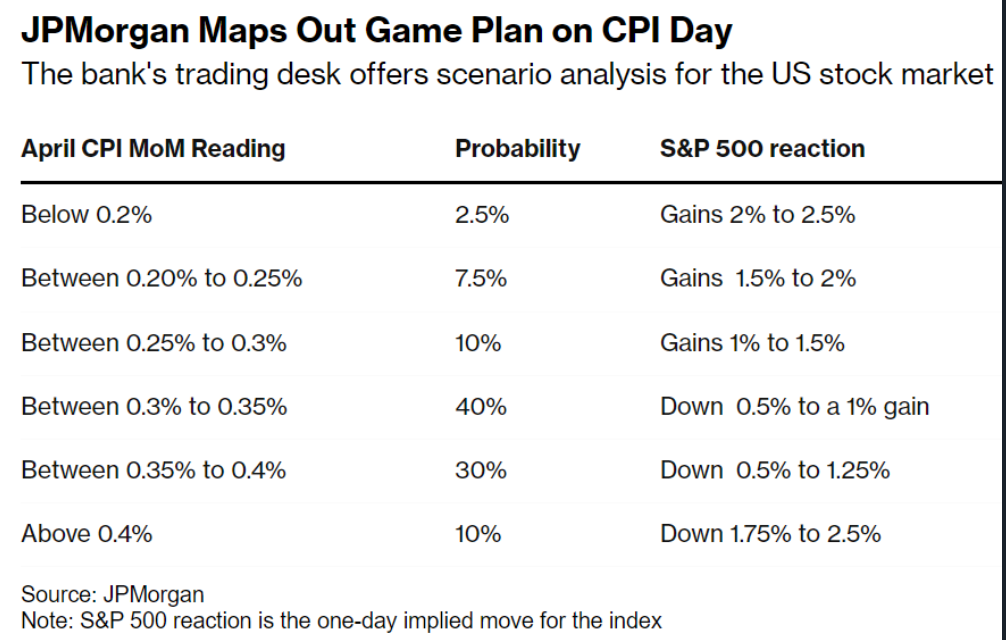

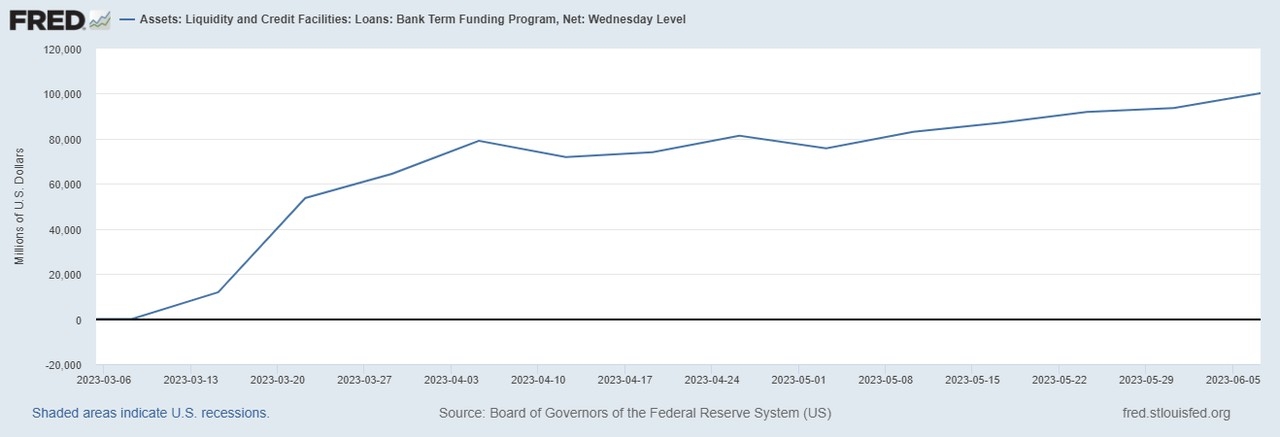

- Rising Interest Rates: The Federal Reserve has been raising interest rates to combat inflation, which can make borrowing more expensive and potentially lead to a decrease in investor confidence.

- Economic Uncertainties: The global economy is facing several challenges, including rising geopolitical tensions, supply chain disruptions, and the potential impact of the COVID-19 pandemic.

- Institutional Investors' Actions: Some institutional investors are reportedly betting against the market, which can create a self-fulfilling prophecy.

Case Studies

One notable example of a "big short" is the 2008 financial crisis, where investors like John Paulson and Steve Eisman bet against the US housing market, predicting that the bubble would burst. Their actions, along with others, contributed to the collapse of the housing market and the subsequent financial crisis.

What Investors Should Do

In light of these concerns, investors should consider the following:

- Diversify Your Portfolio: Diversifying your investments across various asset classes can help mitigate risks.

- Stay Informed: Keep yourself updated with the latest economic news and market trends.

- Avoid Speculative Investments: Focus on well-researched and fundamentally sound investments.

- Seek Professional Advice: Consult with a financial advisor to create a personalized investment strategy.

Conclusion

The potential for a "big short" in the US stock market is a serious concern that investors need to watch closely. By staying informed, diversifying their portfolios, and seeking professional advice, investors can navigate this challenging market environment and protect their investments.

so cool! ()

last:Unlocking the Potential of Tw US Stock: A Comprehensive Guide

next:nothing

like

- Unlocking the Potential of Tw US Stock: A Comprehensive Guide

- Large US Companies with Publicly Traded Stock: A Comprehensive Guide

- US Bank Stock Price Forecast: A Comprehensive Analysis for Investors

- Undervalued US Stocks to Watch in 2021

- Canadian Day Trading US Stocks: A Comprehensive Guide

- Baidu Stock US: A Comprehensive Analysis of Baidu's Stock Performance in the

- MT4 Demo Accounts for Stocks: A Comprehensive Guide for US Investors

- Is the Stock Market Open Tomorrow in the US? Key Information You Need to Know

- Singapore Best Broker for US Stocks: Your Ultimate Guide

- Goldman Says US Stocks Have Likely Bottomed

- US Small Cap Stocks News Today: Key Updates and Insights"

- Coal Company Stocks: The Rising Trend in US Investments

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Big Short in US Stocks Needs Watching

Big Short in US Stocks Needs Watching

The Stock and Flow of US Firearms: Understandi

Understanding the iShares Total U.S. Stock Mar

Title: US Middle Market Stocks: A Golden Oppor

How to Get Involved in the Stock Market in the

Kraken US Stocks: A Comprehensive Guide to Tra

Understanding the CA Stock Price in the US Mar

Top Momentum Stocks This Week: US Market Insig

Cision US Stock: A Comprehensive Guide to Unde

Dbs hk us stock: Exploring Investment Opportun

Fly Us Stock Isn't Crashing: Why You Shou

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- US Stock Advice: Top Strategies for Investors "

- Best AI Stocks to Watch in 2025"

- Does the U.S. Government Own Intel Stock?"

- August 29, 2025: US Stock Market Close Summary"

- US Stock Futures Fall: What It Means for Inves"

- http://stocks.us.reuters.com stocks fulldescri"

- Buy Us OTC Stocks: Your Guide to Investing in "

- AVGO Stock Forecast: What Investors Need to Kn"

- US Military Prepositioned Stocks: The Strategi"

- Title: Chinese Stocks in US List: A Comprehens"