you position:Home > us energy stock > us energy stock

Are US Stocks Crashing? A Comprehensive Analysis"

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

Introduction: In recent weeks, there has been a growing concern about the potential crash of the US stock market. Investors are on edge, wondering if the current market trends indicate a downturn. In this article, we will delve into the factors contributing to the uncertainty and analyze the likelihood of a stock market crash.

Economic Factors Contributing to Market Volatility

Inflation Concerns: Inflation has been a hot topic in recent months, with the Consumer Price Index (CPI) reaching a 40-year high. This has led to concerns about the Federal Reserve's ability to control inflation and its impact on the stock market.

Geopolitical Tensions: The ongoing tensions between the United States and China, as well as the conflict in Eastern Europe, have raised concerns about global economic stability. These geopolitical factors can lead to market volatility and uncertainty.

Monetary Policy: The Federal Reserve's monetary policy decisions play a crucial role in shaping the stock market. The recent increase in interest rates and the possibility of further hikes have created apprehension among investors.

Historical Context and Comparisons

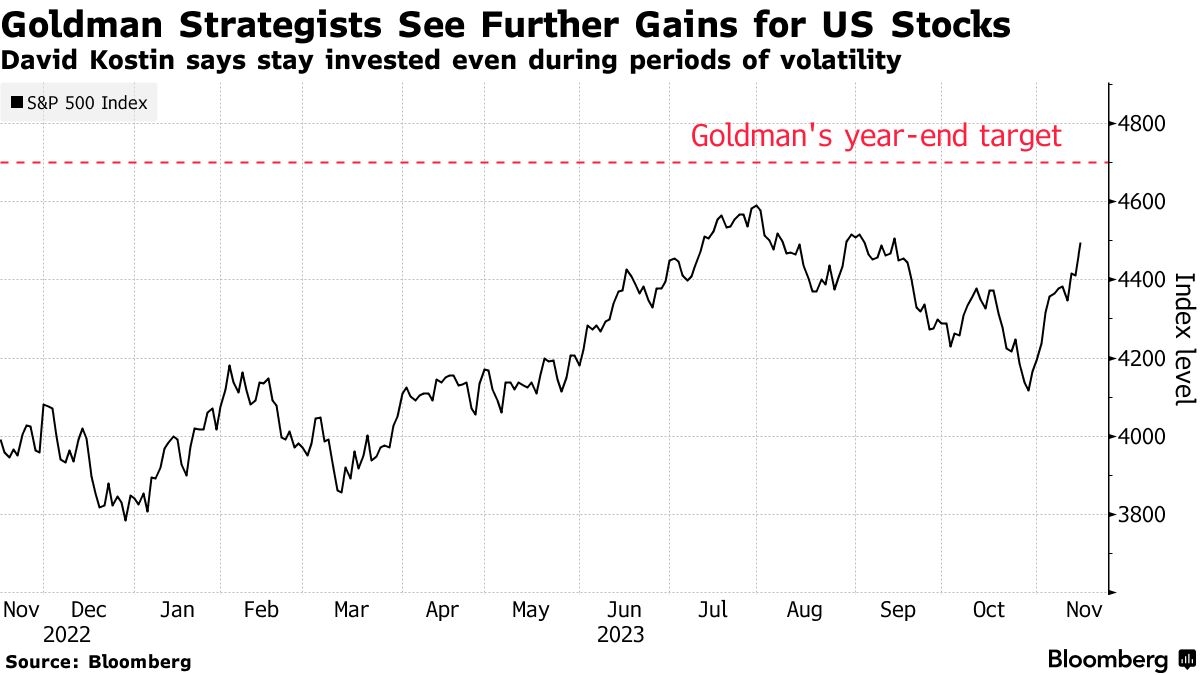

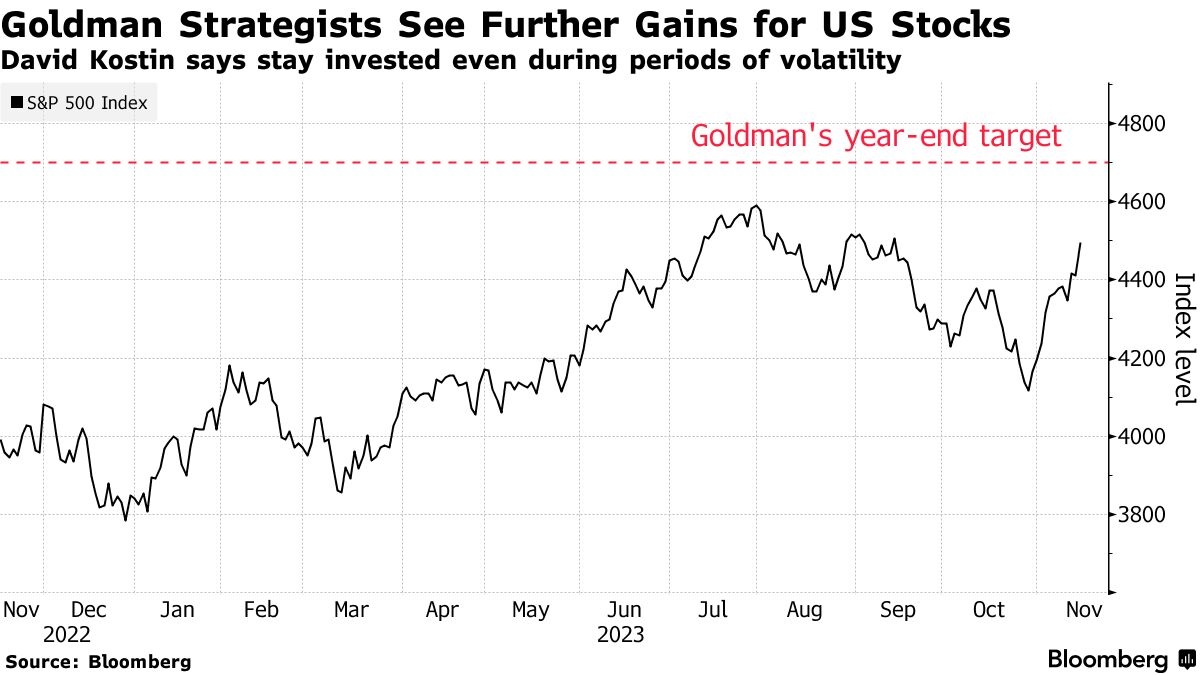

It is essential to put the current market situation into historical context. In the past, there have been instances of market crashes, such as the dot-com bubble in 2000 and the financial crisis of 2008. However, the current situation differs in several aspects:

Liquidity: The current market has ample liquidity, which can help absorb potential shocks.

Corporate Profits: Corporate profits are at an all-time high, providing a strong foundation for the stock market.

Market Valuations: The stock market is not as overvalued as it was during the dot-com bubble, which reduces the likelihood of a crash.

Key Indicators to Watch

To gauge the likelihood of a stock market crash, it is essential to monitor certain key indicators:

VIX Index: The VIX, also known as the "fear gauge," measures market volatility. A high VIX reading can indicate potential market crashes.

Breadth of the Market: Monitoring the breadth of the market, i.e., the number of stocks trading above their 50-day moving average, can provide insights into market strength.

Leverage: High levels of leverage in the financial system can lead to market crashes. It is crucial to keep an eye on leverage levels among institutions and retail investors.

Case Studies: Historical Market Crashes

Dot-Com Bubble: The dot-com bubble, which burst in 2000, was characterized by the overvaluation of technology stocks. Many investors lost substantial amounts of money when the bubble burst.

Financial Crisis of 2008: The financial crisis of 2008 was caused by a combination of factors, including the housing bubble, excessive risk-taking by financial institutions, and a lack of regulatory oversight. The market crash resulted in massive job losses and economic downturn.

Conclusion: While concerns about a potential stock market crash are valid, it is crucial to analyze the factors contributing to the uncertainty. By considering economic factors, historical context, and key indicators, investors can make informed decisions. While the possibility of a crash cannot be entirely ruled out, the current market conditions suggest a higher likelihood of market volatility rather than a full-blown crash.

so cool! ()

last:TFSA Holding US Stocks: A Comprehensive Guide for Canadian Investors

next:nothing

like

- TFSA Holding US Stocks: A Comprehensive Guide for Canadian Investors

- US Stock Blue Chips: Your Guide to Investment in the Market's Giants

- Has the International Stock Market Ever Outperformed the US Stock Market?

- US Momentum Stocks: Top Performers Over the Past 5 Days in September 2025&quo

- How to Trade in the US Stock Market from Canada: A Comprehensive Guide

- Capgemini US Stock Price: A Comprehensive Analysis

- Tots R Us Spokabe Cribs in Stock: The Ultimate Guide for Safe and Stylish Baby Cr

- Si1935b Stock in the US: What You Need to Know

- Santander US Stock: A Comprehensive Guide to Understanding and Investing

- How to Invest in the Hong Kong Stock Market from the US: A Comprehensive Guide

- Unlocking Opportunities: Exploring the World of Small US Company Stocks

- How Global Events Influence the US Stock Exchanges

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Are US Stocks Crashing? A Comprehensive Analys

Are US Stocks Crashing? A Comprehensive Analys

US Steel Companies Stock Prices: A Comprehensi

FTX US Stocks: The Ultimate Guide to Investing

Unlocking the Potential of US Ethanol Stocks:

Amneal US Stocks: A Deep Dive into the Potenti

2018 US Stock Market Performance: A Comprehens

Meituan Stock US: The Rise and Future of China

Pancontinental Resources Corp US Stock Symbol:

US Stock Futures Mixed Ahead of Inflation Data

How to Buy US Stocks from India: A Comprehensi

RLX US Stock: The Ultimate Guide to Investing

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- Gift Tax for Non-US Citizens Owning Stock of a"

- Maximizing Returns: A Deep Dive into US Farm S"

- Snowflake Stock: The Future of Financial Inves"

- US-China Trade War and the Impact on Tech Stoc"

- It Stocks Us: How Tech Giants Are Transforming"

- US Congress Stocks and Crypto Will Be Banned"

- Title: Unveiling the US Dividend Stock Phenome"

- How Much of the US Stock Is Owned by China?"

- US Marijuana Stocks to Buy in 2019: A Guide to"

- Questrade Buy US Stock: A Comprehensive Guide "