you position:Home > us energy stock > us energy stock

Adidas Stock Price in US Dollars: A Comprehensive Analysis

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In the fast-paced world of finance, keeping a close eye on stock prices is crucial for investors and enthusiasts alike. One such stock that has been capturing attention is the Adidas stock price in US dollars. In this article, we delve into the factors influencing this stock price, its historical performance, and potential future trends.

Historical Performance of Adidas Stock

The stock of Adidas, a leading global sports brand, has seen its fair share of ups and downs over the years. Since its initial public offering (IPO) in 2005, the stock has experienced significant growth. In the early 2000s, the stock price hovered around

Factors Influencing Adidas Stock Price

Several factors contribute to the fluctuation of the Adidas stock price in US dollars. Here are some key factors to consider:

Revenue Growth: Adidas has consistently reported strong revenue growth, driven by its diverse product portfolio and global expansion. A robust revenue stream is a positive indicator for investors, often leading to an increase in stock price.

Market Competition: The sports apparel industry is highly competitive, with brands like Nike and Under Armour constantly vying for market share. How Adidas performs in comparison to its competitors can significantly impact its stock price.

Product Innovation: Adidas has been known for its innovative products, such as the Boost technology and the Yeezy collaboration with Kanye West. Successful product launches and collaborations can boost the brand's image and, consequently, its stock price.

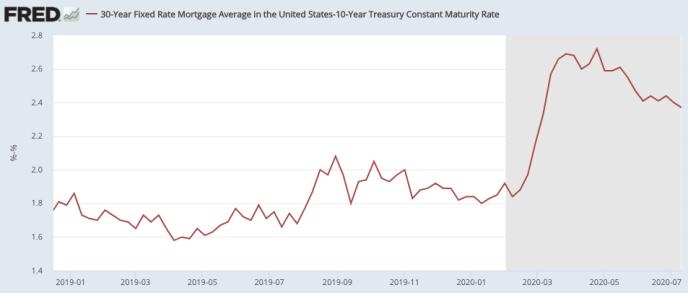

Economic Factors: Global economic conditions, such as inflation, interest rates, and currency fluctuations, can also influence the stock price. For instance, a strong US dollar can make Adidas products more expensive in other countries, potentially affecting sales and, subsequently, the stock price.

Brand Reputation: Adidas' reputation as a premium sports brand plays a crucial role in its stock price. Any negative news or controversy can lead to a decline in stock value.

Case Study: Adidas Stock Price in 2020

A notable case study of the Adidas stock price in US dollars is the year 2020. Amid the global COVID-19 pandemic, many companies faced significant challenges. However, Adidas managed to navigate the crisis relatively well, thanks to its strong digital presence and focus on e-commerce. As a result, its stock price remained relatively stable, even as the market experienced significant volatility.

Future Trends for Adidas Stock

Looking ahead, several factors could influence the future of the Adidas stock price in US dollars:

Expansion into New Markets: Adidas continues to expand into emerging markets, which could drive future growth and positively impact the stock price.

Sustainability Initiatives: Adidas has been making efforts to become more sustainable, which could appeal to environmentally conscious consumers and investors.

Product Innovation: As long as Adidas continues to innovate and launch successful products, its stock price is likely to remain strong.

In conclusion, the Adidas stock price in US dollars is influenced by various factors, including revenue growth, market competition, product innovation, and economic conditions. By understanding these factors and staying informed about the latest developments, investors can make more informed decisions about their investments in Adidas.

so cool! ()

last:Best Momentum Stocks: Top Large Cap US Performers in 5 Days

next:nothing

like

- Best Momentum Stocks: Top Large Cap US Performers in 5 Days

- Indian Broker for US Stocks: Your Ultimate Guide to Cross-Border Investing

- Dow Jones Figures Today: Unveiling the Latest Financial Insights

- Top US Bank Stocks to Watch in 2025: A Comprehensive Guide

- AdvisorShares Pure US Stock: The Ultimate Guide to Navigating the U.S. Market

- Dow, S&P, and Nasdaq Futures: A Comprehensive Guide to Understanding Mark

- Tom Lives in the US and Owns Stock in MRK: Understanding the Investment Opportuni

- Unlock the Future: A Comprehensive Guide to INX Futures

- Semiconductor Stocks: The US Market's Leading Players and Future Outlook

- Did Stocks Fall Today? A Comprehensive Analysis of Today's Market Movement

- Indian Stocks to Buy in the US: A Comprehensive Guide

- US Troop Transportations to Afghanistan: The Logistics Behind the Scenes

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Adidas Stock Price in US Dollars: A Comprehens

Adidas Stock Price in US Dollars: A Comprehens

Unlock the Power of After-Hours Stock Market T

US Islamic Stock Market: A Growing Sector for

US Steel Marathon Stock Split: What It Means f

Understanding US Stock Exchange Listings: A Co

Title: Top Stocks to Buy Now: US Market Analys

Is the Stock Market Up or Down? A Comprehensiv

US Stock C2P17152: A Deep Dive into the World

Title: US Gypsum Stock: The Ultimate Guide to

US Stock Earnings This Week: Key Highlights an

Global Stock Market Update: May 17, 2025

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stock us stocks games silver etf

like

- How Many US Stocks: A Comprehensive Guide to t"

- How to Buy Cannabis Stocks in the U.S."

- Yahoo Finance News Today: Breaking Economic He"

- Best US Stock ETFs: Your Ultimate Guide to Div"

- Penny Stocks US List: Unveiling the Potential "

- Title: Understanding the Market Bubble: Causes"

- Water Stocks: A Smart Investment in a Thirsty "

- Understanding Stock Capital Gains Tax in the U"

- Top Sexy Stockings Available in the US Market&"

- Title: 4245 150 US Gal Stock Tank: A Comprehen"