you position:Home > us energy stock > us energy stock

2022 US Stock Market Outlook: Predictions and Opportunities

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

As we step into the new year, investors and market analysts are eager to decipher the 2022 US stock market outlook. With the lingering impact of the COVID-19 pandemic and the ongoing geopolitical tensions, the market is brimming with uncertainty but also ripe with potential opportunities. In this article, we'll explore the key trends, predictions, and strategies for navigating the US stock market in 2022.

Economic Recovery and Growth

The US economy is on the mend, with signs of recovery bolstered by the rollout of COVID-19 vaccines. The Federal Reserve has signaled its commitment to supporting economic growth, with interest rates expected to remain low in the near term. This low-interest-rate environment is expected to benefit stocks, particularly in sectors like technology and consumer discretionary.

Technology and Innovation

The technology sector has been a beacon of strength throughout the pandemic, and this trend is expected to continue in 2022. Innovations in AI, 5G, and cloud computing are driving growth, and companies like Apple, Microsoft, and Amazon are well-positioned to capitalize on these advancements. Additionally, the rise of remote work and online shopping has accelerated the shift towards digital solutions, further bolstering tech stocks.

Healthcare and Biotech

The healthcare sector has also emerged as a significant winner in the wake of the pandemic. Vaccines and treatments for COVID-19 have driven significant investment, and the sector is poised for continued growth as we move towards herd immunity. Biotech companies like Moderna and Pfizer are leading the charge, but traditional pharmaceutical companies like Johnson & Johnson and Merck are also well-positioned to benefit from this trend.

Value vs. Growth

The debate between value and growth stocks is likely to continue in 2022. While growth stocks have surged in recent years, value stocks are beginning to regain their allure. Factors such as rising interest rates and inflation concerns could lead to a revaluation of value stocks, particularly in sectors like financials, energy, and industrials.

International Factors

Geopolitical tensions, particularly in Eastern Europe and Asia, are a concern for the US stock market. However, the strong US dollar and the resilience of the US economy are expected to mitigate some of these risks. Investors should keep a close eye on global events, as they can have a significant impact on market sentiment.

Dividend Stocks

In an environment of low interest rates, dividend stocks are becoming increasingly attractive. Companies with strong balance sheets and a history of paying dividends are likely to be well-regarded by investors. Sectors like consumer staples and utilities are often seen as defensive plays, offering stability and income in uncertain times.

Case Studies

To illustrate the potential opportunities in the US stock market, let's consider a few case studies:

Apple Inc. (AAPL): With its strong position in the tech industry and a diverse product lineup, Apple is well-positioned for continued growth. The company's commitment to innovation and its ability to adapt to changing consumer preferences make it a compelling investment.

Johnson & Johnson (JNJ): As a leader in healthcare and consumer products, Johnson & Johnson is well-positioned to benefit from the ongoing shift towards digital health solutions and increased demand for healthcare products.

Procter & Gamble (PG): With a strong portfolio of consumer brands and a focus on sustainability, Procter & Gamble is a defensive play that can provide stability and income in uncertain times.

In conclusion, the 2022 US stock market outlook presents a mix of opportunities and challenges. By staying informed and strategic, investors can position themselves for success in this dynamic market. As always, it's crucial to do thorough research and consider your own risk tolerance before making any investment decisions.

so cool! ()

last:US Stock Clearance: Unbeatable Deals on Top Brands at Deep Discounts

next:nothing

like

- US Stock Clearance: Unbeatable Deals on Top Brands at Deep Discounts

- Trading on the US Stock Market: A Comprehensive Guide

- Understanding the CA Stock Price in the US Market

- US Marijuana Stocks to Buy in 2019: A Guide to Pot Stocks

- Title: US Large Cap Stocks Best Momentum: Top 5 Performance in Last 5 Days

- Understanding the US Money Stock: A Comprehensive Guide

- Chinese Shares Delisted from US Stock Exchange: What You Need to Know

- Title: Are US Stocks Overvalued? Morgan Stanley Weighs In

- Unlocking the Potential of SaaS US Stock: A Comprehensive Guide

- Best US Stocks to Buy in August 2018: A Strategic Investment Guide

- How Do I Buy Volkswagen Stock in the US? A Comprehensive Guide

- Best Brokerage Account Singapore for US Stocks: Your Ultimate Guide

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

2022 US Stock Market Outlook: Predictions and

2022 US Stock Market Outlook: Predictions and

US Shariah Stock List: A Comprehensive Guide t

KPMG US Stock Price: What You Need to Know

Small Cap US Tech Stocks: A Lucrative Investme

June 26, 2025: US Stock Market News Roundup

US Shipping Company Stocks: A Comprehensive Gu

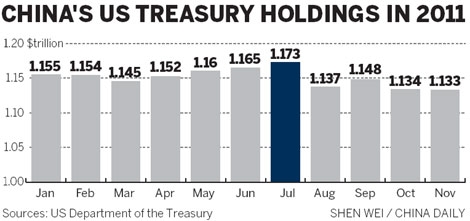

How Much of the US Stock Is Owned by China?

US Recycling Company Stock: A Growing Investme

US Food Holding Stock: A Comprehensive Guide t

Maximizing Returns: A Guide to Canadian Invest

US Stock Market in the Past 3 Months: A Compre

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Apple Stock Post US-China Trade War: The Impac"

- US Stock Day Trade: The Ultimate Guide to Day "

- US Stock Market 2023 Predictions: A Comprehens"

- RF US Stock Price: A Comprehensive Guide to Un"

- Title: "Clinton Campaign's Misst"

- Railroad Stocks: A Strategic Investment for th"

- Tata Motors Stock US: A Comprehensive Guide"

- US Small Cap Growth Stocks: Unleashing the Pot"

- US Shariah Stock List: A Comprehensive Guide t"

- Capitalization: The Key to Understanding the U"