you position:Home > us energy stock > us energy stock

US Stock Market 2023 Predictions: A Comprehensive Outlook

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Introduction:

The year 2023 is fast approaching, and investors are eager to know what the US stock market holds in store. As we reflect on the challenges and opportunities of the past year, it's crucial to look ahead and make informed predictions for the year to come. This article will provide a comprehensive outlook on the US stock market in 2023, highlighting potential trends, risks, and investment opportunities.

1. Economic Recovery and Interest Rates:

After a tumultuous 2022 marked by inflation, supply chain disruptions, and geopolitical tensions, the US economy is expected to show signs of recovery in 2023. According to the Federal Reserve, the economy is likely to grow modestly, with GDP expanding around 2% to 2.5%. This growth is supported by a strong labor market, low unemployment rates, and increased consumer spending.

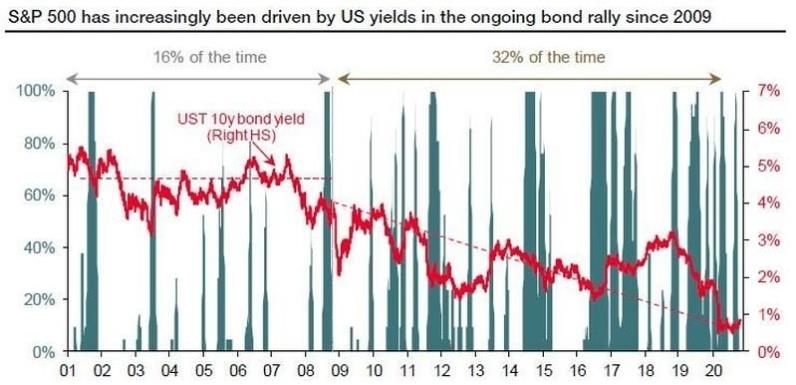

However, one of the key factors to watch out for in 2023 is the potential increase in interest rates. The Federal Reserve has indicated that it may raise rates to combat inflation, which remains a persistent concern. This could lead to higher borrowing costs, potentially slowing down economic growth and impacting stock market performance.

2. Tech Stocks:

Tech stocks have been a major driver of the US stock market in recent years. However, 2023 may see a shift in focus as investors become more diversified. Despite the ongoing growth potential of companies like Apple (AAPL), Microsoft (MSFT), and Google's parent Alphabet (GOOGL), valuations have become stretched, leading to a possible correction.

Nonetheless, certain tech sectors, such as artificial intelligence (AI) and cybersecurity, are expected to remain strong. AI companies like NVIDIA (NVDA) and CrowdStrike (CRWD) could see significant growth as AI continues to transform various industries.

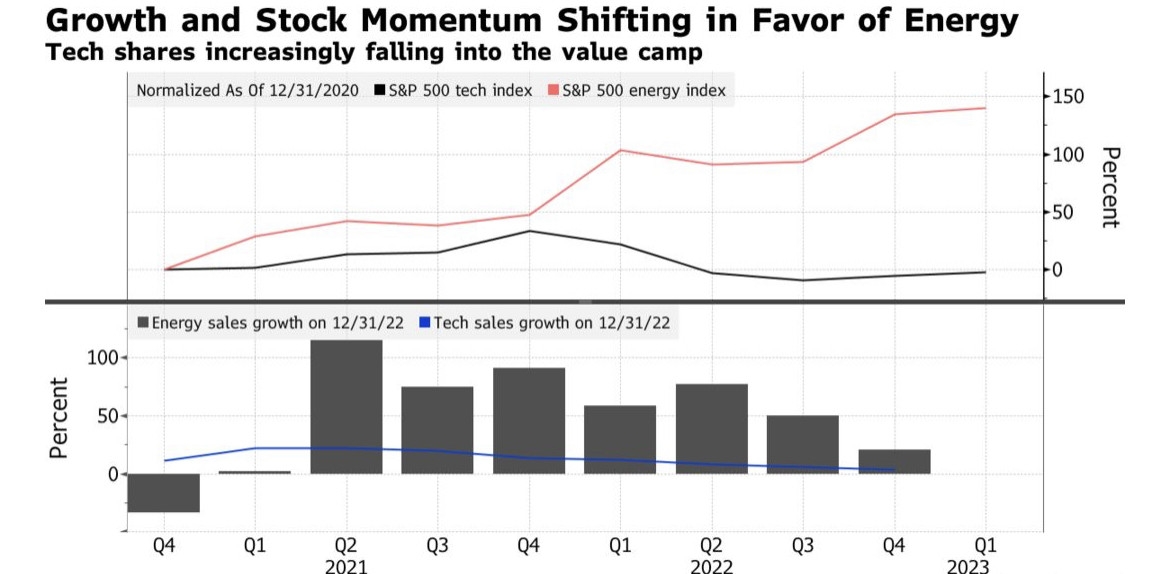

3. Value Stocks:

After a strong performance by growth stocks in recent years, 2023 may see a shift towards value stocks. As interest rates rise and economic uncertainty persists, investors may seek stability and dividends offered by value stocks. Sectors like financials, energy, and industrials are likely to benefit from this trend.

4. Small-Cap Stocks:

Small-cap stocks often outperform large-cap stocks during periods of economic expansion. With the US economy expected to grow modestly in 2023, small-cap stocks could see significant gains. However, it's important to conduct thorough research and invest in companies with strong fundamentals.

5. International Investments:

Despite the uncertainty in the global economy, international investments could provide diversification and potential growth opportunities. Emerging markets, such as China and India, are expected to see robust growth in 2023. Companies like Alibaba (BABA) and TCS (TCEHY) are likely to benefit from this trend.

Conclusion:

While it's difficult to predict the exact trajectory of the US stock market in 2023, these trends and opportunities provide a roadmap for investors. As always, it's crucial to conduct thorough research, stay informed, and manage risk accordingly. With a diverse investment portfolio and a focus on sectors with strong growth potential, investors can navigate the challenges and opportunities of the upcoming year.

so cool! ()

last:Blue Chip Stocks: A Solid Investment in the US Market

next:nothing

like

- Blue Chip Stocks: A Solid Investment in the US Market

- Can You Buy Pop Mart Stock in the US? A Comprehensive Guide

- US Large Cap Stocks Momentum Analysis: Top Performers

- Title: Profitable US Pot Stocks: A Guide to Investment Opportunities

- US Listed Rare Earth Stocks: A Comprehensive Guide

- US Based Marijuana Stock: A Growing Investment Opportunity

- Momentum Stocks: Top Performers in the US Large Cap Market Over the Last 5 Days

- HMMJ.CA: Unveiling the US Stock Symbol of HMM, the Global Shipping Giant

- US Mint Proof Set Stock Photos: The Ultimate Guide to Capturing the Beauty and De

- Holiday US Stock Market 2025: What to Expect and How to Prepare

- US Steel Nippon Stock: A Comprehensive Analysis

- Holidays in US Stock Market 2021: A Comprehensive Guide

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Stock Market 2023 Predictions: A Comprehens

US Stock Market 2023 Predictions: A Comprehens

February 2020 IPOs: A Deep Dive into the US St

RF US Stock Price: A Comprehensive Guide to Un

Stock Ownership in the US: Understanding the B

RIO US Stock: A Comprehensive Guide to Investi

US Stock Market 2023 Predictions: A Comprehens

Are the US Stock Markets Open on Presidents Da

Holidays in US Stock Market 2021: A Comprehens

Toys R Us Liquidation Stock Quotes: Your Ultim

Canadian ETFs Traded on US Stock Exchanges: A

High Yield Dividend US Stocks: The Ultimate Gu

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- When to Sell Stocks: A Comprehensive Guide for"

- Good Time to Buy US Stocks: Expert Insights an"

- Blue Chip Stocks: A Solid Investment in the US"

- US Listed Rare Earth Stocks: A Comprehensive G"

- Dividend Increase: A Lucrative Indicator for I"

- Title: "http stocks.us.reuters.com st"

- LCID Stock: A Comprehensive Guide to Understan"

- Alb.us Stock: Unveiling the Potential of This "

- Title: Leveraged ETFs: Your Gateway to High-Yi"

- PayPal Stock Forecast: What's in Store fo"