you position:Home > aphria us stock > aphria us stock

US Stock Buy from India: A Strategic Investment Opportunity

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In recent years, the United States has seen a significant increase in the number of investors looking to diversify their portfolios by purchasing stocks from Indian companies. This trend has been driven by the rapid economic growth and technological advancements in India, making it an attractive market for American investors. This article delves into the reasons behind this growing interest and highlights the key factors to consider when investing in Indian stocks from the US.

Rising Economic Growth in India

India has been experiencing a period of robust economic growth, with a GDP growth rate that has outpaced many developed countries. This growth has been fueled by various factors, including a young and growing population, a strong IT sector, and increasing foreign investment. As a result, many Indian companies have seen significant growth in their revenue and profitability, making them attractive investment opportunities for US investors.

Technological Advancements in India

India has become a hub for technological innovation, with numerous startups and established companies leading the way. This has attracted the attention of global investors, including those in the US. Many Indian companies are at the forefront of technological advancements, such as artificial intelligence, robotics, and e-commerce. Investing in these companies can provide US investors with exposure to cutting-edge technologies and potentially high returns.

Diversification of Portfolio

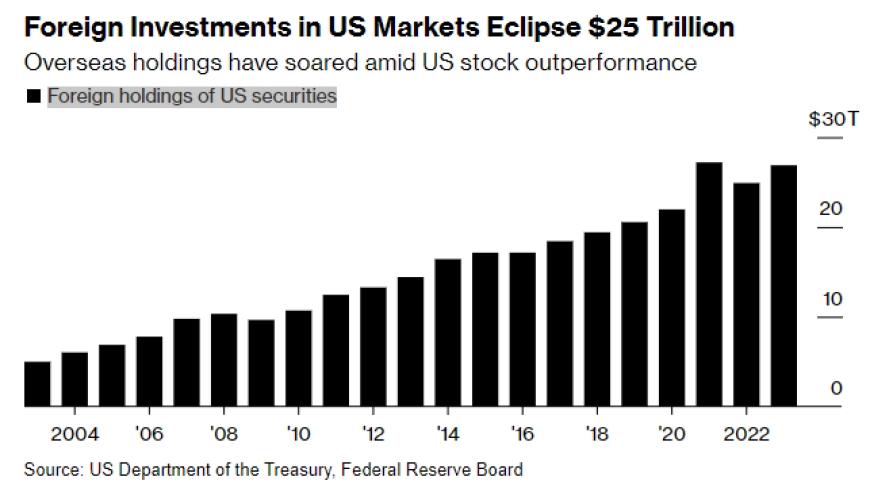

Investing in Indian stocks can help US investors diversify their portfolios, reducing their exposure to the volatility of the US market. India's stock market has a different economic cycle and market dynamics compared to the US, which can provide a level of stability and balance to an investment portfolio.

How to Buy Indian Stocks from the US

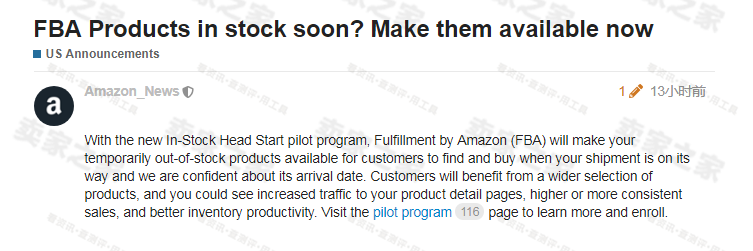

Buying Indian stocks from the US is relatively straightforward. Investors can purchase shares of Indian companies through various platforms, including online brokers, mutual funds, and exchange-traded funds (ETFs). It is important to research and understand the specific regulations and requirements for investing in foreign stocks.

Case Studies: Successful Investments in Indian Stocks

Several US investors have successfully invested in Indian stocks, achieving significant returns. For example, investors who purchased shares of Infosys, an Indian IT services company, in the early 2000s have seen their investment grow exponentially. Similarly, investors who invested in Reliance Industries, India's largest private sector company, have also seen substantial returns.

Key Factors to Consider When Investing in Indian Stocks

Before investing in Indian stocks from the US, it is important to consider several key factors:

- Economic Stability: Assess the economic stability and growth potential of India.

- Political Environment: Understand the political landscape and any potential risks or opportunities.

- Currency Fluctuations: Be aware of the impact of currency fluctuations on your investment.

- Regulatory Environment: Familiarize yourself with the regulatory environment in India.

Conclusion

Investing in Indian stocks from the US can be a strategic move for investors looking to diversify their portfolios and gain exposure to the rapid economic growth and technological advancements in India. By conducting thorough research and considering key factors, investors can make informed decisions and potentially achieve significant returns.

so cool! ()

last:All World Ex US Stock Index Fund: A Comprehensive Guide

next:nothing

like

- All World Ex US Stock Index Fund: A Comprehensive Guide

- Kato Rabe N Scale US Shop in Stock: Your Ultimate Guide to Model Train Paradise

- Is the US Stock Market Open on December 26, 2023?

- Chinese Stock Delisting in US: Understanding the Implications and Impact

- Understanding US Propane Stocks: A Comprehensive Guide

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol elos.

- Title: US Blue Chip Stocks: The Ultimate Guide to Investment Success

- China Stocks That Trade on U.S. Exchanges: A Comprehensive Guide

- US Stock Exchange Today Graph: A Comprehensive Overview

- Can I Buy Constellation Stock in the US? A Comprehensive Guide

- US Cannabis Penny Stock: A Guide to Investment Opportunities and Risks

- Understanding the S&P US Preferred Stock Index: A Comprehensive Guide

recommend

US Stock Buy from India: A Strategic Investmen

US Stock Buy from India: A Strategic Investmen

US Architectural Stock Plan Market 2019: An In

Key Market Trends and Risks in the US Stock Ma

Polymer Black Stock Set NATO US: The Ultimate

How Are US Stocks Doing? A Comprehensive Analy

Stock Video Sold in the US: A $700 Million Mar

US Shorted Stocks: Understanding the Risks and

Kato Rabe N Scale US Shop in Stock: Your Ultim

Title: Inflation Adjusted Long-Term Return of

Jim Rogers Sold All US Stocks: What It Means f

Title: Chinese Company US Stock Market: Opport

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock