you position:Home > aphria us stock > aphria us stock

China Stocks That Trade on U.S. Exchanges: A Comprehensive Guide

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Are you intrigued by the prospect of investing in China but unsure where to start? Look no further! This guide delves into the world of China stocks that trade on U.S. exchanges, providing you with a clear and concise overview of this exciting market.

Understanding China Stocks Trading on U.S. Exchanges

When we talk about "China stocks that trade on U.S. exchanges," we're referring to Chinese companies that have chosen to list their shares on U.S. stock markets. These companies have gone through the process of registering with the U.S. Securities and Exchange Commission (SEC), making their shares accessible to American investors.

The Advantages of Investing in China Stocks on U.S. Exchanges

- Accessibility: By listing on U.S. exchanges, Chinese companies make it easier for American investors to gain exposure to the world's second-largest economy.

- Transparency: U.S. exchanges are known for their stringent reporting and disclosure requirements, which ensures that investors have access to accurate and timely information.

- Diversification: Investing in China stocks can add diversification to your portfolio, as the Chinese market often moves independently of U.S. markets.

Popular China Stocks Trading on U.S. Exchanges

Several Chinese companies have made a name for themselves on U.S. exchanges. Here are some notable examples:

- Baidu: China's leading search engine, Baidu, offers a platform for businesses to connect with potential customers in the country.

- Alibaba: The e-commerce giant Alibaba dominates the Chinese online retail market, offering investors a chance to tap into the massive Chinese consumer base.

- Tencent: China's largest social network, Tencent, has interests in various industries, including gaming, e-commerce, and fintech.

Considerations for Investing in China Stocks on U.S. Exchanges

Before investing in China stocks that trade on U.S. exchanges, there are several factors to consider:

- Currency Fluctuations: Changes in the exchange rate between the U.S. dollar and the Chinese yuan can impact your investment returns.

- Political Risks: As with any international investment, political risks should be a concern. Keep an eye on relations between the U.S. and China, as they can affect business operations in the region.

- Regulatory Changes: China's regulatory environment can be unpredictable, and changes to the rules and regulations can impact the performance of listed companies.

Case Study: Baidu’s U.S. Listing

Baidu, one of the most popular China stocks on U.S. exchanges, provides a compelling case study for investing in Chinese companies. Launched in 2000, Baidu became the first Chinese company to be listed on the NASDAQ Stock Market. The company's success is a testament to the opportunities available in the Chinese market for innovative companies.

However, it's essential to remember that Baidu's journey on the U.S. stock market has not been without challenges. The company has faced increased competition from domestic and international players, and there have been concerns regarding its market dominance in China.

In conclusion, investing in China stocks that trade on U.S. exchanges can offer a unique opportunity for investors looking to gain exposure to the world's second-largest economy. By understanding the advantages, considerations, and risks associated with these investments, you can make informed decisions and potentially achieve significant returns.

so cool! ()

last:US Stock Exchange Today Graph: A Comprehensive Overview

next:nothing

like

- US Stock Exchange Today Graph: A Comprehensive Overview

- Can I Buy Constellation Stock in the US? A Comprehensive Guide

- US Cannabis Penny Stock: A Guide to Investment Opportunities and Risks

- Understanding the S&P US Preferred Stock Index: A Comprehensive Guide

- US Stock Earnings: A Comprehensive Overview

- Best US Lumber Stocks: A Guide to Investing in the Lumber Industry

- How to Enter the US Stock Market

- Lithium Mining Stocks: A Lucrative Investment in the US Green Energy Revolution

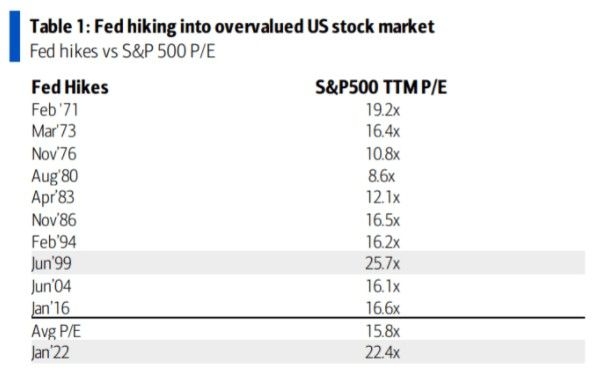

- Title: Is the US Stock Market Currently Overvalued?

- Best US Telecom Stocks: Top Investments for 2023

- Today's Top Momentum Stocks: A Dive into the US Markets

- US Shorted Stocks: Understanding the Risks and Opportunities

recommend

China Stocks That Trade on U.S. Exchanges: A C

China Stocks That Trade on U.S. Exchanges: A C

How Much Did the US Stock Market Lose Today?

FDL Stock: What You Need to Know from US News

Multibagger US Stocks: Unveiling the Power of

Is the US Stock Exchange Open on Veterans Day?

Best Model for Predicting Option Price of US S

Canadian Stocks Paying US Dividends: A Lucrati

Top US Pot Stocks 2021: A Comprehensive Guide

Tots R Us: Spokabe Cribs in Stock

How to Buy Eutelsat Stock in the US

Title: Percentage of US Citizens Who Own Stock

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- stocks to buy now"

- US Stock Exchange Symbols Ending with X: A Com"

- AMD Stock: The US Dollar Connection"

- US Stock Market on April 11, 2025: A Comprehen"

- Title: Us Expat Stock Trader Accounts: A Compr"

- Mo Us Stock Price: What You Need to Know About"

- DeepSeek US Stock: Unveiling the Potential of "

- Title: Stock Market Regulation in the US: Navi"

- swing trading strategies"

- US Stock Calculator: A Comprehensive Guide to "