you position:Home > aphria us stock > aphria us stock

US Large Cap Stocks 21 Day ROC: A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the realm of stock analysis, the 21-day Rate of Change (ROC) is a popular indicator used by investors to gauge the momentum of large cap stocks. This article delves into the significance of the 21-day ROC for U.S. large cap stocks, providing insights into how it can be effectively utilized in investment strategies.

Understanding the 21-Day ROC

The 21-day ROC is a momentum indicator that measures the percentage change in a stock's price over a 21-day period. It is calculated by taking the difference between the current price and the price 21 days ago, dividing it by the price 21 days ago, and then multiplying by 100 to get a percentage. A positive ROC indicates that the stock is gaining momentum, while a negative ROC suggests that the stock is losing momentum.

Why Focus on U.S. Large Cap Stocks?

U.S. large cap stocks are typically shares of companies with a market capitalization of over $10 billion. These companies are often considered to be more stable and less volatile than their smaller counterparts. By focusing on large cap stocks, investors can benefit from the stability and potential growth offered by these well-established companies.

The Role of ROC in Investment Strategies

The 21-day ROC can be a valuable tool for investors looking to identify potential buying or selling opportunities. Here’s how it can be utilized:

- Identifying Trends: A rising ROC indicates that the stock is gaining momentum and may be a good buy. Conversely, a falling ROC suggests that the stock is losing momentum and may be a good sell.

- Timing Entries and Exits: By monitoring the ROC, investors can time their entries and exits more effectively. For example, a buy signal may be generated when the ROC crosses above a certain threshold, indicating that the stock is gaining momentum.

- Risk Management: The ROC can also be used to manage risk. For instance, if the ROC falls below a certain level, it may be a sign to reduce exposure to the stock.

Case Studies

Let’s look at a couple of case studies to illustrate the use of the 21-day ROC:

- Apple Inc. (AAPL): In early 2021, Apple’s 21-day ROC was on the rise, indicating strong momentum. Investors who bought the stock at that time would have seen significant gains over the following months.

- Microsoft Corporation (MSFT): In late 2020, Microsoft’s 21-day ROC began to fall, suggesting that the stock was losing momentum. Investors who sold the stock at that time would have avoided potential losses.

Conclusion

The 21-day ROC is a powerful tool for analyzing the momentum of U.S. large cap stocks. By understanding how to use this indicator, investors can make more informed decisions and potentially improve their investment returns. However, it’s important to remember that the ROC is just one of many indicators available and should be used in conjunction with other analysis tools and strategies.

so cool! ()

last:"Kar Us Equity Stock": A Comprehensive Analysis

next:nothing

like

- "Kar Us Equity Stock": A Comprehensive Analysis

- Trading US Stocks in Canada: Understanding the Taxes Involved

- Toys 'R' Us Overnight Shelf Stocker: A Rewarding Career in Retail&q

- High Volatility US Stocks to Watch in August 2025

- Stay Away from Us Stocks: Why You Should Diversify Your Portfolio

- European Stocks Outperforming US Stocks Amid Economic Challenges

- Hexo US Stock: A Comprehensive Guide to Investing in Hexo Technology Corporation

- In-Depth Analysis of Pura.pk: A Stock to Watch in the US

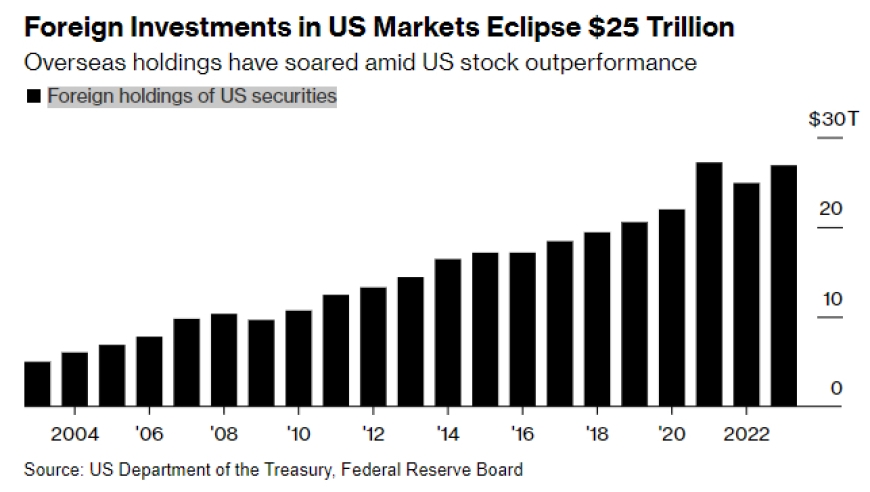

- Foreign Money Invested in the US Stock Market: A Comprehensive Overview

- Discover the Power of US Marine Corps Stock Video: Unleash the Visual Impact

- US Defensive Stocks: A Safe Haven in Volatile Markets

- Buy Us Stocks in TFSA: Maximize Your Retirement Savings"

recommend

US Large Cap Stocks 21 Day ROC: A Comprehensiv

US Large Cap Stocks 21 Day ROC: A Comprehensiv

Enbridge US Stock Price: Current Trends and Fu

BridgeBio Pharma: A Rising Star in US Biotech

Can a US Person Buy CGGC Stock? A Comprehensiv

Top US Pot Stocks 2021: A Comprehensive Guide

Title: Stock Market Regulation in the US: Navi

Stocks More Than $1000: The High-End Investmen

Mid Cap US Stocks Growth: A Strategic Investme

US Large Cap Stocks Momentum Leaders: Unveilin

US Stock Buy from India: A Strategic Investmen

Trading US Stocks in Canada: Understanding the

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Top Performing Stocks in the US Market July 20"

- How to Enter the US Stock Market"

- Title: List of Foreign Stocks Traded in the US"

- Top US Large Cap Stocks Momentum: A 5-Day Anal"

- US Marijuana Stock: The Future of Legal Cannab"

- Best Penny Stocks in the US: Top Picks for 202"

- Total Return of the US Stock Market: A Compreh"

- Top Performing US Stocks Last 5 Days: October "

- Understanding Today's PE Ratio in the US "

- Best Summer Stock Theatres in the US: A Showca"