you position:Home > aphria us stock > aphria us stock

High Volatility US Stocks to Watch in August 2025

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the ever-changing landscape of the stock market, volatility can be both a friend and a foe. As we approach August 2025, investors are keeping a close eye on high-volatility US stocks. These stocks tend to experience significant price fluctuations, which can offer both substantial gains and substantial losses. In this article, we'll explore some of the high-volatility US stocks that are making waves in August 2025 and what factors might be driving their volatility.

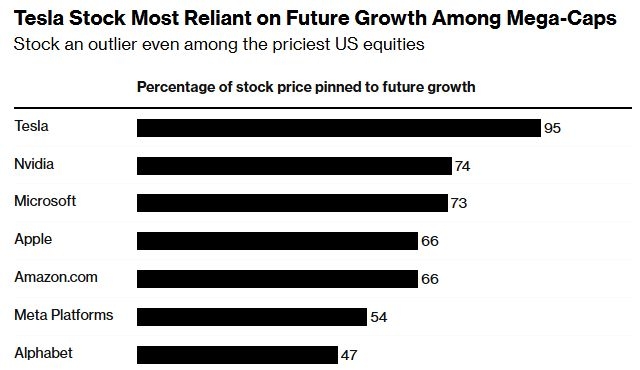

Tesla (TSLA)

Tesla, the electric vehicle (EV) giant, has long been a symbol of high volatility. As the world transitions to sustainable energy, Tesla's stock has seen dramatic swings. In August 2025, investors are closely watching Tesla's expansion into new markets, such as China and Europe, as well as its ongoing production challenges. With the potential for significant growth, Tesla remains a high-volatility stock to watch.

NVIDIA (NVDA)

NVIDIA, a leader in the semiconductor industry, has experienced a rollercoaster ride in recent years. The company's stock has soared on the back of strong demand for its graphics processing units (GPUs) and data center products. However, with the rise of competition and concerns about market saturation, NVIDIA's stock could see increased volatility in August 2025. Investors are keeping a close eye on the company's new product launches and partnerships to gauge its future prospects.

Amazon (AMZN)

Amazon, the e-commerce behemoth, has been a driving force behind the high-volatility US stocks trend. With its vast product offerings and global reach, Amazon's stock has seen significant price swings. In August 2025, investors are focusing on Amazon's efforts to diversify its revenue streams, including its cloud computing arm, Amazon Web Services (AWS). As the company continues to innovate and expand, its stock could experience further volatility.

Berkshire Hathaway (BRK.B)

Berkshire Hathaway, the investment conglomerate led by Warren Buffett, has always been a high-volatility stock. With Buffett's unique investing style and the company's diverse portfolio, investors are constantly analyzing its performance. In August 2025, investors are keeping an eye on Berkshire Hathaway's investment decisions and the potential impact of the global economic landscape on its stock.

Case Study: Twitter (TWTR)

Twitter, the social media platform, has experienced significant volatility in recent years. In August 2025, the company's stock is under scrutiny following a major acquisition and a series of strategic shifts. Investors are closely monitoring Twitter's user growth, revenue streams, and its ability to compete with other social media giants like Facebook and Instagram.

In conclusion, high-volatility US stocks can offer significant opportunities for investors willing to take on the risk. As we approach August 2025, companies like Tesla, NVIDIA, Amazon, Berkshire Hathaway, and Twitter are at the forefront of this trend. By understanding the factors driving their volatility and staying informed, investors can make informed decisions and potentially capitalize on these high-volatility stocks.

so cool! ()

last:Stay Away from Us Stocks: Why You Should Diversify Your Portfolio

next:nothing

like

- Stay Away from Us Stocks: Why You Should Diversify Your Portfolio

- European Stocks Outperforming US Stocks Amid Economic Challenges

- Hexo US Stock: A Comprehensive Guide to Investing in Hexo Technology Corporation

- In-Depth Analysis of Pura.pk: A Stock to Watch in the US

- Foreign Money Invested in the US Stock Market: A Comprehensive Overview

- Discover the Power of US Marine Corps Stock Video: Unleash the Visual Impact

- US Defensive Stocks: A Safe Haven in Volatile Markets

- Buy Us Stocks in TFSA: Maximize Your Retirement Savings"

- Dodge & Cox US Stock Acc GBP: A Comprehensive Analysis

- Can You Buy LG Chem Stock in the US? A Comprehensive Guide

- US Space Force Stock: A Comprehensive Guide to Investing in the Future of Space

- Stock Market Close Today: US Market Review"

recommend

High Volatility US Stocks to Watch in August 2

High Volatility US Stocks to Watch in August 2

Title: US Overseas Stock Fund: A Strategic Inv

Top US Drone Companies Stock: A Comprehensive

US Stock Exchange Public Holidays 2015: A Comp

Jeffrey Gundlach Says US Stocks Will Get Evisc

Fastest Growing US Stocks to Watch in 2025: A

US Government Buys Stocks: What You Need to Kn

Shell US Stock Price: A Comprehensive Analysis

Are U.S. Stock Markets Open on Election Day?

Top US Medical Companies Stock Starting with S

Unlocking the Power of US Dow Stocks: Your Ult

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- International Stock US Warranty: A Comprehensi"

- US Gov Stock Market Graph: A Comprehensive Ana"

- Day Trading U.S. Stocks from India: A Comprehe"

- Takeda Pharmaceuticals Stock US: A Comprehensi"

- The Effect of U.S. Elections on the Stock Mark"

- US Lumber Companies Stock: A Comprehensive Ana"

- Title: In-Depth Analysis of CLF Stock: The Fut"

- Total Number of US Stocks: Unveiling the Bread"

- Key Market Trends and Risks in the US Stock Ma"

- Boeing Stock Price: Current Trends and Future "