you position:Home > aphria us stock > aphria us stock

US Healthcare Stocks: Bigger Forces Than Politics at Play

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In the ever-evolving landscape of the American healthcare industry, the influence of politics often takes center stage. However, it's crucial to recognize that US healthcare stocks are influenced by a myriad of factors, many of which transcend political considerations. This article delves into the key forces shaping the healthcare sector, emphasizing that politics is just one of many elements at play.

Economic Factors: The Driving Force

Economic factors play a pivotal role in the healthcare industry. The rising cost of healthcare services, coupled with increasing demand, creates a fertile ground for growth in the healthcare sector. According to a report by the Centers for Medicare & Medicaid Services, healthcare spending in the United States is projected to reach $6.4 trillion by 2028. This surge in spending is expected to drive investment in healthcare stocks, making it a lucrative sector for investors.

Technological Advancements: A Game-Changer

Technological advancements have revolutionized the healthcare industry, leading to improved patient care and increased efficiency. Innovations such as telemedicine, electronic health records, and artificial intelligence have the potential to transform the way healthcare is delivered. Companies at the forefront of these technological advancements are poised to benefit significantly, making them attractive investments for healthcare stocks.

Regulatory Changes: A Double-Edged Sword

Regulatory changes can have a profound impact on the healthcare industry. While some changes may create favorable conditions for growth, others can pose significant challenges. For instance, the implementation of the Affordable Care Act (ACA) has expanded healthcare coverage to millions of Americans, leading to increased demand for healthcare services. However, the ACA has also faced criticism and potential changes, which could impact healthcare stocks.

Pharmaceutical Industry: A Key Player

The pharmaceutical industry is a crucial component of the healthcare sector. The development of new drugs and treatments has the potential to revolutionize patient care and generate substantial revenue for pharmaceutical companies. However, the industry is also subject to regulatory scrutiny and patent expirations, which can impact the financial performance of healthcare stocks.

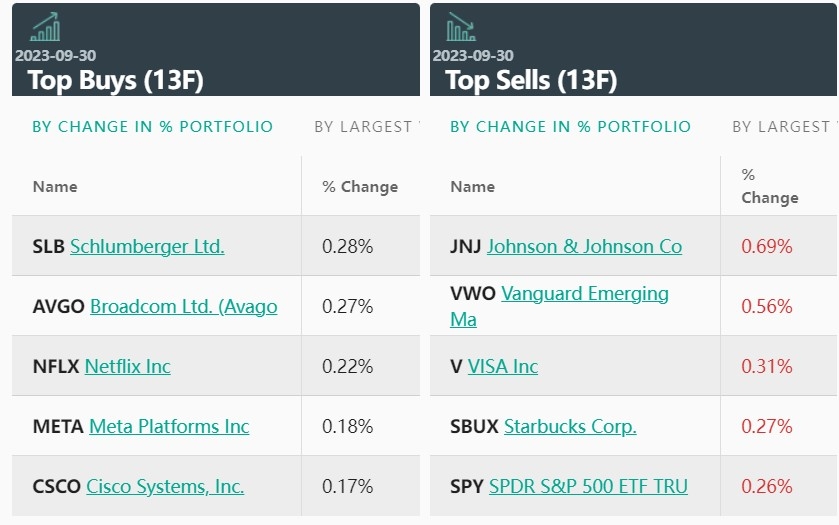

Case Study: Johnson & Johnson

A prime example of a company influenced by these various forces is Johnson & Johnson. The company has a diverse portfolio of healthcare products and services, including pharmaceuticals, medical devices, and consumer healthcare products. While political factors, such as the debate over healthcare reform, have impacted the company's stock, it is the company's ability to adapt to economic, technological, and regulatory changes that has driven its long-term success.

Conclusion

In conclusion, while politics undoubtedly plays a role in shaping the healthcare industry, it is far from the only factor influencing US healthcare stocks. Economic factors, technological advancements, regulatory changes, and the pharmaceutical industry all contribute to the dynamic landscape of the healthcare sector. By understanding these various forces, investors can make informed decisions and identify opportunities for growth in the healthcare market.

so cool! ()

like

- GMO Stock US: A Comprehensive Guide to Investing in Genetically Modified Organism

- 5 Elite US Stocks to Explode in 2018: Louis Navellier's Predictions

- US-Based Pot Stock: The Rise of Legal Cannabis Investments

- US Navy Vietnam Veteran Stocking Hats: A Tribute to Heroism

- Samsung Electronics Stock Purchase in the US: A Strategic Move for Investors

- Bristol Myers Squibb: A Leading Player in US Biotech Stocks

- Barclays Strategists Believe US Stocks Are Overpriced vs. Europe

- Stock X Contact Us Page: Your Gateway to Seamless Engagement"

- Is the US Stock Market Open Easter Monday? A Comprehensive Guide

- AI Biotech Stocks: The Future of Innovation in the US

- Stocks More Than $1000: The High-End Investment Game

- Safe US Stocks: Your Guide to Secure Investments

recommend

US Healthcare Stocks: Bigger Forces Than Polit

US Healthcare Stocks: Bigger Forces Than Polit

Dow Jones US Completion Total Stock Market Ind

1994 Pro Stock Car Vets Are Us: Frankie Sanche

Momentum Stocks: Driving the US Market to New

Title: US Blue Chip Stocks: The Ultimate Guide

Analyst Recommendations: US Stocks Short-Term

KFC Stock Price US: What You Need to Know

Best 5G Stocks in US: Your Guide to Investment

lng us stocks: The Growing Market for Natural

US Steel Stock on NASDAQ: A Comprehensive Guid

US ACB Stock: Safe Investment or Risky Venture

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- home depot dividend"

- Top Trending US Stocks Today: A Comprehensive "

- Hatchimals Toys R Us Stock: A Comprehensive Gu"

- stock chart patterns"

- costco dividend"

- US Cellular Stock Drop: What You Need to Know"

- tech stocks to buy"

- Confidence Flight Indicators: How to Navigate "

- Fidelity US Focus Stock: A Strategic Investmen"

- convertible bond"