you position:Home > aphria us stock > aphria us stock

US-Based Pot Stock: The Rise of Legal Cannabis Investments

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In recent years, the cannabis industry has experienced a remarkable transformation, with the legalization of marijuana in various states across the United States. This shift has opened up a new wave of investment opportunities, particularly in the realm of US-based pot stocks. This article delves into the growing potential of these companies and explores why investors should consider adding them to their portfolios.

Understanding US-Based Pot Stocks

What Are US-Based Pot Stocks?

US-based pot stocks refer to publicly traded companies that operate within the legal cannabis industry. These companies range from those that grow and sell marijuana to those that provide ancillary services, such as packaging, testing, and consulting. With the increasing acceptance of cannabis across the nation, these stocks have become a hot topic among investors looking for high-growth opportunities.

The Legalization Landscape

The legalization of cannabis has been a significant driver of growth for US-based pot stocks. As of now, 18 states have fully legalized recreational cannabis, while 35 states have approved medical marijuana. This expanding market has created a fertile ground for businesses to thrive and has sparked a surge in investment interest.

The Potential of US-Based Pot Stocks

High Growth Potential

One of the primary reasons investors are attracted to US-based pot stocks is their high growth potential. The cannabis industry is expected to reach $30 billion by 2025, with a significant portion of this market being in the United States. Companies that can effectively navigate the regulatory landscape and capture market share will likely see substantial returns on investment.

Diversification Opportunities

Investing in US-based pot stocks offers diversification opportunities for investors. While traditional markets may be volatile, the cannabis industry presents a unique opportunity to invest in a rapidly growing sector. This diversification can help mitigate risks in a portfolio.

Case Studies: Successful US-Based Pot Stocks

Several US-based pot stocks have already demonstrated their potential for success. One such example is Canopy Growth Corporation (TSX: WEED) (NYSE: CGC), a leading cannabis producer and distributor. The company has seen significant growth, with its market capitalization reaching over $10 billion.

Another notable company is Aurora Cannabis Inc. (TSX: ACB) (NYSE: ACB), which has expanded its operations globally and has a strong focus on innovation. The company has also seen substantial growth, with its market capitalization surpassing $5 billion.

Investment Risks

While US-based pot stocks offer high growth potential, they also come with their share of risks. These risks include regulatory uncertainty, competition, and the potential for market saturation. Investors should conduct thorough research and consider these risks before investing.

Conclusion

The rise of US-based pot stocks presents a compelling investment opportunity for those willing to navigate the complexities of the cannabis industry. With the growing acceptance of marijuana and the high growth potential, these stocks could be a valuable addition to any investment portfolio. However, as with any investment, it's crucial to do your due diligence and understand the risks involved.

so cool! ()

last:US Navy Vietnam Veteran Stocking Hats: A Tribute to Heroism

next:nothing

like

- US Navy Vietnam Veteran Stocking Hats: A Tribute to Heroism

- Samsung Electronics Stock Purchase in the US: A Strategic Move for Investors

- Bristol Myers Squibb: A Leading Player in US Biotech Stocks

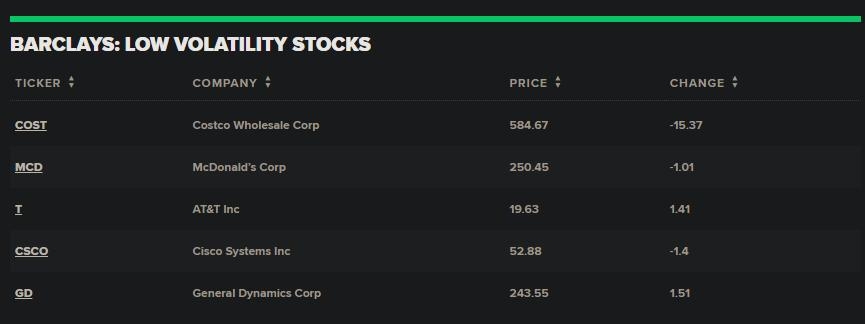

- Barclays Strategists Believe US Stocks Are Overpriced vs. Europe

- Stock X Contact Us Page: Your Gateway to Seamless Engagement"

- Is the US Stock Market Open Easter Monday? A Comprehensive Guide

- AI Biotech Stocks: The Future of Innovation in the US

- Stocks More Than $1000: The High-End Investment Game

- Safe US Stocks: Your Guide to Secure Investments

- 3 Major Stock Markets in the US: Understanding Their Impact and Influence

- US Stock Market 2020: A Comprehensive Chart Analysis

- Best Performing US Stocks in October 2024: Top 5 Stocks to Watch"

recommend

US-Based Pot Stock: The Rise of Legal Cannabis

US-Based Pot Stock: The Rise of Legal Cannabis

Top 10 in US Stocks Market Review

Apple Stock: A Deep Dive into the US News Pers

Cannabis Stocks Headquartered in the US: The G

Indian Brokers for US Stocks: How to Invest in

Title: Tax Treaty US and Canada Common Stock:

US ACB Stock: Safe Investment or Risky Venture

Title: "http stocks.us.reuters.com st

Title: US Dollar to Yen Stock Symbol: Understa

Title: Toshiba US Stock: A Comprehensive Overv

Understanding the US Precious Metals Inc Stock

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Loc 94 Silk Stocking Lane Akron, AL, US: A Pri"

- nvda price target"

- Syngenta US Stock Price: A Comprehensive Analy"

- Toys "R" Us Seasonal Off-Hou"

- Trading Platform US Stocks: Your Gateway to th"

- Average Annual Stock Market Return in the US: "

- Oversold Us Stocks: Understanding the Implicat"

- target date fund"

- Niu US Stock: A Comprehensive Guide to Investi"

- Battery Stocks US: A Comprehensive Guide to In"