you position:Home > aphria us stock > aphria us stock

US Bank Stock: A NASDAQ Analysis

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

Are you looking to invest in the financial sector? If so, you might want to consider US Bank, a company listed on the NASDAQ. This article delves into the stock performance of US Bank on the NASDAQ, providing investors with valuable insights into its market trends and potential growth opportunities.

Understanding US Bank's Stock Performance on NASDAQ

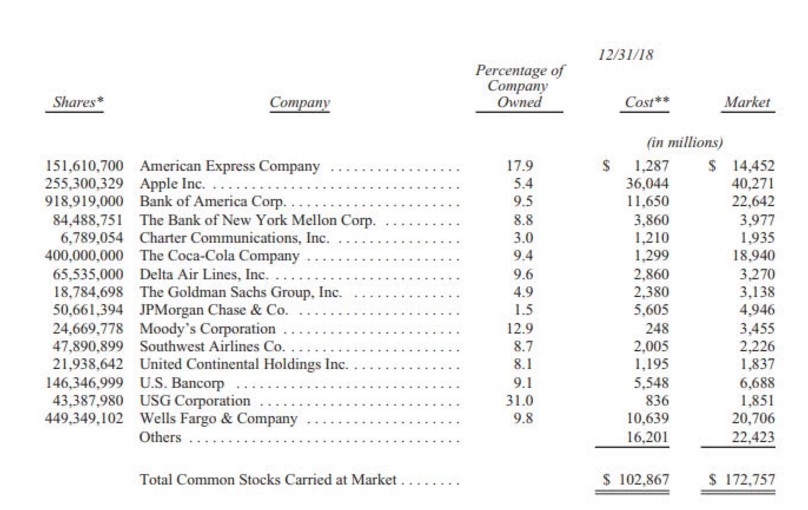

US Bank, also known as U.S. Bancorp, is a financial services company that offers a range of banking and financial services to individuals, businesses, and institutional clients. The company is listed on the NASDAQ under the ticker symbol USB. Analyzing its stock performance on the NASDAQ can help investors make informed decisions about their investments.

Market Trends and Historical Data

Over the years, US Bank's stock has shown significant growth on the NASDAQ. From its initial public offering (IPO) in 1984, the stock has consistently outperformed the market. As of the latest data, USB has a market capitalization of over $300 billion, making it one of the largest financial institutions in the United States.

Key Factors Influencing US Bank's Stock Performance

Several factors have influenced US Bank's stock performance on the NASDAQ. These include:

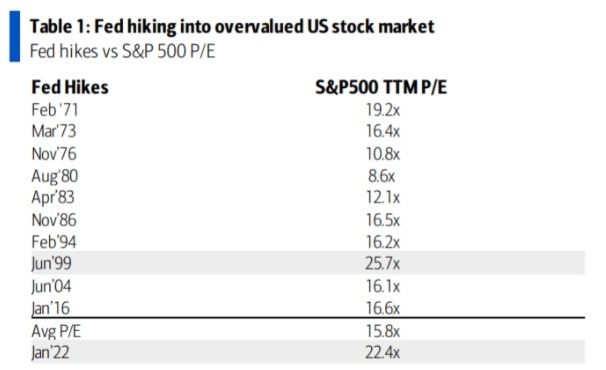

- Economic Conditions: Economic downturns can negatively impact the financial sector, but US Bank has demonstrated resilience in times of economic uncertainty.

- Interest Rates: Changes in interest rates can significantly impact the profitability of financial institutions. US Bank has managed to navigate these changes effectively.

- Regulatory Environment: The regulatory landscape in the financial sector can affect the operations of banks. US Bank has a strong compliance record, which has helped it maintain a stable stock performance.

Recent Stock Performance Analysis

In the recent past, US Bank's stock has shown a strong upward trend on the NASDAQ. This can be attributed to several factors, including:

- Improved Profitability: The company has reported consistent profitability, driven by strong revenue growth and cost management.

- Diversified Business Model: US Bank offers a wide range of financial products and services, which helps mitigate risks associated with any single market segment.

- Effective Risk Management: The company has a robust risk management framework, which has helped it maintain a stable stock performance.

Case Study: US Bank's Acquisition of First National Bank of Omaha

One notable example of US Bank's strategic growth is its acquisition of First National Bank of Omaha in 2019. This acquisition helped US Bank expand its footprint in the retail banking sector and diversify its revenue streams. As a result, the stock has shown significant growth since the acquisition.

Conclusion

In conclusion, US Bank's stock has shown impressive performance on the NASDAQ, driven by its strong financial performance, diversified business model, and effective risk management. Investors looking to invest in the financial sector should consider US Bank as a solid investment opportunity. As always, it is important to conduct thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

like

- Stratos Stock US Firmware 2.3.2.7.zip: The Ultimate Guide to Updating Your Device

- Discover the Power of Global Stock Insights at https://tw.stock.yahoo.com/us/&

- How to Buy OTC Stocks in the US: A Comprehensive Guide

- Financial Times US Stock Market Analysis: August 9, 2017

- Understanding Taxes on US Stocks: What You Need to Know

- Live Us Stock Market Index: Bitcoin's Rising Influence

- Spotify Stock Price: A Comprehensive Look at US Market Dynamics

- Best App for US Stock Investment: Your Ultimate Guide

- Title: In-Depth Analysis of KEM Stock: Everything You Need to Know

- How to Pay for US Stock Tax in Ukraine: A Comprehensive Guide"

- US Steel Stock Price: A Comprehensive Yahoo Finance Analysis

- Largest US Stock Exchange Companies: Powerhouses of the Financial World

recommend

US Bank Stock: A NASDAQ Analysis

US Bank Stock: A NASDAQ Analysis

Best Momentum Stocks in the US Market: Top Per

Understanding the Dynamics of Listed Stocks in

Description of the US Stock Market in 1929: Th

US Companies Listed on Toronto Stock Exchange:

DeepSeek US Stock: Unveiling the Potential of

Ecobalt Stock: A Game-Changer in the Battery I

US Stock Listed Companies: A Comprehensive Gui

Dates of US Stock Market Crashes: A Timeline o

Is Vested Good for Us Stocks?

Joint Stock Company US: Understanding the Dyna

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- Best App to Invest in US Stocks from India: Yo"

- President Trump's Tariff Announcements Ca"

- Tax on Stock Exchange Transactions in the US: "

- How to Invest in the US Stock Market for Begin"

- US Hot Momentum Stocks: The Rising Stars of th"

- Us Long Term Capital Gains Tax Stocks: Unlocki"

- convertible bond"

- best growth stocks"

- pharma stocks"

- Multibagger Stocks US Paid: How to Identify an"