you position:Home > aphria us stock > aphria us stock

Trade U.S. Stocks from Singapore: A Comprehensive Guide

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

In the world of global investment, trading U.S. stocks from Singapore has become increasingly popular. With its strategic location, robust financial sector, and favorable regulations, Singapore offers investors a gateway to access a wide array of American equities. This article will explore the process of trading U.S. stocks from Singapore, including the benefits, steps, and key considerations.

Why Trade U.S. Stocks from Singapore?

Strategic Location and Time Zone Advantage: Singapore's geographical location places it in the ideal time zone for trading U.S. stocks. The country's proximity to Asia allows investors to capitalize on the American stock market while also participating in the Asian markets, enhancing their overall investment potential.

Robust Financial Sector: Singapore boasts a strong financial sector, making it an attractive hub for international investors. The country's regulatory framework is transparent, secure, and conducive to investment, further bolstering its reputation as a global financial center.

Diversification: Investing in U.S. stocks from Singapore provides investors with a unique opportunity to diversify their portfolios. By accessing American equities, investors can mitigate risks associated with local market fluctuations and benefit from the growth potential of one of the world's largest economies.

How to Trade U.S. Stocks from Singapore:

1. Choose a Broker: The first step in trading U.S. stocks from Singapore is to select a reputable brokerage firm. Many brokerage firms offer services that cater specifically to international investors, making the process straightforward and convenient.

2. Open a Brokerage Account: Once you have chosen a brokerage firm, you will need to open a brokerage account. This process typically involves completing an application, providing identification documents, and verifying your identity.

3. Fund Your Account: After opening your brokerage account, you will need to fund it with the desired amount of capital. Most brokerage firms offer various funding methods, including bank transfers and credit/debit cards.

4. Conduct Research: Before placing any trades, it is crucial to conduct thorough research on the U.S. stocks you are interested in. This includes analyzing financial statements, studying market trends, and understanding the company's business model.

5. Place Your Trade: Once you have completed your research, you can place your trade through your brokerage platform. Ensure that you are aware of the fees associated with trading U.S. stocks, as these can vary between brokers.

Key Considerations:

Regulatory Compliance: It is essential to ensure that you are compliant with Singapore's regulatory requirements when trading U.S. stocks. This includes understanding the tax implications and reporting obligations.

Currency Conversion:

Transaction Costs: Be mindful of the transaction costs associated with trading U.S. stocks, such as brokerage fees, stamp duty, and exchange fees. These costs can vary significantly between brokers and may affect your overall returns.

Case Study:

Let's consider an example of a Singaporean investor, John, who is looking to diversify his portfolio by investing in U.S. stocks. After researching and comparing different brokerage firms, John chooses to open an account with a reputable online broker that offers competitive fees and a user-friendly platform.

John funds his account and begins conducting research on U.S. stocks he is interested in. He decides to invest in a well-known technology company, Apple Inc. (AAPL), based on his analysis of the company's financial statements and market trends.

After placing his trade, John monitors his investment and adjusts his portfolio as needed. By trading U.S. stocks from Singapore, John has successfully diversified his portfolio and capitalized on the growth potential of one of the world's leading technology companies.

In conclusion, trading U.S. stocks from Singapore offers investors a unique opportunity to diversify their portfolios and capitalize on the growth potential of American equities. By following the outlined steps and considering key factors, investors can navigate the process effectively and achieve their investment goals.

so cool! ()

like

- Microsoft Stock US: A Comprehensive Analysis of the Tech Giant's Market Perf

- Maximizing Returns: A Deep Dive into US Dairy Stocks"

- Shell US Stock Price: A Comprehensive Analysis

- Us Gun Inletting and Stocks: The Ultimate Guide to Precision and Comfort"

- Historic Impact of U.S. Presidential Elections on the Stock Market

- Toys "R" Us Rewards & Nintendo Switch Stock Alert: Don&

- Is the US Stock Market Open on December 31st? What You Need to Know"

- 2025 US Stock Recommendations: A Comprehensive Guide for May 2025

- Four US Senators Sold Stock Amidst Controversy: What You Need to Know

- Manulife US Stock Price: Key Insights and Analysis"

- LED 50000LM Cycling Bicycle Bike Front Headlight Lamp: US Stock Available

- Understanding the Tax Implications for U.S. Citizens Buying Canadian Stocks on th

recommend

Trade U.S. Stocks from Singapore: A Comprehens

Trade U.S. Stocks from Singapore: A Comprehens

Tax on Stock Exchange Transactions in the US:

US Stock Losers: Understanding the Factors Beh

Buffet Dumps Us Stocks: What It Means and How

In-Depth Analysis of US Pacific Marine Mammal

Jeffrey Gundlach Says US Stocks Will Get Evisc

Title: US International Stock Index: A Compreh

Toy R Us Stocks: A Comprehensive Analysis of t

Chinese Stock Market Crash: Its Effect on the

Best Dividend US Stock: How to Identify the Be

Stock Market Holidays 2019: A Comprehensive Gu

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- Title: Stock Market Under US Presidents: A Com"

- Understanding US Stock Asset Allocation: A Com"

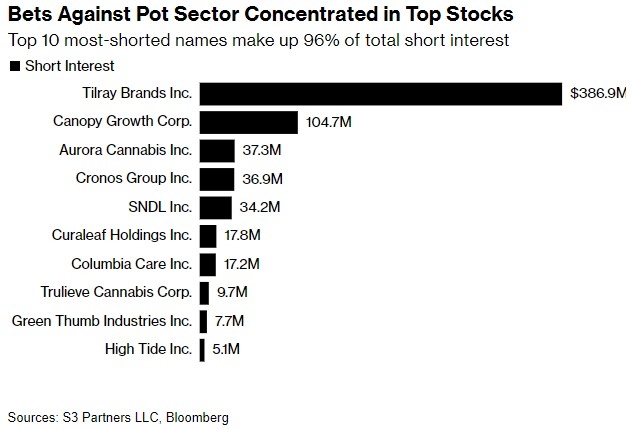

- short interest"

- Top Momentum Stocks: Large Cap US September 20"

- Total Return of the US Stock Market: A Compreh"

- Magnificent Seven US Stocks to Watch in 2023"

- Best US Telecom Stocks: Top Investments for 20"

- commodity etf"

- Understanding the Daily Dollar Value of Traded"

- Title: Momentum Stocks: US Market Top Performe"