you position:Home > aphria us stock > aphria us stock

The Average Time a US Stock is Held: Insights and Trends

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In the ever-evolving world of investing, understanding the average time a US stock is held is crucial for both beginners and seasoned investors. This metric can provide valuable insights into market behavior and investor psychology. In this article, we will delve into the factors influencing this duration, the recent trends, and their implications for investors.

Understanding Stock Holding Periods

The average time a US stock is held refers to the length of time an investor keeps a stock before selling it. This period can vary widely, depending on the investor's strategy, market conditions, and the specific stock in question.

Factors Influencing Stock Holding Periods

Investor Strategy: Investors may hold stocks for short-term gains, medium-term growth, or long-term stability. Short-term traders might hold stocks for days or weeks, while long-term investors could hold them for years or even decades.

Market Conditions: During bull markets, investors tend to hold stocks longer, as prices appreciate. Conversely, during bear markets, investors may become more risk-averse and sell their stocks more frequently.

Sector and Stock Characteristics: Certain sectors or stocks may inherently have longer holding periods due to their stability and growth potential, while others may be more volatile and require frequent trading.

Recent Trends in Stock Holding Periods

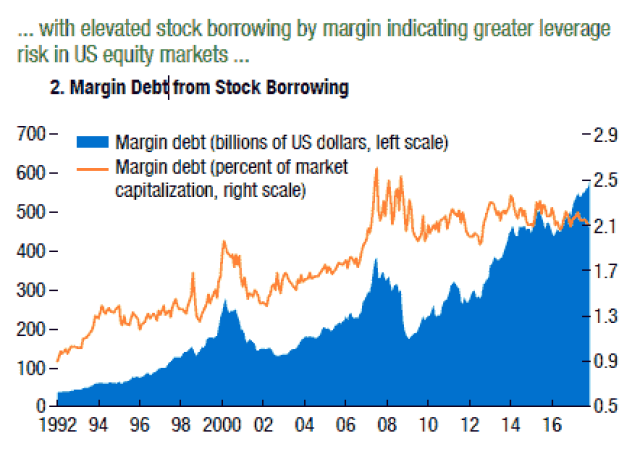

Over the past few decades, the average holding period for US stocks has significantly decreased. According to a study by J.P. Morgan, the average holding period for stocks has shrunk from 8.6 years in the 1960s to just 5.1 years in the 2010s. This trend can be attributed to several factors:

Technological Advancements: The rise of online trading platforms and mobile applications has made it easier for investors to trade frequently and quickly.

Hedge Funds and High-Frequency Trading: The influence of hedge funds and high-frequency traders has increased, leading to more short-term trading activities.

Investor Psychology: With the increasing availability of investment information and tools, investors are more likely to make impulsive decisions based on short-term market movements.

Implications for Investors

Understanding the average time a US stock is held can help investors make more informed decisions:

Risk Management: Investors should be aware of their risk tolerance and investment horizon. Short-term traders may need to manage risks more frequently, while long-term investors can focus on long-term growth potential.

Market Trends: By analyzing the average holding period, investors can gain insights into market trends and investor psychology.

Diversification: Diversifying investments across various holding periods can help mitigate risks and maximize returns.

Case Study: Apple Inc.

To illustrate the impact of stock holding periods, let's consider Apple Inc. (AAPL). Over the past decade, Apple's stock has experienced both strong growth and volatility. Investors who held the stock for the long term have seen significant gains, while those who traded frequently may have missed out on some of the ups and downs.

In conclusion, understanding the average time a US stock is held can provide valuable insights into market behavior and investor psychology. By analyzing the factors influencing stock holding periods and recent trends, investors can make more informed decisions and manage their investments more effectively.

so cool! ()

like

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol cmi.p

- Momentum Stocks: Best Performing US Large Caps

- Top Momentum Stocks This Week: US Markets in Focus

- blk us stock: Unveiling the Potential of Blockchain in U.S. Stock Market

- Unlocking Opportunities: The Future of US Railway Stocks

- Stock Today US: Key Insights for Investors in the Current Market

- Top Performing US Stocks: Momentum from the Last 5 Trading Days

- Can US Employees Get Stock in a Foreign Parent Company? A Comprehensive Guide

- Unveiling the Power of US Stock C2P17152: A Comprehensive Guide

- US Crude Oil Price Stock: Key Factors & Investment Insights

- How to Trade US Stocks in the UK: A Comprehensive Guide

- Us Century Bank Stock: A Comprehensive Guide to Investing in the Financial Giant

recommend

The Average Time a US Stock is Held: Insights

The Average Time a US Stock is Held: Insights

Can I Hold Us Stocks in My TFSA? A Comprehensi

Title: US-Japan Stock Trading Jobs: A Lucrativ

Is the US Stock Market Open Today July 12, 202

Tariffs: The Hidden Threat to the US Stock Mar

Infosys in the US Stock Market: A Comprehensiv

Title: List of Foreign Stocks Traded in the US

Cannabis US Stocks: A Comprehensive Guide to I

Inside the Three Major US Stock Exchange Serve

Top US Stocks to Invest in 2018: Your Ultimate

SMIC US Stock: A Comprehensive Guide to Semico

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stock us stocks games silver etf

like

- US Representative Stock Tracker: Your Ultimate"

- Understanding the PTC US Stock Price: A Compre"

- Nasdaq & S&P 500 Market Sell-O"

- Mutual Fund US Health-Care Sector Stock Index:"

- Stock Invest US: Why NVIDIA is a Must-Have in "

- Largest Cap Stocks in the US: Powerhouses That"

- Total US Stock Market Ireland ETF iShares UCIT"

- US Stock Market Outlook for April 30, 2025: Ke"

- US Stock Market August Outlook: What to Expect"

- The Dow Jones Now: Unveiling the Latest Develo"