you position:Home > aphria us stock > aphria us stock

How to Trade US Stocks in the UK: A Comprehensive Guide

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

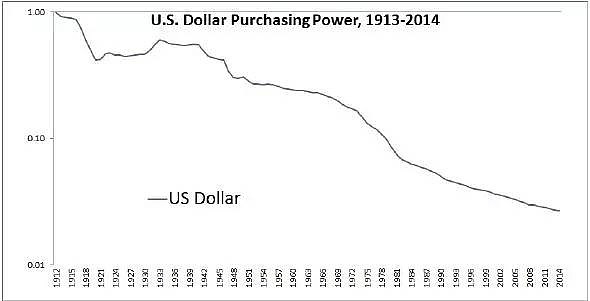

Are you looking to trade US stocks from the comfort of your home in the UK? If so, you're in luck. Trading US stocks has never been easier, especially with the advancements in technology and online trading platforms. In this comprehensive guide, we'll walk you through the steps to get started trading US stocks in the UK. Whether you're a beginner or an experienced trader, this article will provide you with the knowledge and tools you need to succeed.

Understanding the Basics

Before diving into the trading process, it's essential to understand the basics. US stocks represent ownership in a company listed on a US stock exchange, such as the New York Stock Exchange (NYSE) or the Nasdaq. By trading US stocks, you can gain exposure to some of the world's largest and most successful companies.

Choosing a Broker

The first step in trading US stocks in the UK is to choose a reputable online broker. There are many brokers to choose from, so it's important to do your research. Look for brokers that offer competitive fees, reliable customer support, and access to a wide range of US stocks.

Some popular brokers for trading US stocks in the UK include:

- Interactive Brokers

- E*TRADE

- Charles Schwab

- Fidelity

Opening an Account

Once you've chosen a broker, the next step is to open an account. This process is usually straightforward and can be completed online. You'll need to provide some personal information, such as your name, address, and tax identification number.

Funding Your Account

After opening an account, you'll need to fund it with cash. Most brokers offer multiple funding options, including bank transfers, credit/debit cards, and wire transfers. Choose the method that works best for you and ensure that your account is fully funded before placing your first trade.

Placing a Trade

Now that your account is funded, you're ready to place your first trade. Most brokers offer a user-friendly trading platform that allows you to view stock prices, execute trades, and monitor your portfolio. Here's a step-by-step guide to placing a trade:

- Select a Stock: Use the broker's platform to search for a US stock you're interested in.

- Enter the Trade: Enter the number of shares you want to buy or sell, along with the price you're willing to pay.

- Review and Confirm: Double-check your trade details before confirming the transaction.

Understanding Risk Management

Trading stocks carries inherent risks, so it's crucial to understand risk management strategies. Some key risk management techniques include:

- Setting Stop-Loss Orders: This helps limit potential losses by automatically selling a stock if it falls to a certain price.

- Diversifying Your Portfolio: Don't put all your money into a single stock. Diversifying your investments can help reduce risk.

- Staying Informed: Keep up-to-date with market news and company announcements that may affect stock prices.

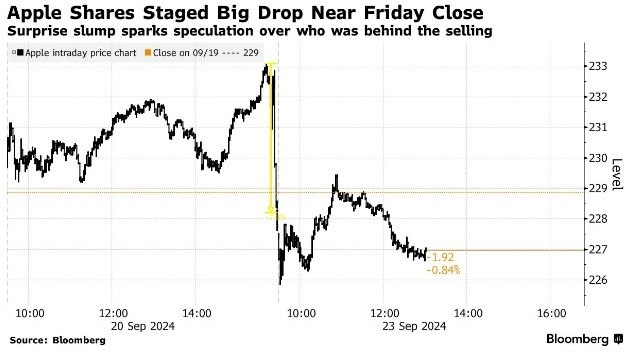

Case Study: Investing in Apple (AAPL)

Let's say you want to invest in Apple Inc. (AAPL). You research the company, analyze its financials, and believe that its stock is undervalued. You decide to buy 100 shares of AAPL at

Conclusion

Trading US stocks in the UK has become increasingly accessible with the right broker and knowledge. By following the steps outlined in this guide, you can start trading US stocks and potentially benefit from the growth of some of the world's largest companies. Remember to always do your research, manage your risk, and stay informed to maximize your chances of success.

so cool! ()

like

- Us Century Bank Stock: A Comprehensive Guide to Investing in the Financial Giant

- Maximize Returns with US Compounding Stocks: Your Ultimate Guide

- LVMH Stock: A Key Player in the US Market

- Rolls-Royce US Stock: A Comprehensive Guide to Investing in Luxury

- It Stocks Us: The Impact of Information Technology on Modern American Life

- US Government Buys Intel Stock: Implications and Analysis

- Unlocking the Potential of AMD US Stock: A Comprehensive Guide

- Canadian Stock Market Price vs US: Unveiling the Differences

- Momentum Stocks: Top Performers in Large Cap US by September 2025

- Unlocking Profits with PLL US Stock: A Comprehensive Guide

- Apple Stock MarketWatch US: Key Insights and Predictions for 2023

- Chinese Companies Listed on US Stock Exchanges: Opportunities and Challenges

recommend

How to Trade US Stocks in the UK: A Comprehens

How to Trade US Stocks in the UK: A Comprehens

US Stock Market: Today's Major Losers Hig

Unlocking the Potential of Us Steel Canada Sto

Ecobalt Stock: A Game-Changer in the Battery I

Penny Stocks News Catalyst: A Game-Changer for

Was the Stock Exchange Open Today? A Comprehen

US Military M14 Fiberglass Stock: A Comprehens

Should You Invest in US Stocks Despite the Wea

Best Momentum Stocks in the US Market: Top 5 P

UK Stock Tax: How It Helps US Companies

Navigating Currency Risk: Investing in Canadia

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stock us stocks games silver etf

like

- US Stock Index History: A Comprehensive Overvi"

- Penny Stocks to Buy in the US Market: Top Pick"

- arm stock"

- Can a US Person Buy CGGC Stock? A Comprehensiv"

- Air Canada US Stock: The Ultimate Guide to Inv"

- Companies with Upcoming Catalysts: US Stocks t"

- Last US Stock to Split: The Big News That'"

- US Stock Low PE Rankings: Identifying Value St"

- What Does NYSE Do: The Comprehensive Guide to "

- Best US Stocks to Watch in 2019: Top Picks for"