you position:Home > aphria us stock > aphria us stock

Stocks in Decline: Navigating the Volatile Market Landscape

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the dynamic world of finance, the term "stocks in decline" is a phrase that often sends shivers down the spines of investors. But what does it truly mean, and how can you navigate the turbulent waters of the stock market? This article delves into the factors contributing to stock declines, provides strategies for managing risks, and examines real-life cases to help you make informed decisions.

Understanding Stock Decline

When we refer to stocks in decline, we are talking about a situation where the value of a particular stock is dropping. This can occur due to various factors, including economic indicators, company performance, industry trends, and geopolitical events. It is essential to understand the underlying causes to effectively navigate this challenging landscape.

Economic Indicators and Stock Declines

Economic indicators such as interest rates, inflation, and unemployment can significantly impact the stock market. For instance, when the Federal Reserve raises interest rates, it becomes more expensive for companies to borrow money, leading to higher costs and reduced profitability. This can result in a decline in stock prices.

Company Performance

Company-specific factors can also lead to stock declines. Poor earnings reports, management changes, or product failures can erode investor confidence and drive down stock prices. It is crucial to closely monitor a company's financial statements and key performance indicators to gauge its health.

Industry Trends

Industry-specific trends can also play a role in stock declines. For instance, technological advancements or regulatory changes can render certain products or services obsolete, leading to a decline in the stock prices of affected companies.

Geopolitical Events

Geopolitical events, such as elections, trade disputes, or geopolitical tensions, can cause uncertainty in the market and lead to stock declines. Investors often react to these events by selling off stocks, driving down prices.

Navigating Risks and Opportunities

To navigate the challenges posed by stocks in decline, it is crucial to adopt a well-diversified investment strategy. Here are some key strategies to consider:

- Diversification: Investing in a diversified portfolio can help reduce risk by spreading your investments across various sectors, industries, and asset classes.

- Long-term Investing: Focusing on long-term investments can help mitigate the volatility associated with short-term market fluctuations.

- Regular Portfolio Reviews: Regularly reviewing your portfolio can help you stay informed about market trends and make necessary adjustments.

- Staying Informed: Keeping abreast of economic indicators, company news, and industry trends is crucial for making informed investment decisions.

Real-Life Cases

To illustrate the impact of stock declines, let's examine a couple of real-life cases:

- 2008 Financial Crisis: The 2008 financial crisis serves as a prime example of how geopolitical events and economic indicators can lead to widespread stock declines. Many investors suffered significant losses during this period.

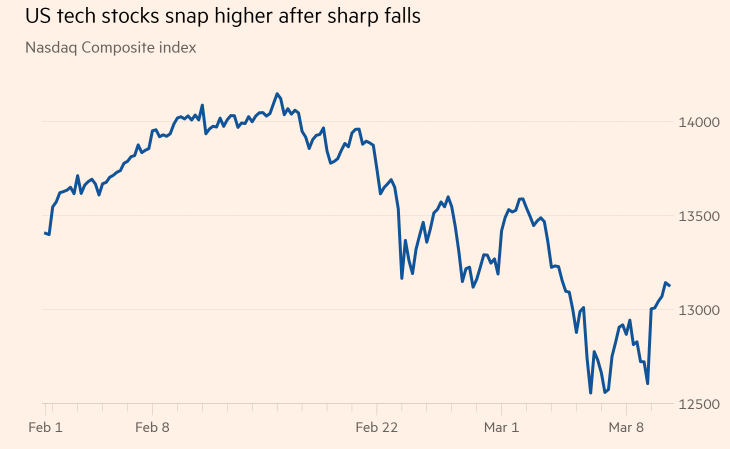

- Tech Stock Decline in 2021: The decline of tech stocks in 2021 can be attributed to regulatory changes and increased interest rates. Investors who remained diversified and focused on long-term investing were better equipped to navigate this decline.

In conclusion, navigating the volatile market landscape when stocks are in decline requires a well-diversified investment strategy, a long-term perspective, and staying informed about market trends. By understanding the underlying causes of stock declines and adopting appropriate strategies, investors can better protect their investments and position themselves for future growth.

so cool! ()

like

- Yahoo Finance News Live: Your Ultimate Resource for Real-Time Stock Market Update

- Why Is the Market So Bad? A Deep Dive into Current Market Trends and Solutions

- US Stock Market Outlook for April 30, 2025: Key Trends and Predictions

- SlickCharts SP500: Unveiling the Power of Data Visualization

- Stocks Back Up: A Comprehensive Guide to the Market Recovery

- Stock Market News Today: Key Updates and Analysis

- What Is Dow NASDAQ: A Comprehensive Guide

- Best Stocks in the US Market for Long-Term Investment

- Samsung Note 5 US Cellular Stock ROM: A Comprehensive Guide

- US Concrete Stock Price Today Per Share: Detailed Analysis and Trends"

- DJIA All-Time High Chart: Analyzing the Record-Breaking Market Milestone

- This Week in the Stock Market: Key Highlights and Analysis

recommend

Stocks in Decline: Navigating the Volatile Mar

Stocks in Decline: Navigating the Volatile Mar

Toys 'R' Us Overnight Shelf Stocker:

SLW Stock Price US: A Comprehensive Analysis

How to Get Involved in the Stock Market in the

Tomson Group Ltd: Unveiling the US Stock Symbo

This Week in the Stock Market: Key Highlights

US Cannabis Stock Catalyst: The Future of Lega

Best Performing US Stocks 2018 YTD: Top Stocks

Toys "R" Us Overnight Stocke

Buying U.S. Stocks on Wealthsimple Trade: A Co

Trading US Stocks from the UK: A Comprehensive

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- military stocks"

- Title: Discover the Least Correlated Foreign S"

- IPOs March 2022: A Comprehensive List of US St"

- Oversold Us Stocks: Understanding the Implicat"

- Understanding the US Stock Market: A Comprehen"

- US Stock Futures Soar as Trump Wins Presidenti"

- Nintendo Japan Stock vs US Stock: A Comprehens"

- Jordan 1 High Mocha Size US 8 Stock X: A Compr"

- Fractional Investment in US Stocks: Unlocking "

- Royal Bank of Canada (RY) US Stock Price: What"