you position:Home > aphria us stock > aphria us stock

US Stock Futures Soar as Trump Wins Presidential Election

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

The election of Donald Trump as the 45th President of the United States has sent shockwaves through the global financial markets. In a stunning victory, Trump's campaign promises of tax cuts, deregulation, and infrastructure spending have sparked a surge in US stock futures. This article delves into the implications of Trump's win on the stock market and the potential opportunities and risks that lie ahead.

Trump's Economic Agenda

Trump's economic agenda is centered around reducing corporate taxes, cutting regulations, and investing in infrastructure. These policies are expected to boost economic growth and create jobs. The prospect of lower taxes and fewer regulations has been a major driver of investor optimism, leading to a surge in stock futures.

Stock Market Reactions

The immediate reaction to Trump's victory has been a rally in the stock market. The S&P 500 futures, which are a proxy for the broader market, have surged over 2% in the days following the election. This surge has been attributed to the expectation that Trump's policies will lead to higher corporate profits and economic growth.

Sector-Specific Impacts

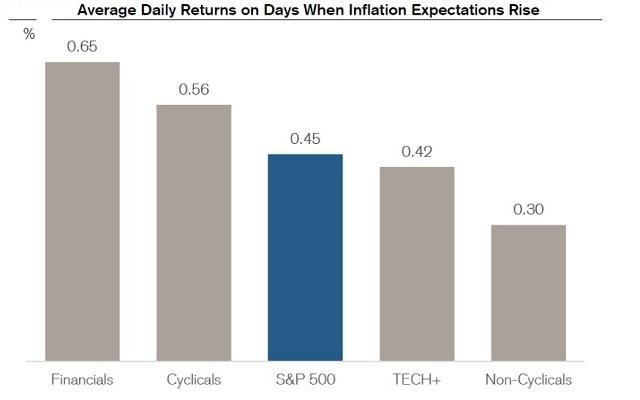

Different sectors of the economy are expected to be impacted differently by Trump's policies. The financial sector, which has been under pressure due to low interest rates and increased regulation, is expected to benefit from lower taxes and fewer regulations. The energy sector, which has been struggling due to low oil prices, is also expected to benefit from Trump's promise to lift energy regulations.

On the other hand, sectors like healthcare and technology, which have been heavily regulated, may face increased uncertainty. The healthcare sector, in particular, is facing the possibility of significant changes to the Affordable Care Act, which could have a negative impact on stocks in this sector.

Case Studies

One notable case study is the stock of Exxon Mobil Corporation (XOM). After Trump's victory, the stock surged over 5% on the expectation that Trump's policies would lead to increased oil production and lower energy regulations. Another example is the stock of JPMorgan Chase & Co. (JPM), which has seen a similar surge on the expectation of lower corporate taxes and fewer regulations.

Risks and Uncertainties

While the immediate reaction to Trump's victory has been positive, there are significant risks and uncertainties that could impact the stock market. The success of Trump's policies will depend on the cooperation of Congress, and there is a possibility of gridlock that could hinder his agenda. Additionally, the global economic environment remains uncertain, and any negative developments could impact the US stock market.

Conclusion

The election of Donald Trump as President of the United States has sent US stock futures soaring. The prospect of lower taxes, fewer regulations, and increased infrastructure spending has sparked investor optimism. However, there are significant risks and uncertainties that could impact the stock market in the coming months and years. Investors should carefully consider these factors before making investment decisions.

so cool! ()

last:Canadian Marijuana Stocks on the US Stock Market: An In-Depth Analysis

next:nothing

like

- Canadian Marijuana Stocks on the US Stock Market: An In-Depth Analysis

- Title: US Stock Future Index: A Comprehensive Guide

- Broker Dealer for Canadian and US Stocks: Your Ultimate Guide to Cross-Border Inv

- Understanding the US Inflation Rate and Its Impact on the Stock Market

- Is the US Stock Market Open on February 19, 2024?

- Understanding the Chinese Corporation Stock Option Plan for US Employees

- How to Purchase Stocks in the US: A Comprehensive Guide

- KFC Stock Price US: What You Need to Know

- Title: Total US Stock Market Capitalization 2014: A Look Back at the Record-Break

- Hot US Stocks Today: Top Performers and Investment Insights

- Investing in Canadian Stocks from the US: Navigating Currency Risk

- Understanding UK Tax Treatment of US Restricted Stock Units

recommend

US Stock Futures Soar as Trump Wins Presidenti

US Stock Futures Soar as Trump Wins Presidenti

Title: Factors Influencing US Stock Market Per

US Oil Stocks: A Comprehensive Guide to API an

Title: EV Stocks US: The Future of Electric Ve

US Stock Losers: Understanding the Factors Beh

Stock Market in US Now: Current Trends and Fut

Title: Buy Us Stocks with Crypto: A Revolution

Marihuana Stock Entering the US Market: A Game

IPOs March 2022: A Comprehensive List of US St

1994 Pro Stock Car Vets Are Us: Frankie Sanche

Best US Cannabis Stocks for 2019: A Guide to I

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock