you position:Home > aphria us stock > aphria us stock

Title: US Stock Market 2016-2017: A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Introduction: The US stock market has always been a significant indicator of the country's economic health. In the years 2016 and 2017, the market experienced a period of remarkable growth and stability. This article provides a comprehensive analysis of the US stock market during these two years, examining key trends, factors influencing the market, and notable performance of major indices.

Stock Market Performance: Between 2016 and 2017, the US stock market experienced a significant bull run. The S&P 500 index, which represents the top 500 companies in the United States, surged by approximately 24% during this period. The Dow Jones Industrial Average also witnessed a substantial increase of around 19%. The NASDAQ Composite index, which focuses on technology stocks, saw a rise of approximately 29%.

Factors Influencing the Market: Several factors contributed to the strong performance of the US stock market during 2016 and 2017. Here are some of the key factors:

- Economic Growth: The US economy experienced steady growth during this period, supported by low unemployment rates, increasing consumer spending, and robust industrial production.

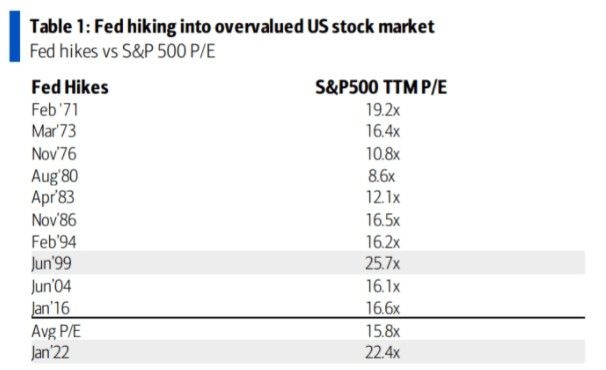

- Interest Rates: The Federal Reserve raised interest rates gradually during this period, signaling a confident outlook for the economy. The increased interest rates attracted investors seeking higher yields.

- Corporate Profits: Companies reported strong earnings growth, driven by improved economic conditions and cost-cutting measures. This led to increased investor confidence and higher stock prices.

- Global Economic Recovery: The US stock market was also influenced by the global economic recovery, with emerging markets and developed economies experiencing growth.

Sector Performance: Different sectors within the US stock market performed differently during 2016 and 2017. Here are some notable trends:

- Technology Sector: The technology sector, particularly the NASDAQ Composite index, experienced significant growth during this period. Companies like Apple, Amazon, and Facebook posted impressive gains, driven by strong demand for their products and services.

- Energy Sector: The energy sector recovered strongly after the decline in oil prices in previous years. Increased oil production and improved exploration techniques contributed to higher stock prices.

- Financial Sector: The financial sector also performed well, supported by improved economic conditions and regulatory changes that allowed banks to expand their operations.

Case Study: Tesla, Inc. One notable company that performed exceptionally well during 2016 and 2017 was Tesla, Inc. The electric vehicle manufacturer saw its stock price surge by over 100% during this period. This was driven by the strong demand for electric vehicles and Tesla's innovative technology. The company's ability to attract investors and maintain growth expectations contributed to its remarkable performance.

Conclusion: The US stock market experienced significant growth and stability between 2016 and 2017. Factors such as economic growth, low interest rates, and strong corporate earnings contributed to the strong performance of major indices. While different sectors within the market performed differently, technology and energy sectors stood out. Companies like Tesla, Inc. showcased the potential of innovative businesses in driving stock market performance. Understanding these trends and factors can help investors make informed decisions and capitalize on future opportunities in the US stock market.

so cool! ()

last:Meg Energy Corp US Stock Symbol: Understanding the Investment Potential

next:nothing

like

- Meg Energy Corp US Stock Symbol: Understanding the Investment Potential

- List of Bank Stocks in US: Your Ultimate Guide to Investment Opportunities

- Title: Time in the US Stock Market: Strategies for Maximizing Returns

- US Mint Kennedy 50th Out of Stock: What You Need to Know

- Buying Indian Stocks in the US: A Comprehensive Guide

- US Stock Historical Tick Data: A Comprehensive Guide

- Roomba Front Wheel Caster US Stock: The Ultimate Guide to Finding the Right Repla

- US Information Technology Stocks: A Comprehensive Guide to the Tech Giants

- Joint Stock Company US: Understanding the Dynamics of American Corporate Structur

- Earnings Calendar Week of October 6, 2025: A Deep Dive into US Stocks

- Top US Drone Companies Stock: A Comprehensive Guide

- Is the US Stock Market Open on Monday, November 12th?

recommend

Title: US Stock Market 2016-2017: A Comprehens

Title: US Stock Market 2016-2017: A Comprehens

US Bombs Iran Stock Market: The Impact on the

Top 10 in US Stocks Market Review

Best US Penny Stocks for 2021: Your Guide to H

How Many Stock Markets Are There in the US?

DeepSeek US Stock: Unveiling the Potential of

Title: Total US Stock Market Capitalization 20

TD Bank Stock: A Comprehensive Guide to Invest

US Large Cap Stocks: Highest Gains and Momentu

Oversold Us Stocks: Understanding the Implicat

US Healthcare Stock Market Trends in April 202

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- avgo stock forecast"

- nvda price target"

- Top Gaining US Stocks This Week: Momentum Anal"

- US Steel Stock on NASDAQ: A Comprehensive Guid"

- sustainable investing"

- US Mint Kennedy 50th Out of Stock: What You Ne"

- Title: US Bond Market vs Stock Market Size: A "

- Title: Top 3 Stock Exchanges in the US"

- all weather portfolio"

- http stocks.us.reuters.com stocks fulldescript"