you position:Home > aphria us stock > aphria us stock

Should I Get Out of US Stocks?

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

Are you contemplating whether or not you should exit the US stock market? This is a crucial question for any investor, especially considering the current economic climate and market volatility. In this article, we will delve into the factors you should consider before making this decision.

Understanding Market Volatility

First and foremost, it's essential to recognize that the stock market is inherently volatile. While the US stock market has historically provided significant returns, it's not immune to downturns. In recent years, we've seen numerous fluctuations, and some investors may be concerned about the future.

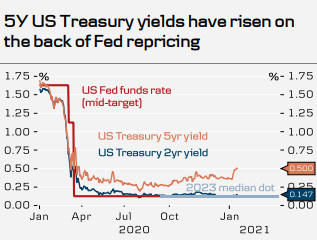

Economic Indicators

One of the primary factors to consider is the current economic climate. If you're worried about economic instability or a potential recession, it may be prudent to reconsider your investments. Keep an eye on key economic indicators such as unemployment rates, GDP growth, and inflation.

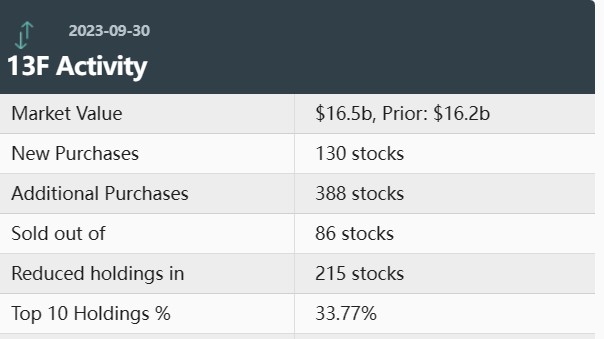

Diversification

Diversification is a fundamental principle of investing. If your portfolio is heavily concentrated in US stocks, you may want to consider diversifying to mitigate risk. This could involve investing in international stocks, bonds, or other asset classes.

Personal Financial Goals

Your personal financial goals should also be a consideration. If you're nearing retirement and require a stable income, it may be wise to reduce your exposure to the stock market. Conversely, if you're younger and have a longer time horizon, you may be better suited to withstand market volatility.

Historical Performance

When evaluating the US stock market, it's essential to look at historical performance. While the market has experienced significant growth over the past few decades, it's not without its ups and downs. It's crucial to remember that past performance is not indicative of future results.

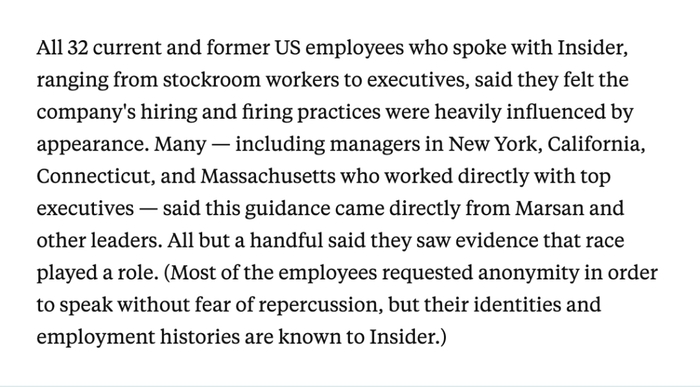

Case Study: 2008 Financial Crisis

One of the most significant market downturns in recent history was the 2008 financial crisis. This event serves as a stark reminder of the potential risks associated with the stock market. Those who had a diversified portfolio and reduced their exposure to US stocks fared better than those who were heavily invested in the market.

Conclusion

In conclusion, the decision to get out of US stocks is a complex one that requires careful consideration of various factors. By analyzing economic indicators, diversifying your portfolio, and aligning your investments with your personal financial goals, you can make a more informed decision. Remember, the stock market is a long-term investment, and patience and discipline are key to achieving success.

so cool! ()

last:Stocks with Momentum: Short-Term Picks for US Investors

next:nothing

like

- Stocks with Momentum: Short-Term Picks for US Investors

- Unlocking Profit Potential: The Sin Stocks Phenomenon in the US

- Is Today a Stock Market Holiday in the US?

- Can You Trade Stocks Without a Work Authorization in the US?

- Momentum Stocks: Top Performers in the US Market Past Week

- Is There Weed Stocks in the US? Exploring the Cannabis Industry's Investment

- Stock Options at Novartis for US Employees: Understanding the Benefits and Implic

- Invest in US Stocks from Ukraine: A Guide for Aspiring Investors

- Cannabis Stocks: A Growing Opportunity in the US Market

- List of US Stock Market Corrections by Date: A Comprehensive Overview

- Top US Green Energy Stocks: A Guide to Investment Opportunities

- Unlocking the Potential of HBRM.PK: A Comprehensive Analysis of the Stock

recommend

Should I Get Out of US Stocks?

Should I Get Out of US Stocks?

Should I Get Out of US Stocks?

US Stock Listed Companies: A Comprehensive Gui

US Steel Stock on NASDAQ: A Comprehensive Guid

Stocks with Catalysts This Week: US Market Ins

Yaoofinance: Revolutionizing the Financial Wor

Title: List of US Penny Stocks Under $1: A Gui

Understanding the US Oil Sands Inc Stock Price

M7 US Stock: Unveiling the Potential of Emergi

Title: Domestic Stocks Outperform Foreign-Faci

Top US Stocks to Invest in 2018: Your Ultimate

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stock us stocks games silver etf

like

- lng us stocks: The Growing Market for Natural "

- Title: US Stock Market Averages Today"

- US Stock Futures Soar as Trump Wins Presidenti"

- Is It Safe to Invest in US Stocks from India?"

- S&P Closed: Key Insights on the Market"

- pltr price target"

- Growth Stocks on the US Market: Unveiling the "

- Trump Tariffs: How They've Impacted the U"

- Is the US Stock Market Closed on Veterans Day?"

- Understanding the Chinese Corporation Stock Op"