you position:Home > aphria us stock > aphria us stock

Rheinmetall US Stock: A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In the realm of defense and aerospace, Rheinmetall AG, a German multinational corporation, has made significant strides. Its American subsidiary, Rheinmetall US, has been a key player in the defense industry, and investors have been keenly interested in its stock performance. This article delves into the details of Rheinmetall US stock, examining its market trends, financial health, and future prospects.

Understanding Rheinmetall US Stock

Rheinmetall US, a subsidiary of Rheinmetall AG, specializes in providing advanced technology solutions for defense and aerospace sectors. The company's diverse portfolio includes military vehicles, weapon systems, and ammunition. Its stock, traded under the ticker symbol "RTX," has been a subject of interest among investors.

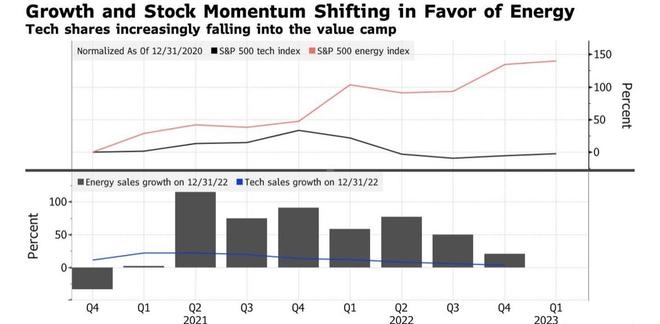

Market Trends

The defense industry has been experiencing steady growth, driven by geopolitical tensions and increasing defense budgets. Rheinmetall US, being a key player in this sector, has seen its stock reflect this upward trend. Over the past few years, the stock has shown a consistent upward trajectory, with periodic spikes in value during significant contract wins or industry news.

Financial Health

Rheinmetall US has demonstrated strong financial health, with consistent revenue growth and profitability. The company's revenue has been on an upward trend, with a significant portion coming from international sales. Its profitability is also impressive, with a healthy profit margin and return on equity.

Future Prospects

The future prospects for Rheinmetall US stock look promising. The company's focus on innovation and expansion into new markets has opened up numerous growth opportunities. Additionally, the increasing demand for advanced defense technologies is expected to drive the company's revenue and stock value.

Case Studies

One notable case study is Rheinmetall US's contract with the United States Army for the production of Stryker vehicles. This contract, valued at billions of dollars, has been a significant driver of the company's revenue and stock performance. Another example is the company's partnership with Airbus for the development of the A400M military transport aircraft, which has further solidified its position in the aerospace sector.

Investment Considerations

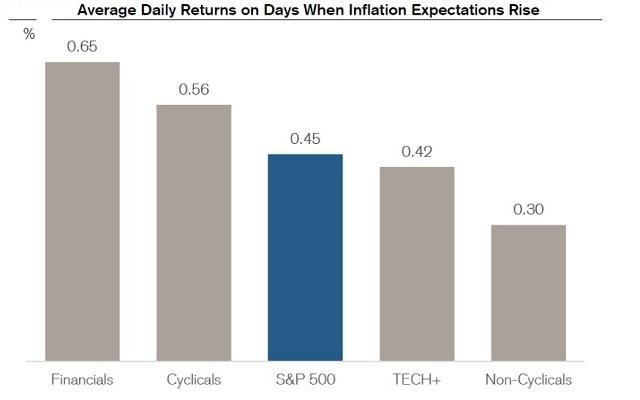

Investing in Rheinmetall US stock requires careful consideration of various factors. These include the company's financial health, market trends, and political and economic factors that could impact the defense industry. It is also important to keep an eye on the company's strategic initiatives and partnerships, as these can significantly impact its future performance.

Conclusion

Rheinmetall US stock has been a compelling investment opportunity for those interested in the defense and aerospace sectors. With a strong financial foundation, promising future prospects, and a diverse portfolio of products and services, Rheinmetall US is well-positioned to continue its upward trajectory. As investors, it is crucial to stay informed about the company's performance and industry trends to make informed investment decisions.

so cool! ()

last:Illumina US Healthcare Stocks: A Promising Investment Opportunity

next:nothing

like

- Illumina US Healthcare Stocks: A Promising Investment Opportunity

- Title: "US Large Cap Stocks Momentum: Top 5 Best Performing Over the Pas

- Top Momentum Stocks: 5-Day Performance in the US Market

- Maca Limited: A Simple Guide to Understanding Its US Stock Market Ticker

- Title: "Single Stock Inverse ETF List US: Your Comprehensive Guide to Sh

- Tomorrow: US Stock Market Drop – What You Need to Know

- US Steel Stocks Today: A Comprehensive Analysis

- NIO Stock Price: A Comprehensive Analysis

- Latest US Stock Market News April 30, 2025

- International Market vs. US Stock Market: A Comprehensive Analysis

- Two Hands Corporation: A Star Performer on the US Stock Market According to Marke

- PMTs and the US Stock Price: Understanding the Impact

recommend

Rheinmetall US Stock: A Comprehensive Analysis

Rheinmetall US Stock: A Comprehensive Analysis

SNES Classic Stock Checker: Toys "R&a

Top US Steel Companies Stocks: A Comprehensive

Foreign Governments Own Us Stocks: The Implica

Title: Buy Us Stocks with Crypto: A Revolution

How Much Foreign Investment in the US Stock Ma

US Springfield Model 1873 Stock: A Timeless Cl

Tencent Stock Price in US Dollars: A Comprehen

Rheinmetall US Stock: A Comprehensive Analysis

All the Us Stocks Penny: A Comprehensive Guide

US Stock Market Boxing Day: A Comprehensive Gu

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock